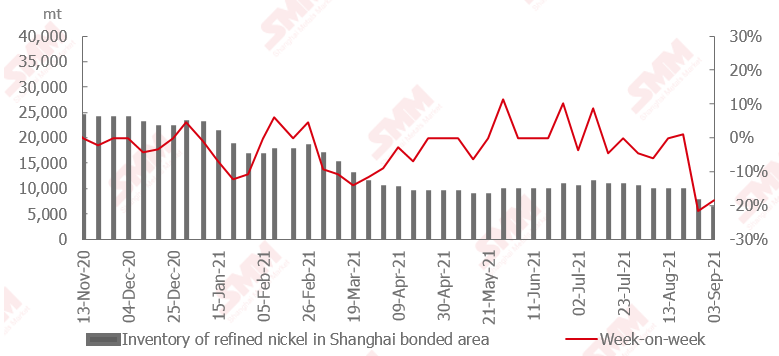

SHANGHAI, Sep 3 (SMM) – Pure nickel inventory in the bonded zone declined over 1,400 mt this week, according to SMM data.

Tight domestic spot supply pushed the SHFE/LME nickel price ratio higher this week. Higher import profits incentivised traders to accelerate delivery taking from bonded zone inventories. The contango structure on LME nickel has turned into a backwardation structure recently and quotes for nickel plate under B/L continued to rise. The highest traded import premiums reached $350/mt. Supply of cargoes under B/L has been tight.

More cargoes are expected to enter the domestic market from the bonded zone next week given the current SHFE/LME nickel price ratio. This will drive further declines in bonded zone inventory.