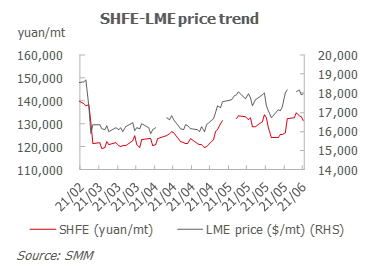

SHANGHAI, Jun 7 (SMM) – Nickel prices surged before falling last week, rising to 135,000 yuan/mt before meeting resistance.

High production schedules in the new energy and stainless steel industry have improved nickel fundamentals. Meanwhile, prices of raw material like nickel sulphate and high-grade NPI have been firm after declines in nickel prices.

Uncertainty about the trend of the US dollar prevented prices from breaching the previous high of 135,000 yuan/mt. ADP employment data and non-farm payrolls for the US caused price volatility at the end of the week.

The Fed continued its quantitative easing, allowing inflation to climb. The market no longer responded positively to the strong US economic data after gains in the CPI. The possibility of the Fed reducing the scale of bond purchases remains low. We believe nickel prices will stop falling and rally this week.

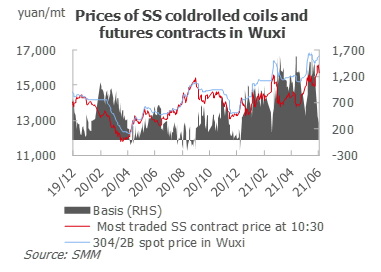

Stainless steel contract prices continued to fall to 14,800 yuan/mt early last week amid risk aversion. Prices then stopped falling and fluctuated tightly around 15,000 yuan/mt. Commodity prices rose on Thursday while ferrous metals prices gained.

SHFE SS2107 contract recovered the weekly decline, and the price spread between spot cargoes and contract prices narrowed. SHFE SS contract prices closed at 15,495 yuan/mt on Friday, with a weekly increase of 330 yuan/mt or 2.18%.

At present, spot prices are relatively strong, and the current price spread between futures contract and spot cargoes stands at high levels. SHFE SS contract prices are expected to strengthen as market caution eases and should move between 15,000-15,700 yuan/mt this week.