Despite soaring vaccination rates, soaring economic data and soaring inflation, Treasury yields have unexpectedly fallen sharply in the past few days. For example, 10-year Treasury yields have fallen 15 basis points this week alone to their lowest level in five weeks. 30-year Treasury yields seem to encounter resistance at their November 2019 high, difficult to break through, and yields are falling across the curve.

And it's not just bonds, but reflation trading (betting on value stocks outperforming growth stocks) seems to have come to an end in recent weeks.

The market is puzzled. What on earth has happened? There are many reasonable explanations in the market. Jim Bianco, president of (Bianco Research), a Bianco research firm, attributed it to asset managers who recently turned 10-year Treasury futures into net bears for the first time since late 2016.

Other views point out that the data show that Japanese investors have invested the most money in overseas bonds since November, with a large portion of about 1.71 trillion yen ($15.7 billion) flowing into US Treasuries. because the yield on exchange rate hedging is still close to its highest level since late 2015.

Others argue that this is just a flash in the pan, possibly because of continued pressure in the repo market, or because large US banks sell bonds after yields, resulting in the flow of hedge funds.

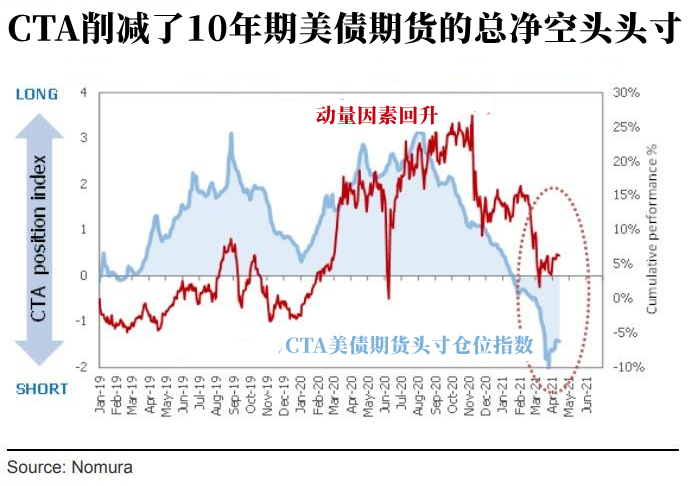

Masanri Takada, a quantifier at Nomura Securities, has made a startling discovery that short-term investors in CTA, a global macro hedge fund, have significantly pulled out of short positions in US Treasuries.

CTA fund, also known as "managed futures" fund, generally refers to asset management products that invest in futures, options and other derivatives, is a common type of hedge funds.

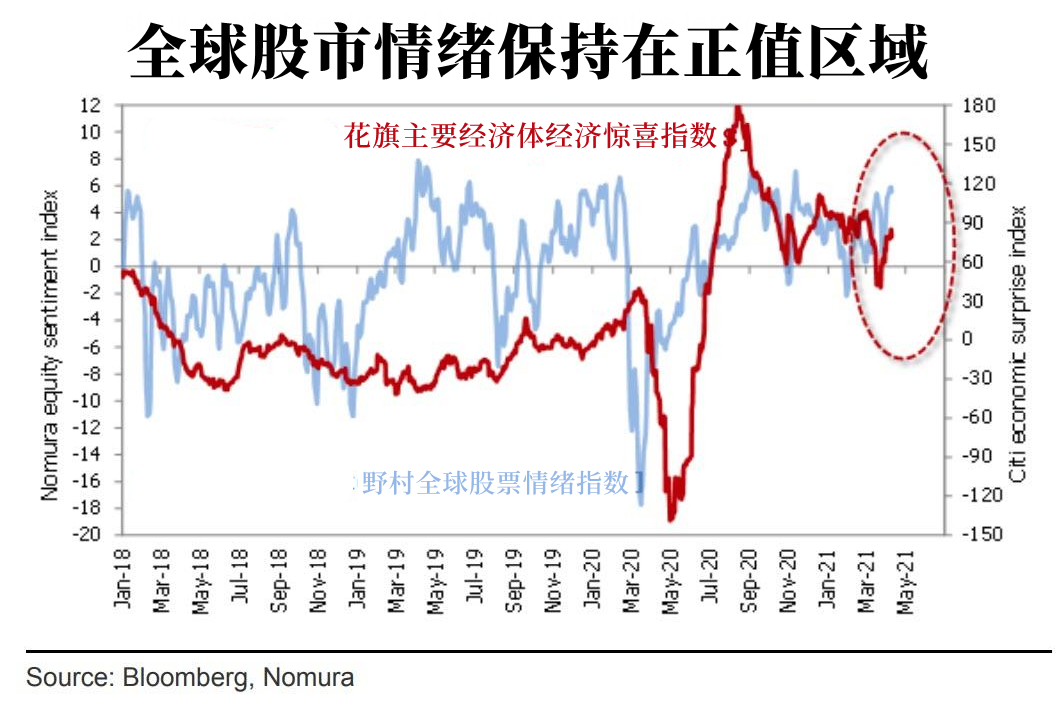

Although global stock markets remain high, especially in the United States, they have risen only slightly. Mainstream investors seem to be taking a more wait-and-see attitude.

Still, Nomura's assessment of investor sentiment in global equity markets is positive, suggesting that investors prefer risk-taking rather than risk aversion. It seems that risk appetite has not changed, and the recent unexpected rise in macroeconomic data has provided some psychological support.

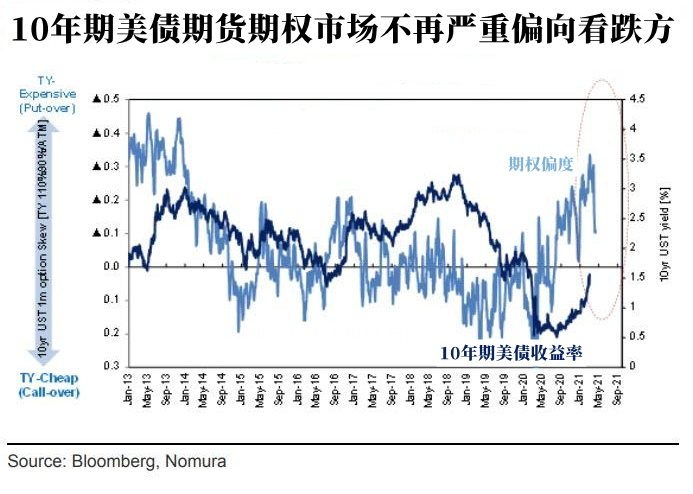

Looking at the trading behavior of major speculators, Nomura noticed that the U. S. bond market has turned from a bear market to a correction. Although yields on 10-year Treasuries remain high, above 1.6 per cent, they have clearly peaked.

Nomura Securities believes that short-term investors may be behind the closing of positions. According to estimates from its team model, fundamentals-oriented global macro hedge funds appear to have unwound all their net short positions in US Treasuries and are likely to turn to net long. These macro funds trade not only futures but also cash instruments and derivatives.

The 10-year Treasury futures option (TY) used to be significantly biased towards the bearish side, but this is no longer the case, and this change is partly related to the liquidity generated by the strategic shift of CTA.

Technology-oriented CTA funds are also expected to cover short positions. Nomura estimates that since January, the short positions accumulated by CTA have balanced on average at a 10-year Fed yield of about 1.47 per cent, so at current market yields, CTA may have made pre-emptive profit-taking.

However, CTA has been expanding its total net long position in Nasdaq 100 futures, seemingly to balance the decline in its net short position in US bond futures.

According to Nomura's model, CTA is likely to remain bullish as long as the Nasdaq 100 index stays above 13100, which is expected to be the average break-even line for long positions accumulated since November.

It can be said that this shift in CTA's position in the futures market may be part of the reason for the recent rebound in the performance of some growth and momentum stocks.

Only time will tell whether the current trading of short-term investors in the US bond market is a temporary position adjustment or a real withdrawal from the re-inflationary trade.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)