SHANGHAI, Dec 21 (SMM)—Indonesian smelters have continued to put on-line new capacity after the export of nickel ore was banned in 2020.

Indonesia's ban on nickel ore exports has also attracted more Chinese NPI or stainless steel companies to build plants in Indonesia, but projects of Tsingshan and Delong accounted for most of the growth in NPI projects.

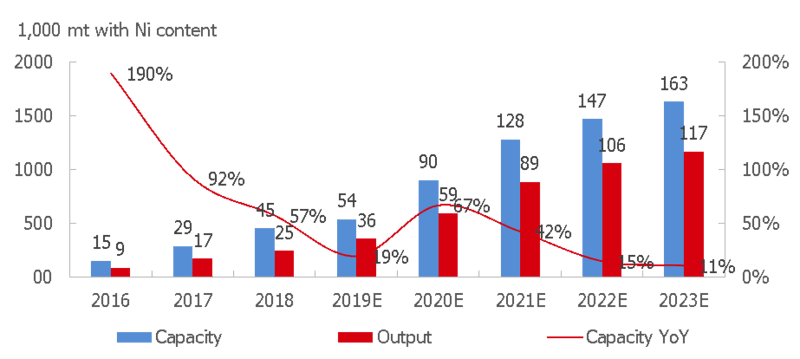

The growth rate of Indonesia’s NPI production will stand at 49%, 20%, and 10%, respectively from 2021 to 2023. Adequate supply of NPI combined with full exploration of downstream demand will account for slower growth rates, which will gradually stand close to the growth rates of #300 stainless steel output.

Indonesia's NPI output to increase 286,000 mt of Ni content to 885,000 mt of Ni content in 2021

At the same time, the Indonesian government will raise entry requirements for companies building plants in Indonesia to slow down energy consumption.

Most of downstream NPI users are stainless steel mills, and only a small number of alloy steel producers use NPI.

Indonesia also exports NPI due to the lack of local market. This will limit NPI plants from putting new capacity into production. The largest NPI industrial parks in Indonesia are run by Chinese stainless steel mills, which will more cautiously control the output.

For more information about NPI market and nickel industry, please subscribe to China Nickel Weekly.