SMM: a few days ago, a number of domestic media reported that the Hainan provincial government decided to acquire the 49% stake held by FAW in FAW seahorse, making it the second largest shareholder of FAW seahorse, and the two sides are currently in negotiations. Although all parties concerned are cautious about the rumor, saying that "relevant information has not been received at present", combined with the overall listing of FAW and the willingness of seahorses to seek "independence", this rumor is not groundless.

Public data show that in 1998, in order to obtain car production qualification, Hainan Automobile Factory transferred state-owned assets to FAW Group, resulting in the birth of FAW seahorse. At the beginning of the establishment of the company, FAW Group, SAIC Group and Hainan Provincial Government held 49%, 49% and 2% of the shares respectively. In 2007, Hainan Province transferred its 2% stake in FAW hippocampus to Haima Motor, which changed its stake in FAW hippocampus to 51%.

However, over the years, FAW has made less contribution to the joint venture company in addition to helping Haima Motor to obtain car production qualifications. "FAW has not provided any help to Haima Motor in recent years, and it gets a lot of money from Haima Automobile every year." There have been such complaints to the media from Haima insiders.

For FAW Group, in order to promote the overall listing, remove obstacles and straighten out equity has become more and more urgent. According to FAW's plan, its overall passenger car business will be packaged under FAW after its listing. Before that, FAW Jiefang and FAW Pentium were reorganized under the leadership of FAW Group. Now FAW Group holds 49% stake in FAW Haima. It's time to "sell".

The actual shareholder behind Hainan Development Holdings Co., Ltd., which is rumored to have taken a 49% stake in FAW Group, is the State-owned assets Supervision and Administration Commission of Hainan Provincial Government. That is to say, if 49% of FAW Haima is successfully handed over to Hainan Development Holdings Co., Ltd., then the latter will become the second largest shareholder of the former FAW Haima. In this way, Haima Motor and the Hainan provincial government will work together to consolidate Haima Automobile Hainan Company.

Automobile analyst Ren Wanfu believes that Hainan Province has incorporated the development of new energy vehicles into the government's key planning projects in recent years, and after the Hainan provincial government takes a stake in Haima Motor, it will certainly take it as the key support object of Hainan Province. For Haima Automobile Hainan Company, equity change at this time can not only get rid of the control of FAW Group, but also get the support of Hainan provincial government, which can be said to kill two birds with one stone.

However, how much value is there for the seahorse, which is about to get rid of FAW and is expected to achieve independence?

Haima revealed in its financial report in the first half of this year that its current production and sales of models are 7X, 8s, S5, S7, Xiaopeng and other products, all of which are produced by the seahorse base in Zhengzhou, while FAW Haima now has zero vehicle inventory. According to the inquiry of the sales data collected by the passenger Association, the monthly sales of FAW Haima has been zero since September last year, which may mean that FAW Haima Hainan plant has stopped production.

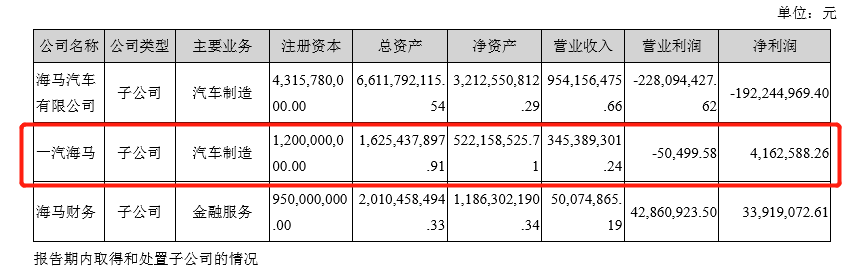

In addition, according to the first half results released by Haima Motor, as of the first half of this year, FAW Haima, a subsidiary of Haima Motor Co., Ltd., had net assets of 522 million yuan, revenue of 345 million yuan, operating profit of negative 50500 yuan, and a net profit of 4.163 million yuan. "there is a big difference between the operating profit and the net profit in half a year, indicating that the operating performance does not pass." Analysts pointed out that, coupled with its nearly zero production and sales in the last year, the industry believes that increasing revenue and reducing expenditure and selling real estate are the key to FAW seahorse profitability.

The operation of Haima Automobile subsidiary in the first half of the year (chart source: Haima Automobile semi-annual report)

Industry analysts pointed out that the production and marketing ratio of the two major production bases of Haima Automobile is seriously out of balance. At this stage, its main selling models and new energy business are transferred to Zhengzhou base, and the production and sales of Haikou base are shrinking. Last year, an employee of the former seahorse new energy department revealed to the media that the company forced employees to move from Haikou to Zhengzhou. "employees who do not go have to find jobs in other departments of the company, otherwise they will be given the cold shoulder." as a result, most employees have no choice but to resign. "

In addition, in the past two years, seahorse cars "selling houses to save themselves" has become a major anecdote in the industry. Public data show that from April to May 2019, Haima sold a total of 401 idle properties twice, with a total valuation of about 334 million yuan. In September last year, Haima successfully sold 156 properties, earning a profit of 57.09 million yuan. In June, Haima Motors announced that it planned to sell 145 properties with an original book value of 4.377 million yuan.

In order to protect its shell and take off its hat, Haima did not hesitate to sell its assets again and again. This year, seahorses, which have few assets to sell, have to focus on cost-cutting. Haima Motors disclosed in its semi-annual report that in the second half of the year, in addition to establishing an effective dynamic evaluation model for sales orders and parts orders, the company will also shrink investment in other product projects or scientific research projects other than strategic projects to reduce unnecessary investment expenditure.

The industry believes that Haima, which has not formed its own advantages in products and technology at this stage, may lag behind mainstream car companies for a long time after reducing R & D expenses in the future. In the long run, the next situation of Haima is not optimistic.