SMM9 March 2: yesterday, the outer disk metal rose and fell, Lunni rose 1.09%, Lunxi rose 1.05%, Lunxi Copper rose 0.07%, Lunzn Zinc fell 1.2%, Lun Aluminum fell 1.54%, Lunren lead fell 1.97%. (LME) copper futures on the London Metal Exchange rose slightly on Wednesday, but it was still trading below a two-year high, so the former disappointing US employment data raised doubts about the economic recovery and the strength of the dollar. Domestically, shanghai aluminum fell 0.93%, shanghai lead fell 0.82%, shanghai zinc fell 0.69%, shanghai copper fell 0.59%, shanghai nickel rose 0.31%, shanghai tin rose 0.8%.

In precious metals, COMEX futures fell 1.7% on Wednesday as the dollar strengthened and a strong rebound in u.s. manufacturing raised hopes of a rapid recovery in the coronavirus-hit u.s. economy. Analysts pointed out that the main factor is the strength of the dollar, gold prices move in exactly the opposite direction to the dollar, and gold prices are also under pressure from good factory order data in the United States in July. Investors are watching the number of U.S. initial jobless claims released on Thursday and non-farm payrolls data released on Friday.

The dollar index extended gains on Wednesday as the euro fell from a key level of $1.20 hit the previous session, as a strong rebound in US manufacturing raised hopes of a rapid recovery of the coronavirus-hit US economy. Us factory orders rose more than expected in July, while US manufacturing data released on Tuesday showed that manufacturing activity accelerated to a nearly two-year high in August, fuelling optimism about a steady economic recovery. On the other hand, private employment growth in the United States in August was lower than expected, indicating a slowdown in the recovery of the labor market.

U. S. stocks closed higher on Wednesday. The Dow regained the 29000-point mark. For the first time in history, the Nasdaq stood at 12000 points, joining hands with the S & P 500 to reach an all-time high. The increase in ADP employment in the United States in August was much lower than expected by 428000. U.S. Treasury Secretary Mnuchin called on Congress to take more stimulus measures. The Fed's beige book believes that economic growth is much lower than it was before the outbreak. The Congressional Budget Office says the budget deficit will reach a record $3.3 trillion this year. The Dow closed up 454.84 points, or 1.59%, at 29100.50; the Nasdaq was up 116.78 points, or 0.98%, at 12056.44; and the S & P 500 was up 54.19, or 1.54%, at 3580.84.

In terms of crude oil, NYMEX crude oil futures fell nearly 3% on Wednesday, reversing early gains as inventory reports showed a drop in gasoline demand in the United States last week. Weekly data released by the US Energy Information Administration ((EIA)) showed that gasoline demand fell last week from the previous week, outweighing the impact of positive crude oil inventory data, and oil prices fell after the inventory report was released.

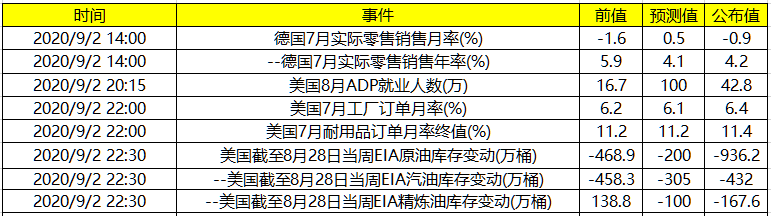

In terms of data, the actual monthly rate of retail sales in Germany in July, the previous value is-1.60%, the expected 0.50%, published-0.9%.

Us August ADP employment (10,000), previous value 16.7, expected 95, released 42.8, revised 21.2 (previous value).

Vice President of ADP Employment data: the August recruitment message shows that the economic recovery is slowing. The growth of jobs is negligible, and the employment growth of all sizes and industries is not close to the level of employment before the epidemic.

Adam Button, an analyst at the financial and economic station Forexlive, commented on the US ADP employment data for August: the number of ADP employment in July was revised to 212000 from 167000, which is a reminder that last month's ADP report also showed a sharp decline, but did not appear in the official data. This may be due to seasonal changes around teachers and pandemics, but not this month. In addition, the number of initial jobless claims in the week of the non-farm survey was also high, so there may be more unease on Friday.

The monthly rate of factory orders in the United States in July, with a previous value of 6.20%, is expected to be 6%, and 6.4% is announced.

Fed Williams: the new framework will help the Fed achieve dual goals. The median forecast for neutral interest rates by the Federal Open Market Committee ((FOMC)) has fallen to 2.5 per cent from 4.25 per cent in January 2012.

Us EIA crude oil inventory (10,000 barrels) for the week to August 28th, previous value-468.9, expected-188.7, announced-936.2.

Domestic crude oil production fell 1.1 million b / d to 9.7 million b / d last week, while changes in US crude stocks fell for six consecutive weeks, the biggest drop since July 24, according to the EIA report. (EIA): of the US Energy Information Administration Gulf crude oil imports fell to a record low of 1.28 million barrels per day in the week to Aug. 28. Us crude oil output fell to its lowest level since January 2018 in the week to August 28. Us crude oil output fell the most on record in the week to August 28.

Financial bloggers zero-hedge EIA crude oil inventory data for the week of Aug. 28: oil prices fell sharply today on the back of reports that Russia used Novijok to poison Navarine and key OPEC allies also increased oil production last month. Domestic crude oil stocks plunged 9.36 million barrels as a result of the shutdown caused by Hurricane Laura, and stocks of gasoline and refined oil also fell as refineries were forced to close. Oil prices, which traded around $43 for nearly a week, fell sharply before the release of the data from the U.S. Department of Energy and rebounded after the data were released. "Let's see how long the rally lasts," said Bloomberg Oil Trading correspondent Catherine Ngai. "it's important to remember that a lot of data in today's data will be affected by Hurricane Laura."

"Click to sign up: 2020 Tin Industry chain Trading Summit

Scan the code to participate in the meeting or apply to join the SMM tin industry exchange group