SMM News: on the evening of July 17, Ningde Times issued an announcement announcing the results of non-public offerings. According to the announcement, Ningde Times issued 122 million shares at an issue price of 161yuan per share. After deducting the issuance fees, the net amount of funds actually raised is about 19.62 billion yuan. Among them, Honda, which announced the signing of a strategic cooperation agreement with Ningde era on July 10, subscribed 3.7 billion yuan, while Hillhouse Capital took it down with a subscription amount of 10 billion yuan.

Photo Source: screenshot of "report on the issuance of non-public shares in Ningde era"

Speed up the pace of "arms race" in the Ningde era

By the end of 2019, Ningde era had a production capacity of 53GWhh, ranking first among domestic power battery companies, but this did not slow down the pace of the "arms race" in Ningde era.

On the evening of February 26th this year, Ningde Times issued a "non-public offering stock pre-plan", which intends to raise no more than 20 billion yuan, of which 12.5 billion yuan will be used for the total production capacity investment of 52GWh, including Jian Huxi lithium battery expansion 16GWh, Jiangsu time Power Phase III 24GWh and Sichuan Times Power Phase I 12GWh.

Although the fund-raising amount was later reduced to 19.7 billion yuan, the amount of investment in capacity expansion projects involved has not changed. On the same day, Ningde Times also announced that it plans to invest no more than 10 billion yuan to build a Ningde Cheliwan lithium-ion battery production base project, which is expected to take two years, with an annual production capacity of about 16GWh for new lithium-ion batteries.

Coupled with the previously planned capacity planned in cooperation with SAIC, Guangzhou Automobile, FAW and Dongfeng, according to the incomplete statistics of the first Electric Network, coupled with the existing 53GWhh, the project capacity expected to be put into production in the Ningde era from 2020 to 2023 has reached 257.6GWh.

Why such a large-scale production capacity is needed has been clearly stated in the Ningde era in the "Private Stock offering Plan": "the new energy vehicle industry is strongly supported by the national industrial policy, which will drive the rapid development of the power battery industry. Ushered in a broad market space."

Once, before the outbreak of the new energy market in the first year, Ningde era began to carry out capacity reserves, although it was not yet ahead of technology at that time, but with the ability to stabilize supply, Ningde era worked out its own way. Today, although the new energy market is likely to see zero growth this year, the Ningde era remains optimistic.

According to the Development Plan of New Energy vehicle Industry (2021-2035) issued by the Ministry of Industry and Information Technology on December 9, 2019 (draft for soliciting opinions), China plans to achieve the goal of accounting for about 25% of new vehicle sales of new energy vehicles by 2025. Many people believe that China's car sales in 2025 are expected to return to the 2017 high of 28.87 million. Based on the conservative level of 28 million vehicles and the zero growth of the new energy vehicle market in 2020, the annualized growth rate of new energy vehicles in the past five years is about 42%.

Even if it does not reach such a high level of growth, it is still enough to make a bet on Zeng Yuqun, chairman of the Ningde era, who thinks that "gambling is mental work".

Are the companies with the highest market capitalization on gem short of money?

Since you have decided to gamble, you must have enough chips.

According to the statistics above, domestic production expansion projects, coupled with the European layout of the R & D base, the overall investment of about 74.9 billion yuan.

According to public sources, Ningde era has planned to raise nearly 50 billion yuan since 2020, and has also applied to banks for an annual comprehensive credit line of 170 billion. In just two quarters, Ningde era has arranged nearly 80 billion more financing plans in domestic and foreign markets than last year. The increase is the first time that Ningde Times has raised money in the form of a rights issue since it went public in 2018.

Some people wonder whether the Ningde era, which is already the most expensive company with the highest market capitalization on gem, is still short of money.

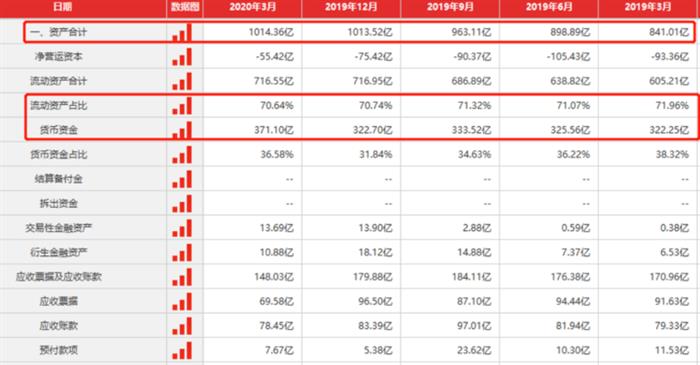

(Ningde era financial statement chart, screenshot source: Huibo)

It can be seen that at the end of the first quarter of this year, the book assets of the Ningde era were nearly 101.436 billion yuan, and the proportion of current assets also reached 70.64%, but its monetary funds were only 37.11 billion yuan. Although the amount of bills and accounts receivable is not small, it is not assets that can be realized immediately.

(Ningde era financial statement chart, screenshot source: Huibo)

However, the current liabilities in the Ningde era (that is, the debts that enterprises will repay within one year or more than one year) are 39.833 billion yuan, and the monthly operating cost is more than 2 billion yuan. Therefore, to expand on the basis of avoiding the risk of short-term debt repayment, financing has become the only option.

This non-public offering of shares is a relatively fast and safe way, at the same time, for the high-quality target of Ningde era, it is very easy to attract excellent investment institutions or individuals to endorse its platform indirectly.

Obviously, Hillhouse Capital played this role in the 19.7 billion increase.

Why choose the Ningde era?

Previously, Hillhouse Capital's most famous investment in the new energy industry was Lulai Motor. After several rounds of investment since 2015, when Hillhouse Capital successfully listed on NASDAQ in September 2018, Hillhouse Capital held 7.5% of the shares, making it the third largest shareholder.

But Hillhouse cleared its position at the end of 2019, a move that was interpreted as a negative response to the capital market, when its share price was at a low. But no one thought that Li Bin was on his way from the worst person to the happiest person.

We don't know whether Hillhouse Capital regrets the exit, but the transition from decline to prosperity should make Hillhouse Capital have a new understanding of the new energy industry.

"Hillhouse Capital and Gao Yi Capital, which is close to them, have a basic idea," he said. "Hillhouse Capital and Gao Yi Capital, which is close to them, have a basic idea that the new energy industry is a good track. After figuring this out, there is almost no doubt about the era of Ningde. " Yun Songling, chief analyst of Capital Management Jun platform, told the first electric network.

Deng Xiaofeng, chief investment officer of Gao Yi assets, said in an exclusive interview with the media in May that if a company could achieve a compound return of 20% in the next five years, it might be a good investment opportunity.

So what is the annualized rate of return of the Ningde era before 2025?

Assume that only half of the 25 per cent of the new energy market is achieved in 2025-12.5 per cent, with a total of 3.5 million vehicles (the total number of cars is still calculated at 28 million), corresponding to a zero growth of 1.2 million vehicles in 2020, an annualised growth of 24 per cent. Lithium battery shipments are generally slightly higher than new energy vehicle sales, let's say 25 per cent.

"it is assumed that Ningde's market share will remain unchanged in the next five years, regardless of overseas market changes. As the price of lithium batteries will continue to fall, all the profit margins of the Ningde era will decline. So when it comes to net profit, we think the annualized growth rate is 20%. Using this growth rate to digest Ningde's valuation at the moment, if you look at the purchase price of Hillhouse 161 yuan, the PE level at that time is 84 times, corresponding to the PE level of 2025 is 30 times. With an industry average of 50 times PE as a reasonable level, the corresponding growth rate in the Ningde era is 67 per cent, with an annualised rate of return of 10.75 per cent. " Yun Songling told the first electric network.

Of course, this figure is a relatively conservative level of return, almost risk-free.

At the same time, once the market starts on a large scale, the profit growth rate of the Ningde era is by no means comparable to an annualized 20%, nor is its valuation 50 times comparable. His share price is likely to grow several times. " Yun Songling said.

This is an excellent investment opportunity for Hillhouse Capital, so it may not be expensive to spend 10 billion.

Of course, any investment comes with risks, and no one can guarantee that the new energy market will return to a turning point in five years' time. But at the moment, the entry of Hillhouse Capital is an absolutely positive sign for this year's somewhat cold industry.

A colored egg

The result of the increase in the Ningde era has made the auto circle, the investment circle, the media circle and even the investor circle very lively. In addition to the exciting entry of Big head Hillhouse Capital and Honda, Huang Xiaoming appeared among the 38 issuing objects that participated in the purchase, which made many self-media begin to sort out the investment history of this entertainment industry investor.

But regrettably, the underwriting agency finally came out to clarify that Huang Xiaoming was not that Huang Xiaoming, and the matter came to an end.

For the new energy industry, the first half of 2020 is a "lost" half a year. At the beginning of the second half of the year, the enthusiasm of the capital market for the Ningde era is undoubtedly a good thing for the industry, but for other small partners in the field of power batteries, especially those battery companies that are not listed on the market and cannot be raised on a large scale, their upward channel has become much smaller.

Scan the code and apply to join the SMM metal exchange group.