SMM7 March 20: last Friday, most of the non-ferrous metals were green. In the foreign market, Lunni fell 2.13%, Lunzn Zinc fell 1.47%, Lunxi lead fell 1.41%, Lunxi fell 0.43%, Lun Aluminum fell 0.33%, Lun Copper rose 0.42%, and Lun Copper rose on Friday, hovering near the highest level in two years, supported by supply disruptions, but the deterioration of Sino-US relations and the rise in the number of new cases restrained the rise. Domestically, Shanghai nickel is down 1.6%, Shanghai zinc is down 1.57%, Shanghai lead is down 1.44%, Shanghai tin is down 0.35%, Shanghai copper is up 0.16%, and Shanghai aluminum is up 1.17%.

The dollar index fell 0.33% to 95.980, with the dollar generally lower on Friday and the euro rising to a slightly less than four-month high as European Union leaders were negotiating a recovery fund that could help the euro zone out of its current recession. The Czech prime minister said Friday that EU leaders still have "very different" views on the massive stimulus package. It is difficult for the leaders of the 27 countries of the European Union to agree on a budget for 2021-27. The proposed budget, with a size of more than 1 trillion euros, and a related new recovery fund worth 750 billion euros, aims to help rebuild the southern economies hardest affected by the epidemic. The dollar's decline against other safe-haven currencies may suggest that the dollar's attractiveness is diminishing even in times of crisis, given the renewed outbreak of the new crown virus in the US.

As for U. S. stocks, they closed mixed on Friday. The Dow fell 62.76 points, or 0.23%, to 26671.95; the Nasdaq rose 29.36 points, or 0.28%, to 10503.19; and the Standard & Poor's 500 Index rose 9.16 points, or 0.28%, to 3224.73. Us stocks continue to perform plate rotations, with investors shifting from technology stocks to other sectors. Domestically, on Friday, the Shanghai Composite Index rose 0.13% to 3214.13 points, with a turnover of 486.536 billion. The Shenzhen Composite Index closed at 13114.94 points, up 0.91%, with a turnover of 629.589 billion. The gem index closed at 2662.40 points, up 0.61%, with a turnover of 213.3 billion. The Shanghai and Shenzhen stock markets totaled 1.116125 trillion yuan. From the disk point of view, scenic spots tourism, military industry, environmental protection, building materials and other sectors led the increase.

In terms of crude oil, NYMEX crude fell slightly on Friday, dragged down by concerns that a sharp rise in new cases would weaken fuel demand, while major crude oil producers were preparing to increase production. As the number of new cases rises again, fuel purchases fall again. The news comes after the Organization of Petroleum Exporting countries (OPEC) and its ally OPEC+ agreed to cut production by 2 million b / d from a record 9.7 million b / d starting in August.

On precious metals, gold closed higher on Friday as a record rise in coronavirus infections in the United States added to uncertainty about the economic recovery and support for a weaker dollar. Gold futures rose for the sixth week in a row, boosted by rising expectations of additional fiscal stimulus in Europe and the US and uncertainty about the outlook for the global economy.

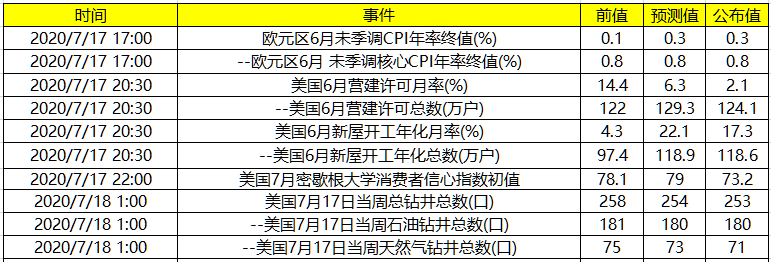

In terms of data, the monthly rate of June CPI in the euro zone, the previous value is 0.30%, the expected rate is 0.30%, and the published rate is 0.3%. Euro zone June CPI annual rate final value, previous value: 0.3%, expected: 0.30%, published: 0.3%, revised: 0.10% (previous value).

Forexlive analyst Justin Low commented on the euro zone's June CPI annualized rate: the data once again show that inflationary pressures in the euro zone have weakened to a large extent, with the euro zone's overall CPI falling to its lowest level in more than a year in June.

The total number of new housing starts in the United States in June was annualized (10,000 units), with a previous value of 97.4, expected to be 116.9, and announced: 118.6. Total number of construction permits in the United States in June (10,000 households), previous value: 122, expected: 129, published: 124.1, revised: 121.6 (previous value).

Agencies review the annualized total number of new housing starts in the United States in June: with the outbreak of the new crown pneumonia, the company allows employees to work flexibly from home, and the demand for housing in low-density areas is rising, and the number of housing starts in the United States rose sharply in June.

The preliminary value of the University of Michigan Consumer confidence Index in July, previous value: 78.1, expectation: 79, published: 73.2.

Curtin:, director of consumer research at the University of Michigan, fell in the first half of July due to the widespread spread of new crown pneumonia, reversing the upbeat rise recorded in June. After the biggest two-month decline on record, consumers need time to reassess the impact of new crown pneumonia on personal finances and the economy as a whole. Consumer confidence is likely to decline further in the coming months as new crown pneumonia spreads and causes persistent economic damage, social chaos and permanent trauma.

Total number of oil drilling in the United States in the week to July 17, previous value: 181, expected: -, announced: 180.

The number of oil and gas drilling in the United States has fallen for 11 consecutive weeks to a record low, according to Baker Hughes.

Scan the QR code and join the aSMM metal communication group.