"SMM Nickel Industry chain Weekly report" is released. SMM will select hot topics, prices, quotations or major changes in the industry chain and release information for your reference.

The following is an excerpt from the weekly report of the SMM nickel industry chain:

The recent market is greatly affected by the capital side, although there has been a sharp correction in metal prices affected by the stock market on Thursday, but it has still maintained more gains since last week, and metal prices are still in a strong state under financial stimulus. Due to the lack of positive fundamentals, the room for nickel to continue to rise is limited, and heavy rains in Sulawesi, Indonesia, do not seem to have a significant impact on smelters at present, but the recent bull market with financial stimulus also needs to be cautiously bearish. It is expected that the high price of nickel will fluctuate next week, with 108000 yuan / ton in Shanghai nickel and 13150mi US $13700 / ton in Lunni.

"apply for free access to the SMM metal industry chain database

Catalogue of "SMM Nickel Industry chain Weekly report" in this issue

Main points of this issue's weekly report

Electrolytic nickel: the price of nickel is high and the downstream acceptance is low in order to increase the price of electrolytic nickel and decrease the water level again and again.

Nickel pig iron: a slight increase in the price quoted by steel mills stimulates the price-raising mentality of the consignors.

Stainless steel: stainless steel futures contracts pull up and the supply of goods in circulation in the market is too low to support the strength of spot prices.

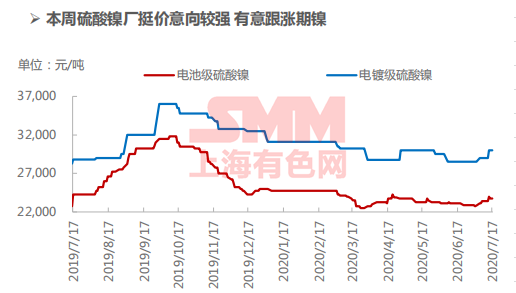

Nickel sulfate: the inventory of nickel sulfate manufacturers has bottomed out. The recent quotation intention follows the rising period of nickel, but the price effect is limited.

Ningbo Nickel Cobalt Lithium Conference focus: how much Nickel will be consumed by New Energy vehicles in the Future? Overview of multiple expectations

Scan the QR code application report for free and join the SMM copper industry chain exchange group

[China Nickel Industry chain High-end report] China Nickel Industry chain monthly report includes macro interpretation, monthly review of nickel price, interpretation of hot events and future forecasts in various sections of the nickel industry chain (nickel ore, electrolytic nickel, nickel pig iron, stainless steel, ferrochromium). And release monthly relevant enterprise operating rate and inventory survey and other data, covering the entire nickel industry chain.

[China Nickel Industry chain routine report] China Nickel Industry chain Weekly report includes macro interpretation, weekly review of nickel price, market trends of various sections of nickel industry chain (electrolytic nickel, nickel pig iron, stainless steel, ferrochromium), weekly social inventory, future forecast, comprehensive interpretation of the nickel market in the week.