SMM, July 14:

Today, SMM1 Electrolytic Nickel is quoted at 107450 RMB108450 per ton. After today's high opening and low return of overnight gains, the Shanghai Nickel 08 contract still fluctuates around 108000 yuan / ton, nickel spot downstream users are not willing to purchase high, the market trading atmosphere is still not good. In terms of discount, more traders reported about 500 yuan / ton, and the market had a small number of low-priced goods reported at 600 yuan / tonne. It is reported that few transactions were made in the morning market, and the transaction situation has not changed much from yesterday. Jinchuan Nickel to Shanghai Nickel 2008 contract is up about 300 yuan / ton, a small number of traders to promote terminal pick-up, to allow a small amount of shipments to Shengshui 200 yuan / ton. The ex-factory price of Jinchuan Company is 108500 yuan / ton in Shanghai and 108050 yuan / ton in Gansu. Nickel beans to Shanghai Nickel 2008 contract quoted 1600mur1500 yuan / ton, slightly larger than yesterday.

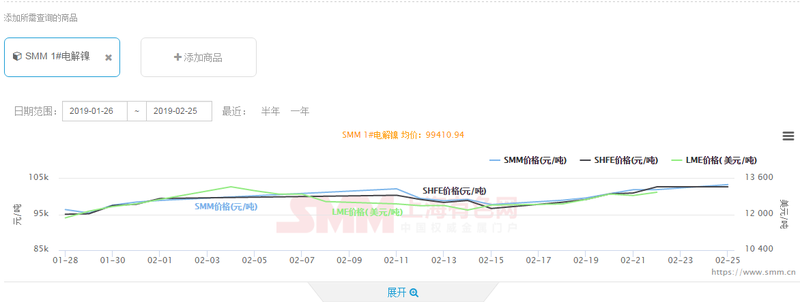

"Click to view SMM exclusive historical price data

Big data business contact:

Zhao Ming: 021mur51666780