SMM7 March 11: the recent financial market surging, China's A-share rally caused the market's attention, wait and see non-ferrous metals, mostly ride the wind and waves to change the decline at the beginning of the year V-shaped rise. On the other hand, the domestic economy and manufacturing industry have recovered steadily, and market demand continues to improve. According to data released by the Bureau of Statistics, PPI rose 0.4% month-on-month in June from a decline to a month-on-month rise, with a narrowing year-on-year decline and a pick-up in macro sentiment.

Against the backdrop of market sentiment repair and capital interference, the Lunpan metal market generally rose sharply last Friday, with Lun copper up 2.1%, Lun aluminum up 2.43%, Lunzn zinc up 1.89%, Lunni up 2.69%, Lunxi down 0.29%, and Lunxi lead up 1.34%. In the domestic market, the trend of non-ferrous metals is strong, the whole line is red, and most of them are up more than 2%. Copper in Shanghai is up 2.83%, aluminum in Shanghai is up 2.23%, zinc in Shanghai is up 2.39%, lead in Shanghai is up 2.35%, nickel in Shanghai is up 1.83%, tin in Shanghai is up 0.95%, thread is up 0.84%, stainless steel is down 0.6%. Shanghai copper grabs the "C position", up nearly 3%. SMM believes that in the context of optimism in the capital market, interference at the copper mine side has intensified, and copper prices still have long-term upward momentum.

The dollar index fell back higher, down 0.52% this week, the biggest drop in nearly a month. At present, there are more than 3.22 million cases of new crown pneumonia in the United States, and the epidemic situation is still grim; there are too many uncertainties in the United States, such as the formal announcement of its withdrawal from WHO. The market is closely watching the US government's fiscal stimulus measures. According to reports, US Treasury Secretary Steven Mnuchin said on July 9 local time that the Trump administration is in discussions with the Senate on a new economic rescue plan for new crown pneumonia. Some analysts believe that the rise in market risk sentiment has depressed the dollar.

In terms of US stocks, the three major indexes in the United States rose on Friday, with the Dow Jones Industrial average rising 1.44% to 26075.30, the NASDAQ up 0.66% to 10617.443, and the S & P 500 index up 0.78% to 3,185.04. The market is still watching the progress of the epidemic in the United States, and a new round of anti-epidemic checks in the United States may be coming, but this time the number of Americans eligible for checks will be greatly reduced.

In terms of crude oil, this week IEA raised its forecast for global oil demand for 2020, which will recover by the end of 2021 and is expected to reach 101.1 million barrels per day by the fourth quarter of next year. Us drilling companies have cut the number of oil and gas rigs to an all-time low for the 10th consecutive week. This helps to support oil prices. As of the close of the week, US oil was at US $40.60 per barrel, a weekly increase of 0.69%, while cloth oil was at US $43.17 per barrel, a weekly increase of 0.91%.

In terms of precious metals, gold prices climbed this week, breaking the $1800 mark for the first time since September 2011, reaching a high of $1818.06 an ounce, but then fell back from their highs and re-passed the $1800 mark to close at $1798.14 an ounce. The World Gold Council said: "concerns about the impact of a second outbreak on the already troubled global economy have triggered a new round of risk and uncertainty. At the same time, non-stop asset purchases by central banks allow them to hold interest-free assets, such as gold, which further reduces the opportunity cost of these assets. These factors continue to boost investment demand for gold, making gold ETF the main beneficiary. "

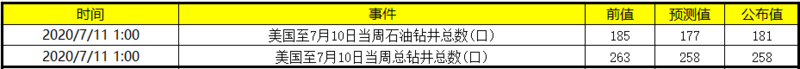

In terms of data,

Total number of oil rigs in the United States for the week to July 10. Pre-value: 185 expected: 177 announcement: 181

Total weekly drilling in the United States to July 10: 163 expected: 258 announcement: 258

Baker Hughes reported that the number of oil and gas rigs in the US fell by another five to 258 this week, marking the 18th consecutive week of decline in the number of active rigs in the US. At present, the number of oil and gas drilling rigs has decreased by 700 compared with the same period last year. The number of oil rigs fell by four this week, reducing the total number of rigs to 181 from 784 in the same period last year, according to Baker Hughes. This week, the number of active natural gas rigs in the US fell by one to 75. There were 172 rigs a year ago.

Overnight important financial data:

Scan the QR code and join the SMM metal communication group.