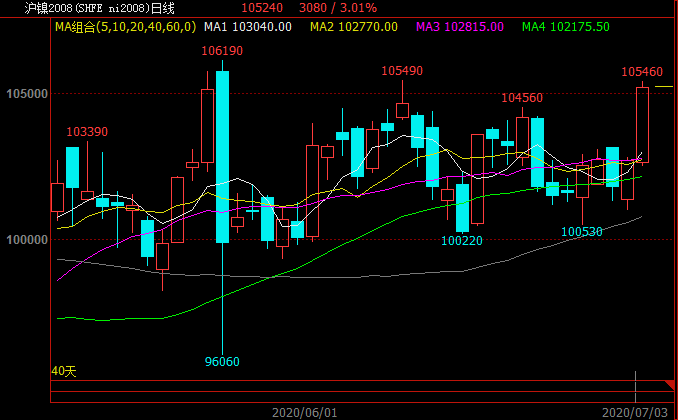

SMM7 March 3: the basic Shanghai nickel is in a concussive trend this week. Shanghai nickel once approached the 100, 000 mark on Monday, falling to 100530 yuan / ton, and then repaired the shock, but suddenly pulled up on Friday, rising to 105240 yuan / ton at one point, the highest since June 8. The US announced a sharp increase in ADP employment, and EIA crude oil inventories fell more than expected this week, while last night's US non-farm data once again boosted nickel market sentiment, leading to a sharp rise in nickel prices in Shanghai and London at the beginning of Friday trading.

However, the weak fundamentals of the nickel market have not been improved at present. With the arrival of the off-season downstream of stainless steel from July to August, domestic demand is weak and lack of obvious benefits, and the industry is generally pessimistic about the late market. Stainless steel profits are poor and the late supply of nickel pig iron in Indonesia continues to increase, under the influence of this recent nickel pig iron market shows a slight weakening trend.

Nickel spot trading is still poor, high nickel prices shock so that traders do nothing. Technically, if Shanghai Nickel cannot effectively repair the jump gap of 106000 yuan / ton above, it will still hold the firm above the 100, 000 mark, and the market will still be viewed as a range shock in the short term.

SMM's point of view:

This week, Shanghai Nickel completed the monthly change to 2010 contract on Friday. Last Wednesday night trading, Shanghai Nickel still fluctuated within a narrow range of 101700 yuan / ton, but after returning from the Dragon Boat Festival holiday, the game began. Monday, it opened from the 40-day moving average of 102200 yuan / ton, and soon quickly dived to 100530 US dollars / ton to test low support. Shanghai Nickel stopped falling and returned to a shock around 102200 yuan / ton. In the following three trading days, Shanghai Nickel was weak and fluctuated between the 20 / 40 daily moving average, with a pressure of 102800 yuan / ton. On Friday, Shanghai Nickel, which has been continuously weakening, was favored by funds to rise sharply, and the main force of Shanghai Nickel also took advantage of the opportunity to complete the change of month, of which the Shanghai Nickel 2008 contract reached as high as 105460 yuan / ton, closing at 105240 yuan / ton, and there were still 78671 positions; while the Shanghai Nickel 2010 main contract reached as high as 105970 yuan / ton, closing at 105840 yuan / ton, with a position of 94053 hands. Although there is no obvious improvement in the fundamentals of the nickel market, at present, the main force of the Shanghai nickel bulls is still present, and the superposition of various technical indicators is on the strong side. If the jump gap of 106000 yuan / ton can be effectively repaired, it may break through a new operating space. It is estimated that the operating range next week will be 102000 million 107,500 yuan / ton.

SMM spot View:

The weekly average price of SMM1 Electrolytic Nickel is 102590 yuan / ton this week, which is stable between 100,300Mel and 1003700 in the first four trading days, but the spot price of nickel rose sharply on Friday, so the spot price rose as a result. The premium has not changed much during the week, and the Russo Nickel discount has remained stable around 2008 yuan / ton for the Shanghai Nickel contract within the week. Due to the reduction of the low-cost supply of first-hand imports, the room for moving goods in the market is limited, so the Russo Nickel discount has not been adjusted with the rise or fall of the stock price in the period. In terms of Jinchuan Nickel, the rising water range this week rose 700mur900 yuan / ton to the Shanghai Nickel 2008 contract, which was larger than that before the Dragon Boat Festival, mainly due to the fact that long-term Association traders picked up goods in Gansu one after another after the holidays, while the supply of goods in circulation in Shanghai was gradually tight. According to traders, in terms of trading volume, Jinchuan Nickel is also slightly better than Russian Nickel. Although downstream users still take goods on demand, traders' willingness to replenish inventory has increased after the supply of goods has been reduced. It is expected that the Russian nickel discount will remain stable at 500 yuan / ton next week, waiting for the hedging plate to move to the warehouse before adjustment, while Jinchuan nickel will have a certain downward adjustment space with the relief of supply pressure, which is expected to be around 600 RMB800 / ton.

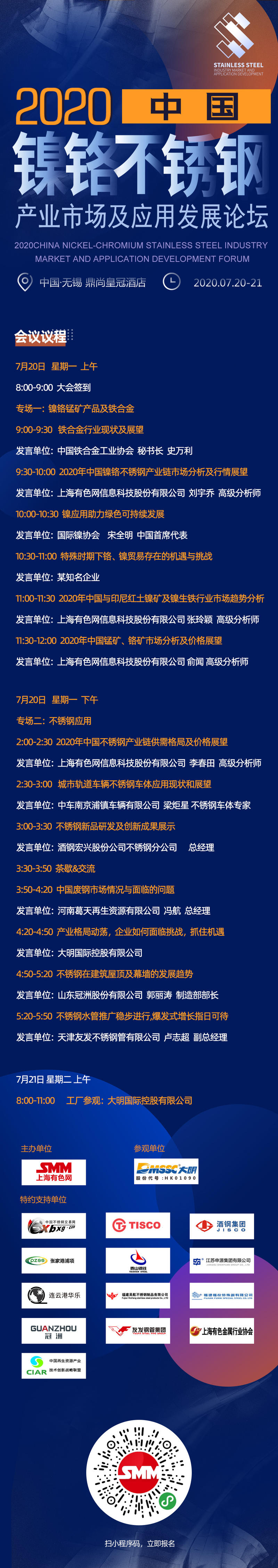

2020 China Ni-Cr stainless Steel Industry Market and Application Development Forum

Scan the QR code, apply for participation or join the SMM metal exchange group