SMM, July 1:

Today's SMM1 Electrolytic Nickel quotation is 101300 won 102800 yuan / ton. Today's nickel futures are adjusted around 101800 yuan / ton. Although the trading price is lower than yesterday, the market transaction situation has not picked up, the terminal demand is still weak, and more traders respond to poor trading volume. Russo Nickel to Shanghai Nickel 2008 contract quoted 500 to 400 yuan / ton, the same as yesterday. Jinchuan Nickel to Shanghai Nickel 2008 contract was overquoted at about RMB800 / ton. The supply of goods in Shanghai is still tight. Some traders' supplies are expected to arrive tomorrow, and most of the intra-day transactions are between businessmen in the market. Today, Jinchuan's ex-factory price is quoted at 102600 yuan / ton in Shanghai and 102150 yuan / ton in Gansu. It is reported that the manufacturer will receive the goods in Shanghai in the last two days. Nickel beans to Shanghai Nickel 2008 contract is still a discount of 1400 won 1300 yuan / ton, there are few transactions today.

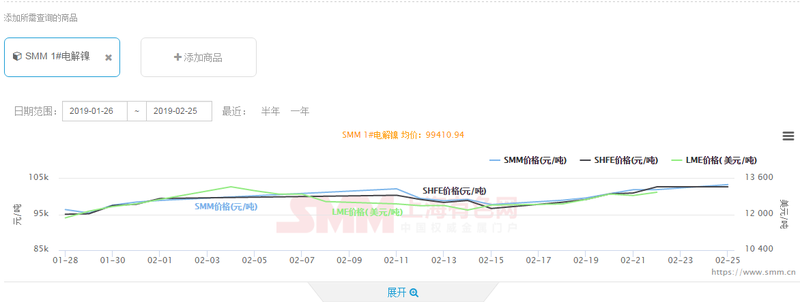

"Click to view SMM exclusive historical price data

Big data business contact: