SMM News: as we all know, recently, retail investors in the United States have become the main driving force of the rise in U. S. stocks.

While most people's attention is focused on "how retail investors drive US stocks", Francesco Pesole, a foreign exchange strategist, finds that a force among US retail investors has long been watching the foreign exchange market, targeting the dollar months ago. However, compared with the retail investors who are bullish on US stocks, they have not attracted much attention.

When Francesco Pesole tried to analyze retail position data in the foreign exchange market, he found that some retail investors had been bullish on the dollar. Using mobile data from online trading platform Robinhood, he analyzed the dynamics of retail purchases of dollars over the past few months.

Retail investors jumped into the carriage that was bullish on the dollar.

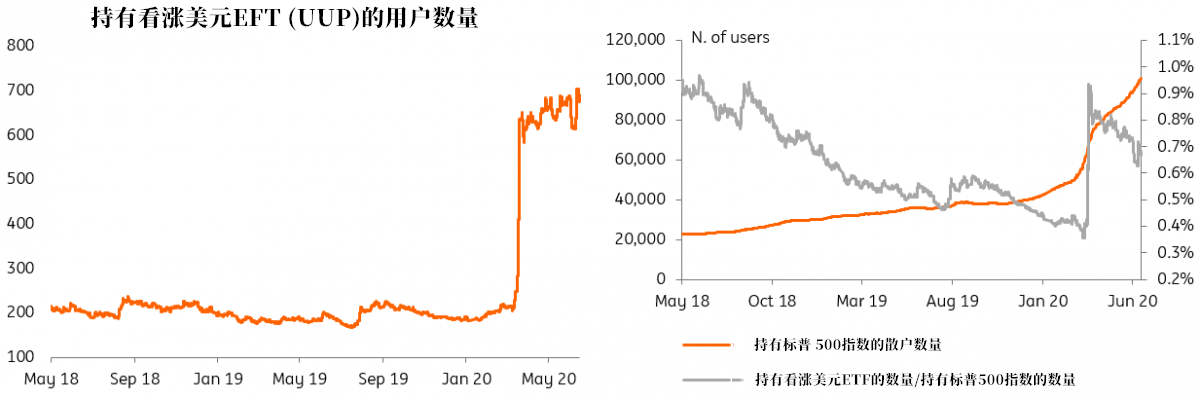

The most popular way for retail investors to take long speculative positions in the dollar through Robinhood is to buy the PowerShares DB dollar index bullish ETF (UUP), which tracks the performance of the dollar against a basket of six currencies (euro, yen, pound, Canadian dollar, Swedish kronor and Swiss franc). The figure below shows the number of users holding the UUP index in Robinhood's portfolio over the past two years.

It can be seen that bullish bets on the dollar increased sharply around mid-March, rising in line with the spot price of the dollar.

Interestingly, in the following weeks, until June, as the dollar narrowed most of its gains, the number of holders did not decline (June 15 is the latest reported data). However, Pesole believes that this may be the result of a succession of new investors following the platform and starting to be bullish on the dollar, and the new positions make up for those sold by abandoning the bullish dollar.

Although we do not have access to specific retail data on a daily basis, we can learn from the performance of retail investors in the stock market and see some clues. ETF positions in the S & P 500 show that retail investors have continued to flow in over the past few months and do not seem to have been affected by actual volatility in the stock market.

Divide the number of retail investors tracking the dollar by the number of retail investors tracking the S & P 500 and we can see that real bullish interest in the dollar among retail investors began to weaken after peaking in March.

Can retail investors pry up the foreign exchange market?

The answer is no. Although retail investors can drive US stocks higher, their current strength in the foreign exchange market is still too weak.

The above data have some obvious defects. If other factors are not taken into account, the number of Robinhood investors bullish on the dollar is relatively small, at about 700 after the rise in the dollar index in March, much less than the number of investors tracking the S & P 500. Of course, this is just data from one platform, without considering other platforms.

Another drawback is the lack of detailed information on the amount invested by each retail investor, so it is impossible to know how much money retail investors are bullish on the dollar.

But Francesco Pesole believes this is not important because retail investors are unlikely to play an important role in increasing dollar volatility, regardless of actual trading volumes.

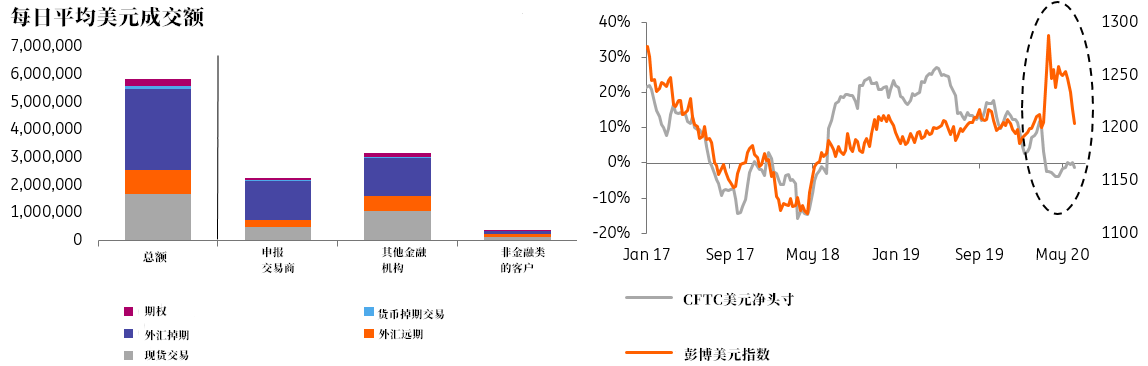

BIS transaction data show that non-financial customers account for a small proportion of daily dollar transactions, while retail investors account for a small proportion of these non-financial customers.

It is worth noting that while some retail investors are still bullish on the dollar, CFTC's speculative positions show signs of being bearish on the dollar. CFTC data show that speculative net short positions in the dollar have jumped in the most recent week. The total value of net short positions in the dollar rose by $15.69 billion in the week to June 16, the biggest increase in net short bets since January. This means that big money is bearish on the dollar.

Scan the QR code and join the SMM metal communication group.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)