SHANGHAI, Jun 10 (SMM) – China’s production of new energy vehicles continued to decline sharply in May from a year earlier, indicating that the market recovers slowly from the Covid-19 pandemic.

About 75,000 NEVs produced in China got certified for sale last month, showed SMM data. That was up just 3% from April, and marked a 32.3% decline from the same month of 2019 which was the last full month before the sharp cut to government subsidies came into force in late June of the year.

Passenger vehicles accounted for 68,000 units, or 90.6% of the total, and the volume increased 4.3% from April. Production of new energy buses slipped 9.3% to 2,600 units, taking up 3.4% of the total, while that of special vehicles fell 7.2% to 4,500 units, accounting for 5.9%.

In May, Tesla remained the top NEV manufacturer with its production inching up from April. BYD took the second place, and its production shrank 25.7% from a month earlier and 63.6% from a year earlier.

Joint ventures including FAW-Volkswagen, SAIC-Volkswagen and Brilliance-BMW continued to ramp up production, while start-ups saw mixed performance with higher production from NIO and WM Motor and production decreases at Lixiang and Xpeng Motors compared with the previous month.

Traditional automakers struggled

China’s traditional automakers have been struggling to maintain their market shares in NEVs, due to the pandemic and price cuts by Tesla as well as competition from some start-ups. BAIC BJEV produced only more than 500 NEVs in May.

Major buyers of NEVs produced by traditional automakers such as BAIC and GAC are taxi and ride-hailing companies, which have been hit hard by the pandemic. These sectors are likely to recover to levels seen in the same period last year in the second half of the year on the back of policy supports by local governments.

On the other hand, NEVs produced by Tesla, start-ups and joint ventures, were mostly bought by individual buyers.

Battery installation fell 2.7% on the month

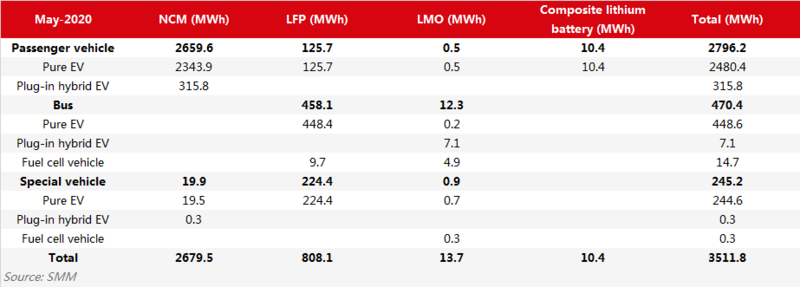

SMM data also revealed that 3.5GWh of batteries were installed to power cars in May, down 2.7% month on month and 38.2% year on year.

In terms of battery types, capacity of installed ternary batteries was 2.7GWh last month, accounting for 75.7% of the total installed EV batteries, while lithium iron phosphate batteries accounted for 23% or 0.8GWh.

About 2.8GWh was installed in PVs, with 2.3GWh in pure-battery PVs. NCM batteries remained the mostly used power batteries in PVs, while the portion for Li-Fe batteries rose slightly.

LFP batteries maintained their dominance in buses and special vehicles. About 0.5GWh of batteries was installed to power buses in May, while 0.2GWh was installed for special vehicles.

LG Chem overtook BYD as the second biggest EV battery maker

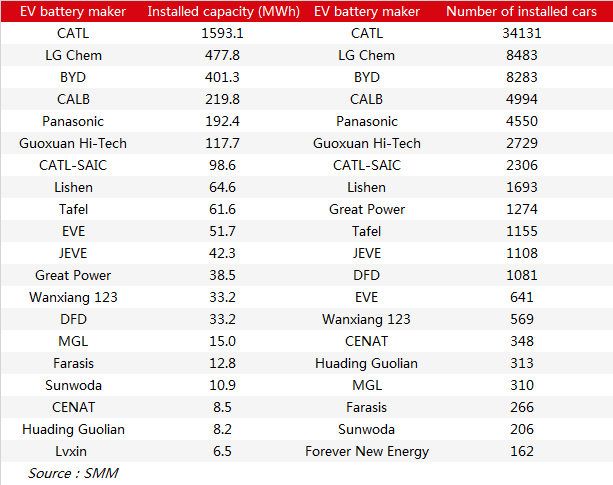

CATL remained the top EV battery producer in China in May, while South Korea's LG Chem maintained its spot as the second biggest producer in terms of both installed capacity and the number of installed cars.

CATL’s batteries accounted for about 45.4% of installed capacity in May. LG Chem supplied batteries for Tesla EVs and became SAIC-GM’s battery supplier last month.

The EV battery market concentration weakened slightly compared with April, with CR10 at 93.4%, CR5 at 82.1% and CR3 at 70.4%.