May 15 price of SMM lead products

May 15 SMM domestic well-known recycled lead enterprises waste battery purchase quotation

May 15 SMM lead Market Trends

Shanghai Changchi Hongyang lead 14100PUE 14150 yuan / ton, price for Shanghai lead 2006 contract 240mur300 yuan / ton, Wuxi market South lead 14055 yuan / ton, Shanghai lead 2006 contract price 200RMB / ton. Lead shock consolidation, holdings quotation with the market, warehouse orders quoted prices do not increase changes, at the same time downstream to just need to purchase, bulk single market trading activity is slightly better.

Guangdong market South China lead 13900 yuan / ton, the average price of SMM1# lead 50 yuan / ton quotation; Henan Yuguang, Wanyang and other smelters to Jiaochang single, Jinli 13800 yuan / ton, to SMM1# lead average price discount 50 yuan / ton, Minshan 13770 yuan / ton, to SMM1# lead average price discount 80 yuan / ton; Hunan Jingui 13700 yuan / ton, SMM1# lead average price discount 150 yuan / ton. Jiang copper 13850 yuan / ton, SMM1# lead average price flat water quotation. Yunnan small factory 13550 yuan / ton, the average price of SMM1# lead discount 300yuan / ton quotation. Lead price shock operation, smelter single quotation discount slightly narrowed, but today's market procurement is mainly recycled lead, primary trading is relatively light.

Shanghai period lead shock upward, because the waste battery quotation is strong, the reduction lead is difficult to make a profit, the recycled refined lead profit is meagre, the cost support has the embodiment, including the tax regenerated refined lead discount range fluctuation is not big.

Electric bicycle battery market terminal consumption is not prosperous, some storage enterprises finished product inventory is on the high side, the major brands maintain promotion, the main model 48v12Ah in 210-240 yuan / group.

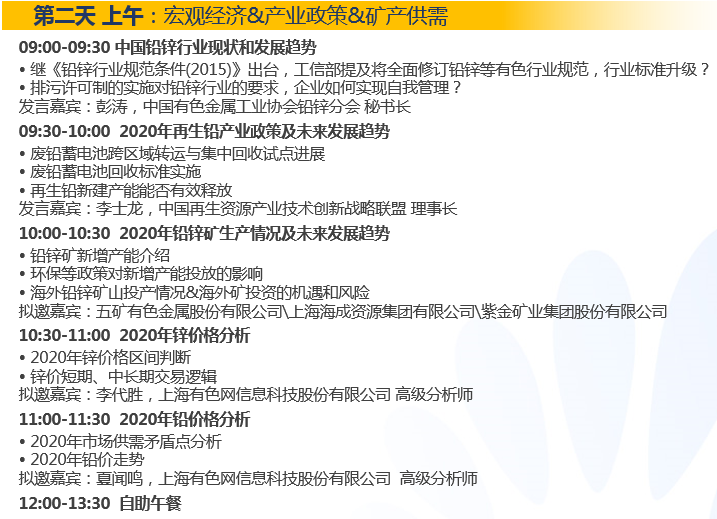

With the escalation of global trade disputes in 2019 and the downward pressure on the global economy, central banks began a wave of interest rate cuts. At the same time, the meeting of the political Bureau of the CPC Central Committee stressed that at present and for some time to come, the basic trend of China's economic stability and long-term improvement will remain unchanged, and 2020 will also be the year when China will build a moderately prosperous society in an all-round way and the 13th five-year Plan ends. In this context, the new crown virus is rampant all over the world, and it is worth looking forward to how to achieve steady economic growth.

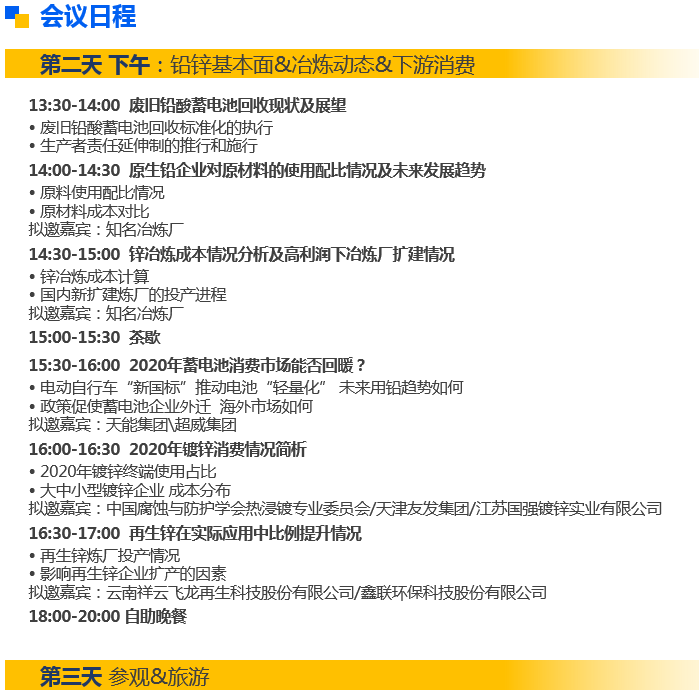

In the zinc market, overseas mines will increase production step by step in 2019, but the increase in domestic mine production will be repeatedly hindered. In the first quarter of 2020, zinc prices fell through the mine cost line, mine profits plummeted, and how smelters and mine profits will be distributed in 2020. can overseas mines be expected to be put into production under the disturbance of the epidemic situation? In addition, the output of domestic refining zinc smelters broke through the bottleneck in 2019 and refreshed the all-time high. Under the disturbance of the supply end of zinc mines in 2020, can the capacity utilization rate of smelters maintain a high load? Whether the infrastructure investment under the tone of "stabilizing the economy" in 2020 can exceed the expected performance, whether the super-seasonal performance of the galvanizing industry can still be expected, and whether the contradiction between supply and demand of zinc may reverse in 2020, paying attention to and laying out structural opportunities is another option. Can zinc prices pick up in 2020?

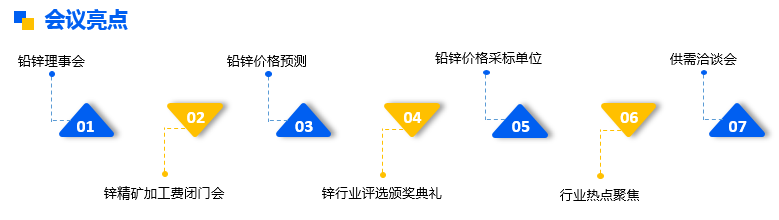

In view of the above topics, SMM will invite industry bigwigs, industry professionals, upstream and downstream enterprises of the industry chain to hold the "2020 (15th) lead and Zinc Summit" in Changsha to discuss the current situation and problems faced by the industry, as well as future development prospects, and analyze the fundamentals and the future trend of zinc prices.

Click to sign up for SMM 2020 (15th) lead and Zinc Summit

Scan the QR code to sign up for the lead and zinc summit and fill in the personal information at the end of the page, and the conference staff will contact you later!