SHANGHAI, Nov 28 (SMM) – SMM sees further downside risk in Shanghai nickel prices in the short term as stainless steel output cuts dampened demand for and destocking inclination at stainless steel producers may extend the decline in stainless steel prices.

An SMM survey found that elevated inventories and lower profit margins drove some stainless steel mills to cut output of #300 series. But this may unlikely to reverse the overall supply glut.

In addition, production cuts will offer limited support to stainless steel prices amid lower prices of feedstock nickel and high inventories of stainless steel products across social warehouses in China.

SMM expects stainless steel prices to remain weak before social stocks start to decrease.

On November 28, the most-liquid nickel contract on the Shanghai Futures Exchange fell to its lowest level in almost four months, at 111,390 yuan/mt, before ending down 1.96% at 111,530 yuan/mt.

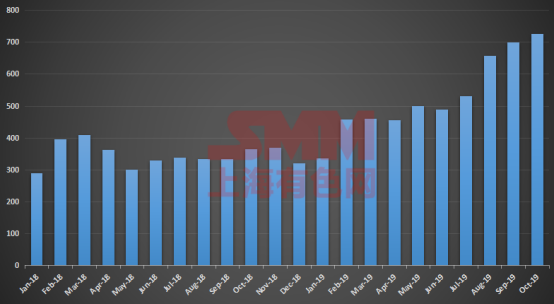

China’s stainless steel inventories (unit: 1,000 mt)