Nickel price judgment: 1. The sudden incident of the nickel mine accident has a certain impact on the market sentiment, just as the nickel price has been falling for several days, so the price has rebounded slightly, but the incident has not caused the mine to stop production, and the substantial impact is expected to be very small; (2) it is rumored that the London Stock Exchange will investigate the trading records of nickel contracts because of the sharp drop in inventories. Although the news is short of the nickel price, the industry believes that the possibility of finding out the illegal operation is very small. 3. The increase caused by the news of the ban on mines in Indonesia in the early stage has been partly vomited, and the increase after the complete implementation of the news at the end of August has basically given up, while the fundamentals of nickel itself have been stable, and the price trend in the later stage is still related to the long-short game around deliverables.

Macroscopically, the dollar index fell below its 200-day moving average near 97.40 for the first time since mid-2019 and is now trading around 97.35. Recent international trade tensions have shown signs of easing, investors have renewed interest in risky assets, the dollar fell sharply last week and the weakness is likely to last longer. Brexit continues, and Brexit will be postponed: according to the parliamentary vote, the timetable for a formal Brexit on October 31 was vetoed. In China, the central bank yesterday unveiled a huge 250 billion reverse repurchase operation, easing capital tensions and is expected to launch a fourth-quarter targeted medium-term lending facility (TMLF) operation in the fourth week of October to replenish liquidity to the market.

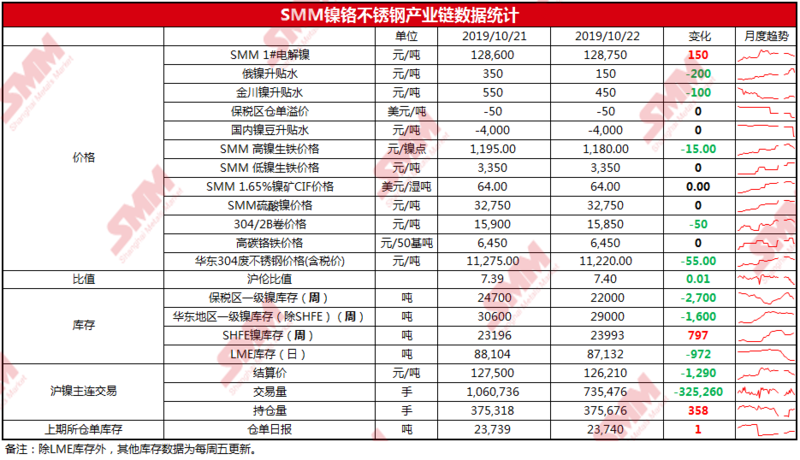

Nickel spot: on October 22, Russian nickel was 1911 yuan higher than Shanghai nickel 1911 to 200 yuan / ton, and Jinchuan nickel was 400-500 yuan / ton higher than Shanghai nickel 1911 contract. The rising water in Jinchuan, Russia is generally lower, mainly due to the recent large price difference between Shanghai nickel and Wuxi nickel. Wuxi nickel was about 10,000 lower than Shanghai nickel on Monday, stimulating steel mills to purchase nickel beans without tin plates, and the demand for nickel plates has been significantly suppressed. Today, the nickel price opened lower, Wuxi and Shanghai nickel price difference has been repaired, but it is still more than 7000 yuan / ton, nickel bean transaction is better than nickel plate, but because the mainstream traders quoted nickel in Shanghai, the Shanghai spot market trading is very light. The ex-factory price of Jinchuan Company is 129500 yuan / ton, 1000 yuan / ton higher than yesterday. Nickel prices fluctuate around the daily moving average in the afternoon, market sentiment continues in the morning, transactions continue to be weak.

Nickel pig iron: on October 22nd SMM high nickel pig iron (ex-factory price) is 11601200 yuan / nickel point, which is 15 yuan / nickel point lower than that of the previous day, and there is still room for downward adjustment in the short term. With the sharp correction of nickel prices, the price of high nickel and iron followed the trend of decline in nickel prices. In addition, a large stainless steel factory in the south yesterday lowered the bid price from 1180-1190 yuan / nickel point (to factory tax) to 1150-1160 yuan / nickel point (to factory tax) for price inquiry. The market mentality for high nickel-iron price is more negative, and the focus of discussion has dropped sharply. At present, the price is in a state of great fluctuations, in addition to rigid demand procurement and long contract delivery, most of the stainless steel plants with low demand are in a wait-and-see state. Market participants believe that even if the price falls to 1150 yuan / nickel point (ex-factory price) may also be difficult to stimulate a lot of buying.

Stainless steel: October 22 Wuxi area quotation: state 3042B cut edge volume price 1605016250 yuan / ton, private 3042B rough edge volume price 1580015900 yuan / ton. 304 / NO. 1 five feet at 14950-15050 yuan / ton. Nickel prices fell, dragging down stainless steel prices, demand failed to support the case, agents and traders comply with the trend, in the morning Wuxi market private cold and hot rolling fell 50 yuan / ton. For 10:30 SHFE SS2002 contract selling price 14850 yuan / ton, Wuxi stainless steel spot water 820-920 yuan / ton (spot edge cutting = rough edge + 170 yuan / ton)

On the inventory side, Lunni stocks on 22 October were 87132 tons, a decrease of 972 tons from 21 October.