On the macro front, the dollar index fell in the afternoon yesterday but then gradually recovered its losses and held steady. The minutes of the September policy meeting released by the Federal Reserve in the early hours of Thursday (October 10) Beijing time showed that most policymakers supported the need to cut interest rates at the September meeting, but views on the future monetary policy path remain deeply divided. Us manufacturing activity fell to a 10-year low and services fell to a three-year low. Consumer spending, the main driver of US economic growth, has also recently slowed to modest growth. Citigroup believes the Fed's outlook is not the main resistance to the dollar, but the Fed will continue to respond to weakening data.

Nickel spot: today, Russian nickel than Shanghai nickel 1911 reported flat water to 100 yuan / ton, Jinchuan nickel compared with Shanghai nickel 1911 contract generally reported 200-300 yuan / ton, rising discount water slightly higher than yesterday, Russian nickel is mostly flat water trading concentration, Jinchuan Shengshui 200 yuan / ton has a small number of transactions. At the beginning of the session, nickel prices rose all the way to 137000 near the shock, spot trading is weak, the market is mostly on the sidelines. Subsequently, nickel prices fell slightly to 136800 yuan / ton, some traders entered the market to replenish the warehouse, concentrated in the vicinity of 13.68-136900 trading is slightly concentrated, the downstream market buyers are on the low side. Jinchuan nickel holders are generally more, although the downstream demand is weak, rising water fell near the cost line of most traders, the possibility of continued decline is small. The ex-factory price of Jinchuan Company is 137200 yuan / ton, which is 700 yuan / ton higher than that of yesterday, and the mainstream transaction is 136800-137200 yuan / ton. Nickel prices in the afternoon under the overall pressure below the daily average, the market without waves, the morning has been concentrated trading completed, the mainstream transaction in 136800-137100 yuan / ton.

Nickel pig iron: on October 9, when we returned to the market after the festival, the focus of negotiations on high nickel pig iron continued to be strong. Most manufacturers according to the previous price delivery of goods, the price is fully in 1200 yuan / nickel point above, the latest negotiated price is generally 1250 yuan / nickel point (ex-factory) above, and it is rumored that some of the high price source of goods in the market transaction in 1280 yuan / nickel point (arrival price). Nickel and iron manufacturers do not intend to ship at a low price. Although stainless steel plants are unwilling to accept excessive prices, the acceptance intention of some rigid demand does continue to rise compared with that before the festival.

Stainless steel: on October 9, the price of private cold rolled stainless steel in Wuxi area is generally flat, and some businesses increase the price of hot rolling: state-owned 304 2B cut edge coil price 16100-16300 yuan / ton, private 304 2B rough edge roll price 15900-16000 yuan / ton. 304 / NO. 1 five feet at 15050-15150 yuan / ton. Morning quotation is generally flat yesterday, some businesses small trial up 50 yuan / ton, two days after the transaction is OK, some businesses respond to replenish the demand, whether it can be sustained. For 10:30 SHFE ss2002 contract selling price 15675 yuan / ton, Wuxi stainless steel spot water 95-195 yuan / ton (spot edge cutting = rough edge + 170 yuan / ton).

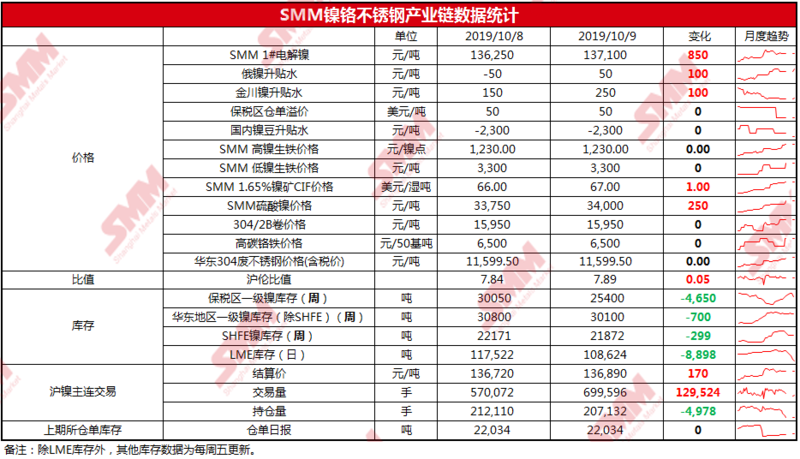

On the inventory side, Lunni stocks on 9 October were 108624 tons, down 8898 tons from 8 October.

Nickel price judgment: the performance of Lunni inventory and the actual consumption of nickel fundamentals are different, the mentality of the industry is different, in the short term, the nickel price is still fluctuating above 135000. Lunni closed in the small negative line, the top pressure 5-day moving average, K column fell below the 10 / 20 moving average of $17400 / tonne line, today focus on Lunni can hold the $17300 / tonne level. Overnight Shanghai nickel closed in the small positive line, the upper 5 / 10 moving average crossing resistance is strong, there is no moving average support near the bottom, today pay attention to whether Shanghai nickel can be stable in 135000 yuan / ton line.