Macroscopically, there was a sudden upbeat in the market last night, with the Trump administration postponing a 10 per cent tariff on some Chinese products, including laptops and mobile phones, which was scheduled to begin in September until December. The news gave a boost to global financial markets: all three major US stock indexes traded red, then quickly expanded to more than 2 per cent; the dollar index and the renminbi rose sharply, with the offshore renminbi rising more than 1000 points against the dollar; and in the crude oil market, oil cloth oil both rose sharply, with Brent crude up more than 4 per cent. Germany's ZEW economic sentiment index hit an eight-year low of 44.1 in August, indicating a significant deterioration in the German economic outlook.

Today, we focus on the monthly and annual rate of retail sales of consumer goods in China in July, and the monthly and annual rate of industrial value added above the scale of July. The euro zone adjusted the quarterly rate of employment in the second quarter to the revised annual rate of GDP in the second quarter. Evening focus on EIA crude stocks (10,000 barrels) in the week ending Aug. 9 in the United States.

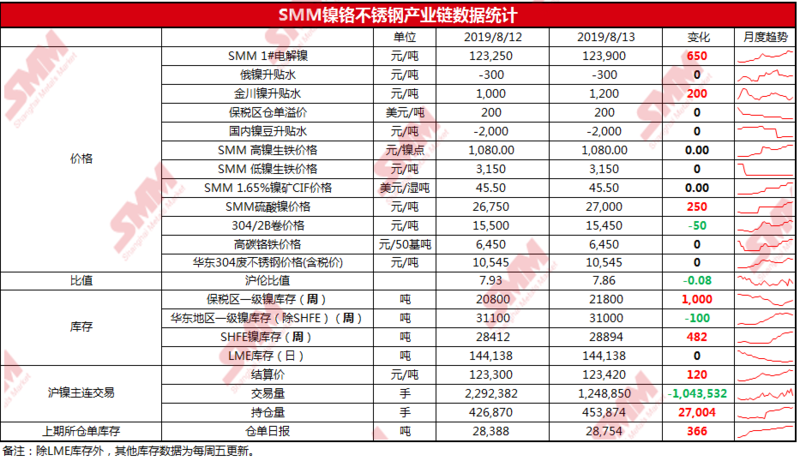

Nickel spot: August 14 SMM 1 # electrolytic nickel 123100 124700 yuan / ton. The discount of Russian nickel is about 300yuan / ton compared with Shanghai nickel 1909, and Jinchuan nickel is 1100RMB / ton higher than Shanghai nickel 1909 contract. This morning, nickel prices continued a strong shock last night, around 123400 yuan near the shock, spot market trading continued to be light, traders feedback in the lower reaches of the last two days basically did not purchase, basically in a priceless state. In the second trading session, Shanghai nickel continued to move higher than 124000, downstream that nickel prices can be expected to fall, more in the wait and see.

Stainless steel: August 13 3042B roll-rough edge (Wuxi) fell 100 yuan / ton, 3042b volume-Maobian (Foshan) fell 100 yuan / ton.

The European Union has launched anti-dumping investigations against hot rolled stainless steel coils in China and Indonesia, and India has imposed countervailing duties on Chinese stainless steel welded pipes. The double reverse pressure faced by the export market has further increased, which has a certain impact on demand. The Shanghai Futures Exchange issued a notice on Aug. 13 to start trading stainless steel futures, showing a two-week simulation of trading from Monday, Aug. 19, 2019 to Friday, Aug. 30, 2019. it is closer to the listing node.

Nickel price judgment: nickel price will still fluctuate broadly in the short term. Indonesian mining ban news continues to contribute to the subject matter of speculation, people from all walks of life have different views, and it is expected that the supporters and opponents will continue to struggle for a long time. In addition to rumors of a ban on mining in Indonesia, the closure of a high-nickel mine in the Philippines in October, stainless steel continued to maintain high production and other fundamental support, bulls full of confidence. However, it is vigilant that the output of the third series of a stainless steel plant in Indonesia will decrease, and the return of nickel pig iron will increase in the later period. Whether the actual fundamental situation can support the high nickel price; second, the financial level pays attention to whether the bulls are profitable or not. In view of the unconfirmed rumors of a ban on mining, and the late Indonesian return of ferronickel will make up for some of the domestic demand, from the nickel fundamentals, nickel prices continue to rise without strong momentum, nickel prices are expected to be high and wide fluctuations.

Today, we are concerned about whether Lennie can continue to be supported by the 5-day EMA, as well as the resistance above the US $16000 / ton barrier. Shanghai nickel today focused on the above 126000 yuan / ton gate resistance.