SMM2 25-month news: Ehrman Group (Eramet) recently announced 2018 results.

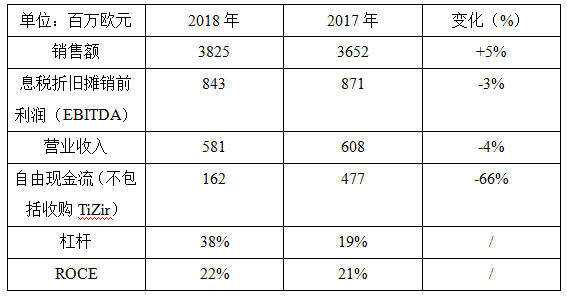

Operation of the Group in 2018:

4.3 million tons of manganese ore were produced in 2018;

Export of 1.2 million tons of New Caledonian nickel mines in 2018;

Thanks to rising metal prices, sales rose 5 per cent to 3.825 billion euros in 2018;

The good performance of manganese ore (Comilog) and mineralized sand (TiZir) was offset by the production difficulties of the nickel business and the adverse market environment faced by the high performance alloys sector, the losses of the Sandouville and Aubert&Duval plants, and revenue of 581 million euros in 2018;

The EBITDA is 843 million euros, in line with the production target.

Outlook for 2019:

The production target for manganese ore in 2019 is 4.5 million tons, which is expected to increase to 7 million tons by the end of 2023.

At the same time, focus on the Argentine lithium project, which marks the acceleration of the transition metal energy diversification strategy.

Current market conditions have been offset by growth and expected productivity growth in 2019, and EBITDA is expected to be close to 2018 in 2019.

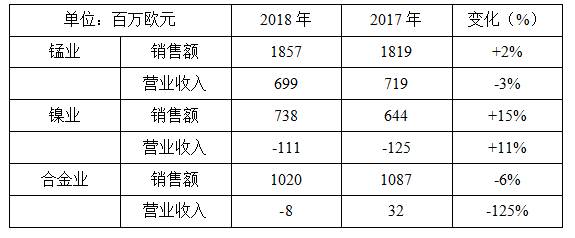

Key business data:

Nickel industry:

Industry situation:

Global stainless steel production increased by 4.8% in 2018 compared with 2017. The year-on-year increase was 9.7% in the first half of the year and 0.4% in the second half of the year. Chinese production shrank by 0.5 per cent in the second half of the year as a result of a slowdown in the car and construction sectors, offsetting strong growth in Indonesian composite producers.

During this period, demand for primary nickel increased by 3.4 per cent, supported by the good prospects for the development of stainless steel and electric vehicle battery industries.

As a result of the continued growth in NPI production, particularly in Indonesia, global primary nickel production increased by 5.3 per cent in 2018 compared with the same period last year.

However, this increase in production is not enough to meet the change in demand, and the balance of supply and demand for nickel remains short in 2018, with a shortfall of more than 100000 tons compared with 2017. As a result, LME and SHFE nickel stocks continued to decline significantly throughout the year, reaching 222000 tons at the end of December 2018 (down 46 per cent from the end of December 2017).

Compared with the 2017 average of $4.72 / lb ($10,407 / tonne), the average LME price rose 26 per cent to $5.95 / lb ($13118 / tonne) in 2018.

After strong growth in the first half of the year, the growth outlook was affected by international trade tensions, particularly in China, which had a negative impact on prices.

Operation of nickel industry of the group:

Total nickel sales in 2018 were 738 million euros, up 15 per cent from 2017. Driven by higher nickel prices and higher ore exports, SLN's sales were 64 million euros, a net increase of 31 million euros. The Sandouville plant again dealt a heavy blow to the results, with losses of 57 million euros.

In New Caledonia, the closure of the Kouaoua Mining Centre during the period from August to October had an impact on the Group's current operating income of 11 million euros in fiscal year 2018.

Due to good mining production (excluding Kouaoua), SLN, which reached a record 1.2 million tons of ore exports in 2018, an increase of 36 per cent compared with 2017. The low content of nickel in the exported ore cannot be used to supply local metallurgical production.

Compared with 2017, Doniambo's nickel production fell 4 per cent in 2018, while sales remained stable at 5.53 million tons.

The new economic model, rebalancing the mining and metallurgical industries, will increase the company's revenue by increasing the value of the current mining industry and correspondingly reducing cash costs. The success of the model is based on the target volume of 4 million tons of ore exported each year and will reach this rate in the second half of 2020. SLN aims to export 1.5 million tons of ore by 2019.

The implementation of the Weda Bay nickel project in Indonesia marks the beginning of the construction of the NPI (nickel cast iron) production plant, which is expected to reach 300000 tons of NPI capacity by the end of 2020.

Lithium Project:

In 2018, Eramet actively carried out the development of lithium mines in Argentina.

Since its discovery at the beginning of the decade, geological work has increased resources to 9.9 million tons of LCE.

Based on the detailed engineering study currently in the final stage and the administrative authorization process in Argentina the investment decision is expected to be completed in the spring of 2019.

The target production capacity is 24000 tons of LCE, per year. According to the decision, production will begin at the end of 2021.

Scan QR code, apply to join SMM metal exchange group, please indicate company + name + main business