Metal materials are widely used in automotive components, and their price fluctuations significantly impact cost structures. According to SMM estimates, a typical NEV's cost breakdown is as follows: power battery (35%-40%), traction motor and motor controller (10%-20%), body/chassis/interior (30%), and other electronics (7%). This analysis focuses on the traction motor system, as SMM has extensively covered batteries elsewhere.

Within the motor system (10%-20% of total vehicle cost), raw materials account for the largest share. Key metal inputs include rare earth-neodymium iron boron (NdFeB) magnets (30%-35%), copper-enameled wires (15%), and aluminum-structural components (20%). The simultaneous surge in these metals from late 2025 to early 2026 has placed immense cost pressure on motor manufacturers and NEV OEMs .

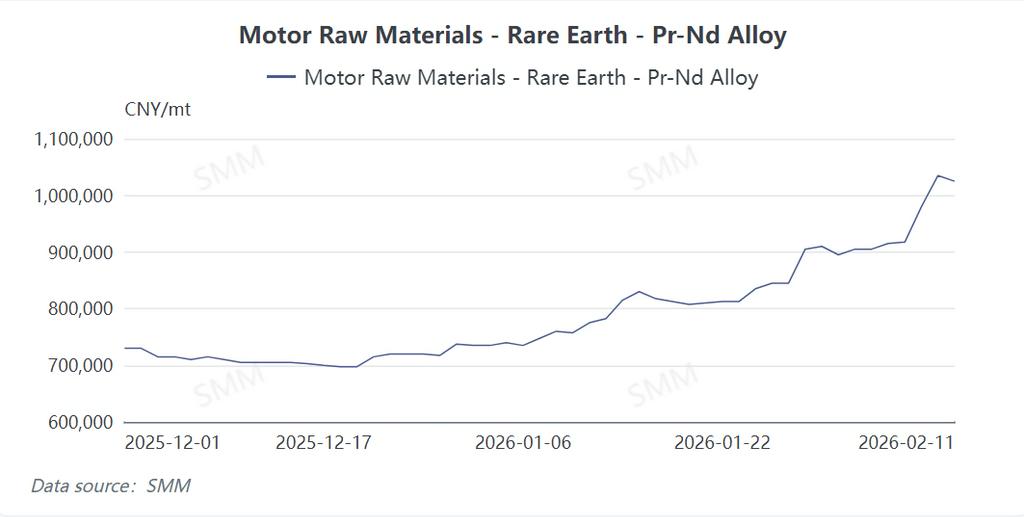

1. Rare Earth Metals: Supply Squeeze and Demand Resilience Drive Prices Up

Rare earth prices, particularly for praseodymium-neodymium (PrNd) metal, have risen sharply. As of February 9, 2026, PrNd prices reached 975,000–985,000 RMB/ton, a year-to-date increase of 33.1%. This acceleration stems from tight supply (limited upstream output, weak production activity, and reduced spot availability due to long-term contract deliveries) and robust demand (steady overseas orders for magnetic materials and growing expectations for NEVs and e-bikes in 2026). These factors collectively pushed prices upward .

Motor manufacturers face greater challenges than magnetic material suppliers. They must absorb not only soaring rare earth costs but also high copper prices. Compounding this, motor makers struggle to pass cost increases downstream. NEV OEMs, grappling with fierce market competition, resist price adjustments. Consequently, motor producers are caught between expanding losses (if they continue production) and losing market share (if they halt operations). Their weak bargaining power, due to proximity to concentrated downstream customers, exacerbates the strain .

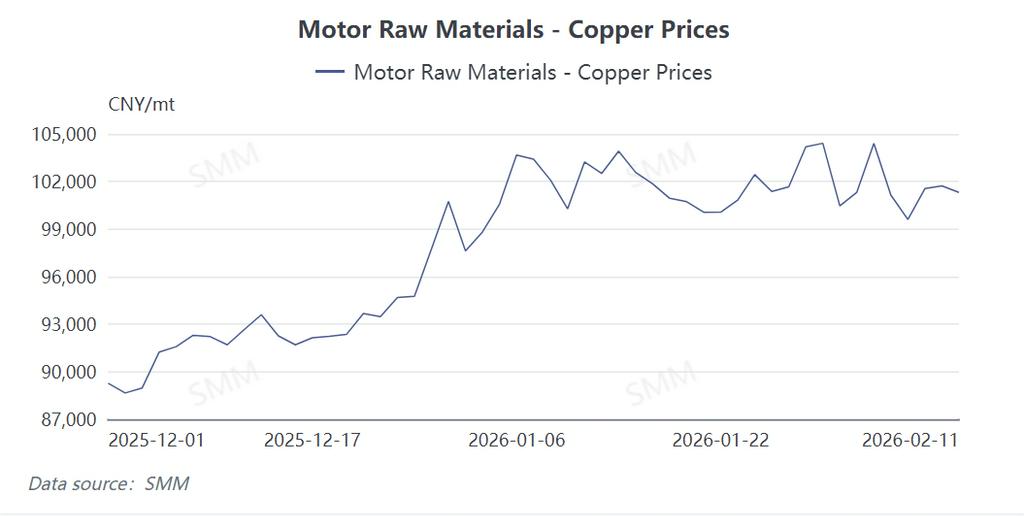

2. Copper: Structural Supply-Demand Imbalance and Financial Factors

Copper prices rose sharply from 87,000 RMB/ton in late 2025 to 105,000 RMB/ton in early 2026, a gain of over 20%, and have remained elevated. This rally was driven by:

-

Supply-chain constraints: Production disruptions in major copper-producing countries (e.g., Chile, Peru), geopolitical tensions, and logistics bottlenecks limited short-term supply.

-

Financial influences: Global liquidity conditions and inflation expectations attracted speculative capital, amplifying price volatility.

-

Strong demand: Sustained optimism regarding data centers and cable demand further supported prices .

The impact on motors is direct and significant. Copper, critical for stator and rotor windings, constitutes a substantial portion of motor raw material costs. The price surge adds hundreds of RMB to the cost per motor, translating to billions of RMB in additional annual expenses for large-scale OEMs. This pressure cascades through the supply chain, squeezing margins for material suppliers, motor makers, and vehicle manufacturers. While some industrial motor firms have raised prices, NEV OEMs have so far absorbed the costs, further straining their profitability .

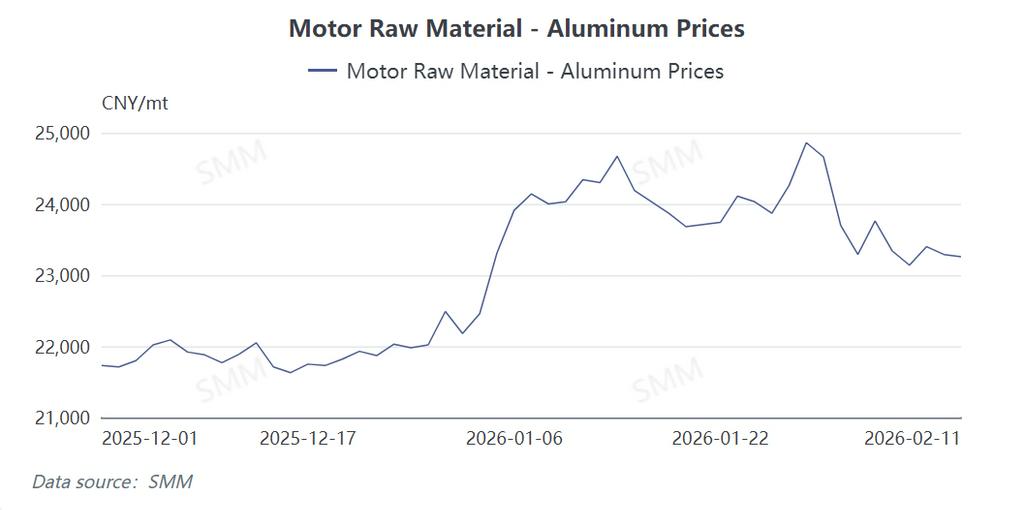

3. Aluminum: Tight Fundamentals Amid Energy Transition Demand

Aluminum prices climbed nearly 10% from December 2025 to January 2026, primarily due to structural supply-demand tightness. Demand is bolstered by global energy transition trends (e.g., NEV bodies, battery trays, and e-drive casings) and solar PV growth. On the supply side, aluminum production—highly energy-intensive—faces pressure from elevated global power prices, leading to unstable operational rates. Financial investors' focus on "green metals" has also contributed to price gains .

Although aluminum's cost sensitivity is lower than copper's, it is widely used in motor housings, end covers, and cooling systems. Price increases directly raise motor manufacturing expenses, costing hundreds of millions of RMB for producers at million-unit annual scales and eroding margins for motor suppliers and OEMs .

4. Path Forward: Technology and Supply Chain Adaptation

The concurrent rise in rare earth, copper, and aluminum prices has created unprecedented cost pressure. Motor and vehicle manufacturers urgently seek cost reductions, but technological solutions (e.g., flat-wire motors, material recycling) require time. Short-term strategies include long-term supply contracts and futures hedging to manage risks. Long-term success will hinge on material innovation (e.g., reducing rare earth content, optimizing aluminum-for-copper substitution) and vertical supply chain integration to navigate resource constraints .

SMM advises industry players to closely monitor policy shifts and alternative technologies, adapting procurement and production strategies dynamically

![Consumption Demand Recovered, Spot Discounts Continued to Narrow [SMM North China Spot Copper]](https://imgqn.smm.cn/usercenter/uoTGi20251217171713.jpg)