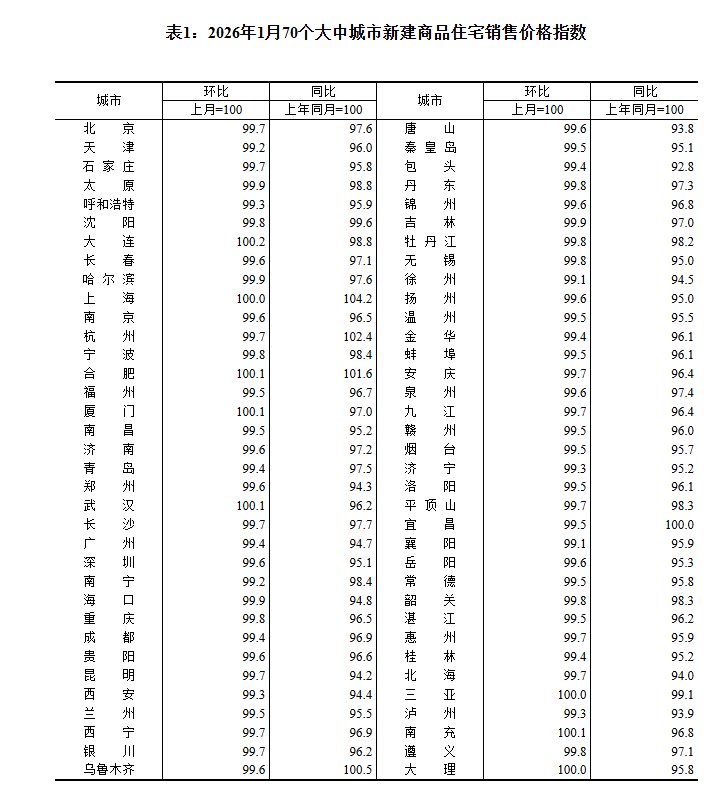

According to data from the National Bureau of Statistics (NBS), in January, the selling prices of new commercial residential buildings in first-tier cities fell 0.3% MoM, with the decline rate the same as the previous month. Specifically, Shanghai remained flat, while Beijing, Guangzhou, and Shenzhen fell 0.3%, 0.6%, and 0.4%, respectively. The selling prices of new commercial residential buildings in second-tier cities fell 0.3% MoM, with the decline narrowing by 0.1 percentage points. The selling prices of new commercial residential buildings in third-tier cities fell 0.4% MoM, with the decline rate the same as the previous month.

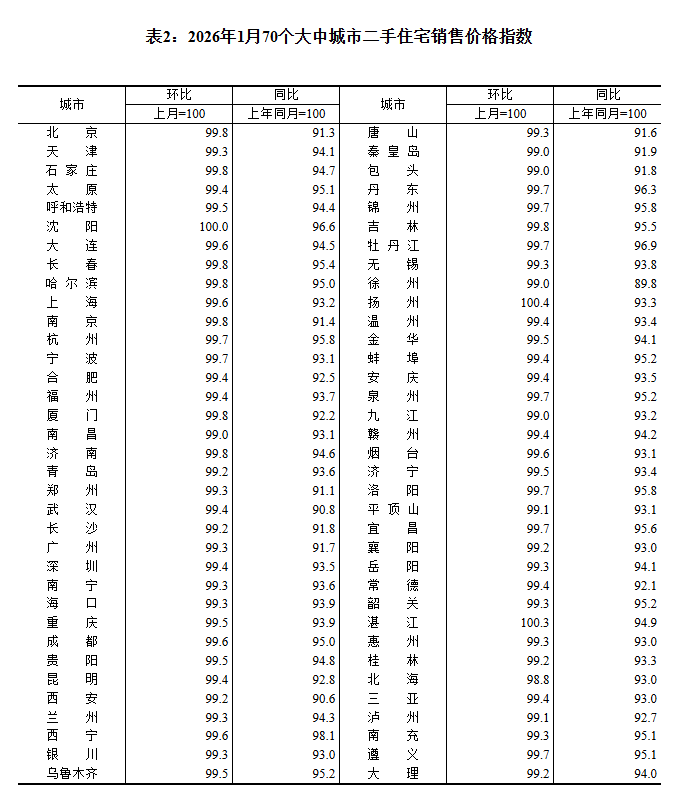

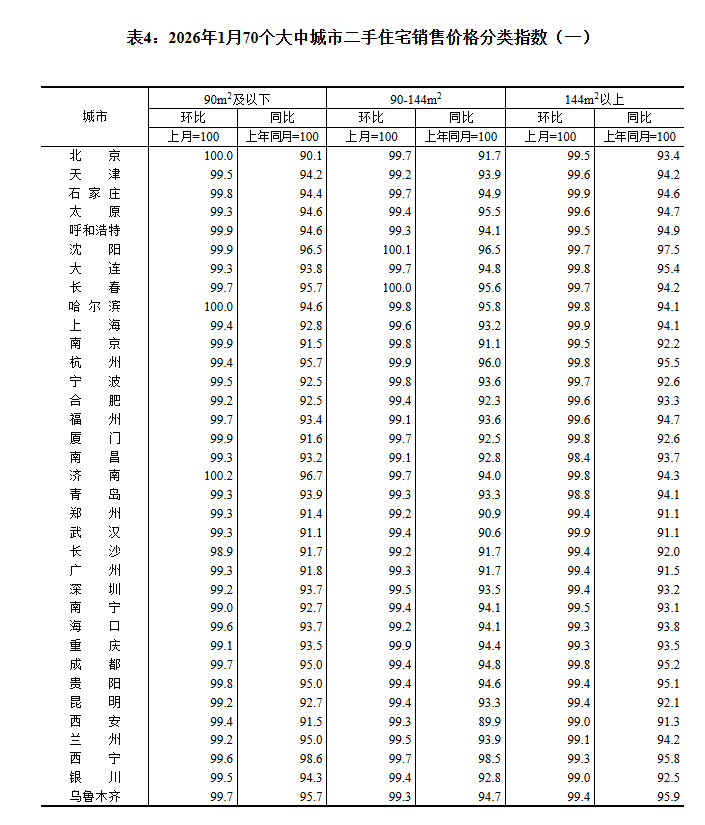

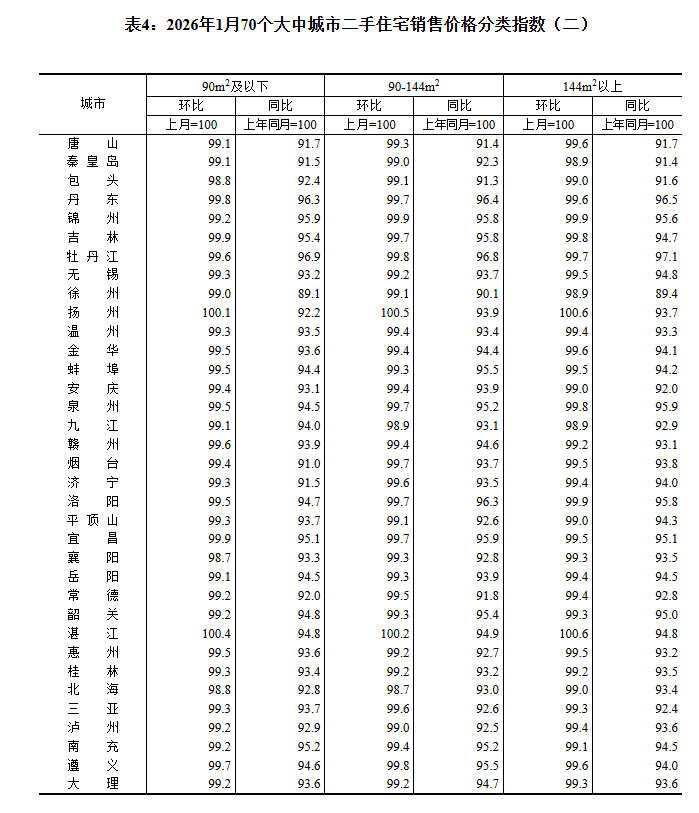

In January, the selling prices of existing residential buildings in first-tier cities fell 0.5% MoM, with the decline narrowing by 0.4 percentage points compared to the previous month. Specifically, Beijing, Shanghai, Guangzhou, and Shenzhen fell 0.2%, 0.4%, 0.7%, and 0.6%, respectively. The selling prices of existing residential buildings in second- and third-tier cities fell 0.5% and 0.6% MoM, respectively, with the declines narrowing by 0.2 and 0.1 percentage points. In January, the selling prices of new commercial residential buildings in first-tier cities fell 2.1% YoY, with the decline widening by 0.4 percentage points compared to the previous month. Specifically, Shanghai rose 4.2%, while Beijing, Guangzhou, and Shenzhen fell 2.4%, 5.3%, and 4.9%, respectively.

The selling prices of new commercial residential buildings in second- and third-tier cities fell 2.9% and 3.9% YoY, respectively, with the declines widening by 0.4 and 0.2 percentage points. In January, the selling prices of existing residential buildings in first-tier cities fell 7.6% YoY, with the decline widening by 0.6 percentage points compared to the previous month. Specifically, Beijing, Shanghai, Guangzhou, and Shenzhen fell 8.7%, 6.8%, 8.3%, and 6.5%, respectively. The selling prices of existing residential buildings in second- and third-tier cities fell 6.2% and 6.1% YoY, respectively, with the declines widening by 0.2 and 0.1 percentage points.

Overall Narrowing of MoM Declines in Selling Prices of Commercial Residential Buildings Across City Tiers in January 2026

—Wang Zhonghua, Chief Statistician of the Department of Urban Surveys of the National Bureau of Statistics (NBS), Interprets the Statistical Data on Changes in Selling Prices of Commercial Residential Buildings in January 2026

In January 2026, the selling prices of commercial residential buildings in 70 large and medium-sized cities generally saw narrowing MoM declines and YoY decreases.

I. Overall Narrowing of MoM Declines in Selling Prices of Commercial Residential Buildings Across First-, Second-, and Third-Tier Cities

In January, the selling prices of new commercial residential buildings in first-tier cities fell 0.3% MoM, with the decline rate the same as the previous month. Specifically, Shanghai remained flat, while Beijing, Guangzhou, and Shenzhen fell 0.3%, 0.6%, and 0.4%, respectively. The selling prices of new commercial residential buildings in second-tier cities fell 0.3% MoM, with the decline narrowing by 0.1 percentage points. In third-tier cities, the selling price of new commercial residential buildings decreased by 0.4% MoM, with the decline rate unchanged from the previous month.

In January, the selling price of pre-owned residential properties in first-tier cities fell by 0.5% MoM, with the decline narrowing by 0.4 percentage points from the previous month. Specifically, Beijing, Shanghai, Guangzhou, and Shenzhen saw declines of 0.2%, 0.4%, 0.7%, and 0.6%, respectively. The selling prices of pre-owned residential properties in second- and third-tier cities dropped by 0.5% and 0.6% MoM, respectively, with the declines narrowing by 0.2 and 0.1 percentage points.

Second, the selling prices of commercial residential buildings in first-, second-, and third-tier cities all declined YoY.

In January, the selling price of new commercial residential buildings in first-tier cities decreased by 2.1% YoY, with the decline widening by 0.4 percentage points from the previous month. Among them, Shanghai rose by 4.2%, while Beijing, Guangzhou, and Shenzhen fell by 2.4%, 5.3%, and 4.9%, respectively. The selling prices of new commercial residential buildings in second- and third-tier cities dropped by 2.9% and 3.9% YoY, respectively, with the declines widening by 0.4 and 0.2 percentage points.

In January, the selling price of pre-owned residential properties in first-tier cities decreased by 7.6% YoY, with the decline widening by 0.6 percentage points from the previous month. Among them, Beijing, Shanghai, Guangzhou, and Shenzhen fell by 8.7%, 6.8%, 8.3%, and 6.5%, respectively. The selling prices of pre-owned residential properties in second- and third-tier cities dropped by 6.2% and 6.1% YoY, respectively, with the declines widening by 0.2 and 0.1 percentage points.

![Focus on Post-Holiday Inventory Accumulation in Ferrous Metals [SMM Steel Industry Chain Weekly Report]](https://imgqn.smm.cn/usercenter/Ddxkv20251217171747.jpg)