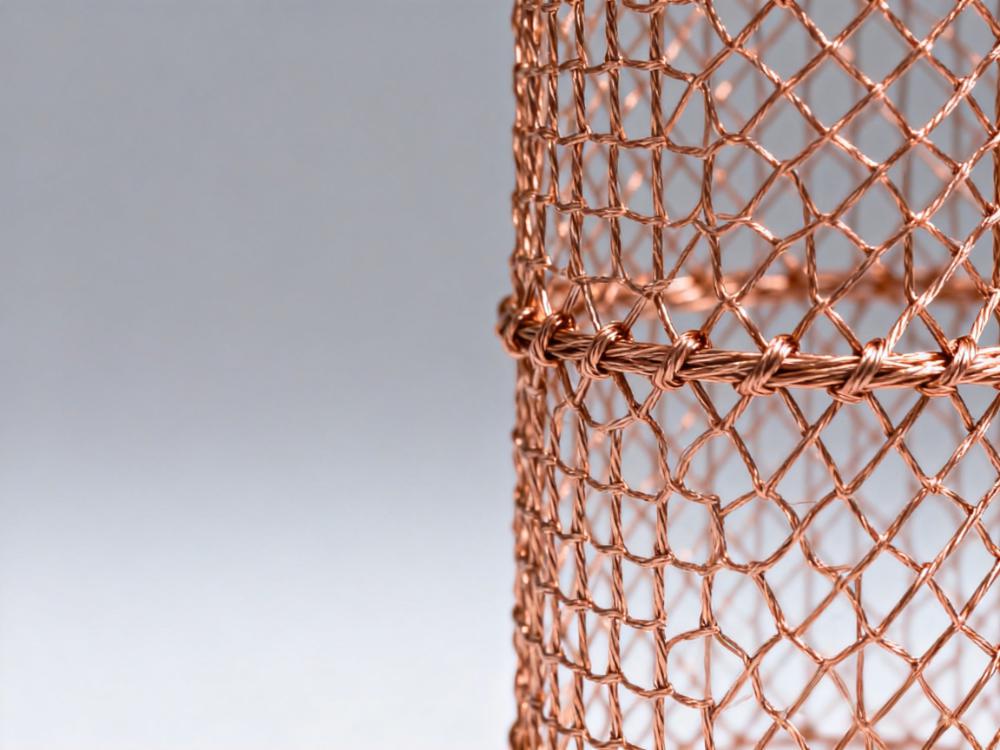

LME Zinc: At the beginning of the week, LME zinc trended lower as macro sentiment gradually digested; however, continued destocking in overseas LME zinc inventories provided bottom support for prices. Subsequently, the market remained cautious while awaiting the delayed release of non-farm payrolls and CPI data, with LME zinc maintaining a fluctuating trend. Later, unexpected stagnation in US December retail sales, combined with ongoing reductions in overseas inventories, provided strong bottom support, pushing LME zinc higher. However, US non-farm payrolls added 130,000 in January and the unemployment rate fell to 4.3%, indicating strong data performance. The US dollar index continued to rise, reducing market bets on interest rate cuts. Coupled with sell-offs in other financial markets, precious and non-ferrous metals broadly declined, leading LME zinc to pull back. As of 15:00 Friday, LME zinc fell to $3,354.5/mt, down $28.5/mt, a decrease of 0.84%.

SHFE Zinc: At the beginning of the week, SHFE zinc rose slightly; however, it failed to sustain the upward trend due to inventory accumulation, putting pressure on zinc prices to move lower. Subsequently, as domestic TCs remained low, zinc prices found support, with SHFE zinc stabilizing and maintaining a fluctuating trend. Later, SHFE zinc rose in sync with gains in LME zinc. However, domestic fundamentals provided insufficient support for zinc price surges, and overseas employment data exceeded expectations, leading zinc prices to pull back continuously. Afterwards, SHFE zinc rose to recover some losses; nevertheless, seasonal off-season effects were significant in domestic fundamental consumption, while social inventories of zinc ingots continued to accumulate on the supply side, weakening support for zinc prices. Combined with downward pressure from LME zinc, SHFE zinc trended lower. As of 15:00 Friday, SHFE zinc recorded 24,195 yuan/mt, down 255 yuan/mt, a decrease of 1.04%.

![The SHFE/LME zinc price ratio pulled back to around 7.1 and fluctuated [SMM Weekly Review of SHFE/LME Zinc Price Ratio]](https://imgqn.smm.cn/usercenter/ebBVe20251217171754.jpg)