SMM Feb 13 News:

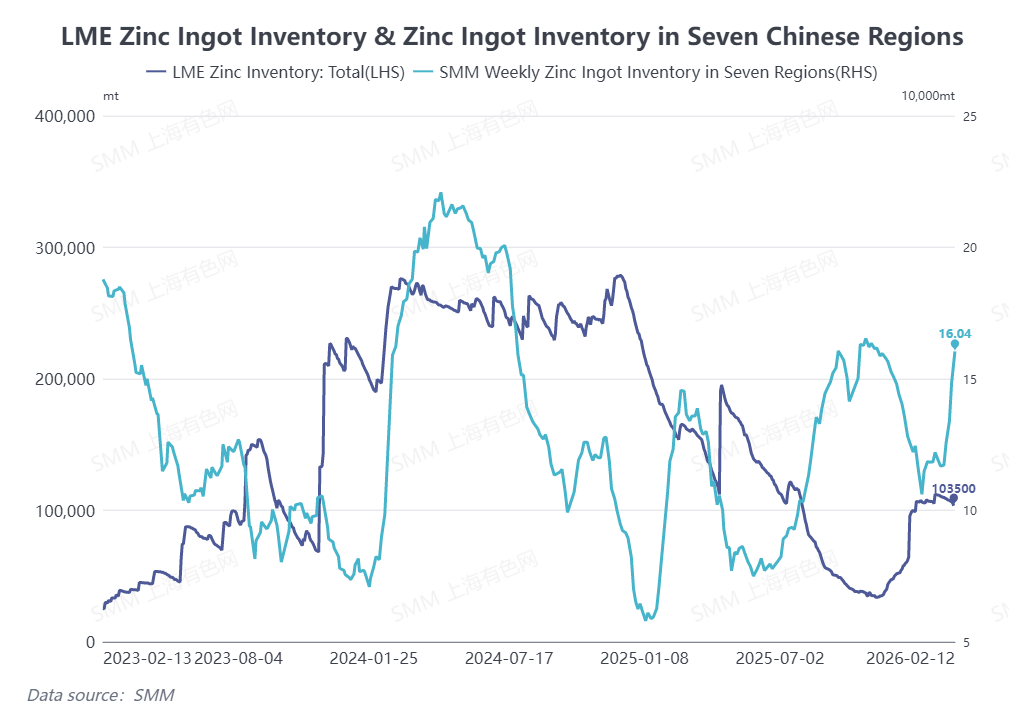

As of February 12, 2026, LME zinc ingot inventory continued to decline to 103,500 mt, while the LME Cash-3M contango narrowed from over $40/mt in January to below $20/mt. At the same time, due to the Chinese New Year holiday, many downstream zinc enterprises suspended operations, leading to a continued buildup in domestic zinc ingot inventory to over 160,000 mt. This divergence in inventory trends further exacerbated the deterioration of the zinc price ratio between domestic and international markets, with losses on imported zinc ingot into China widening to over 3,000 yuan/mt.

Will the price ratio continue to worsen?

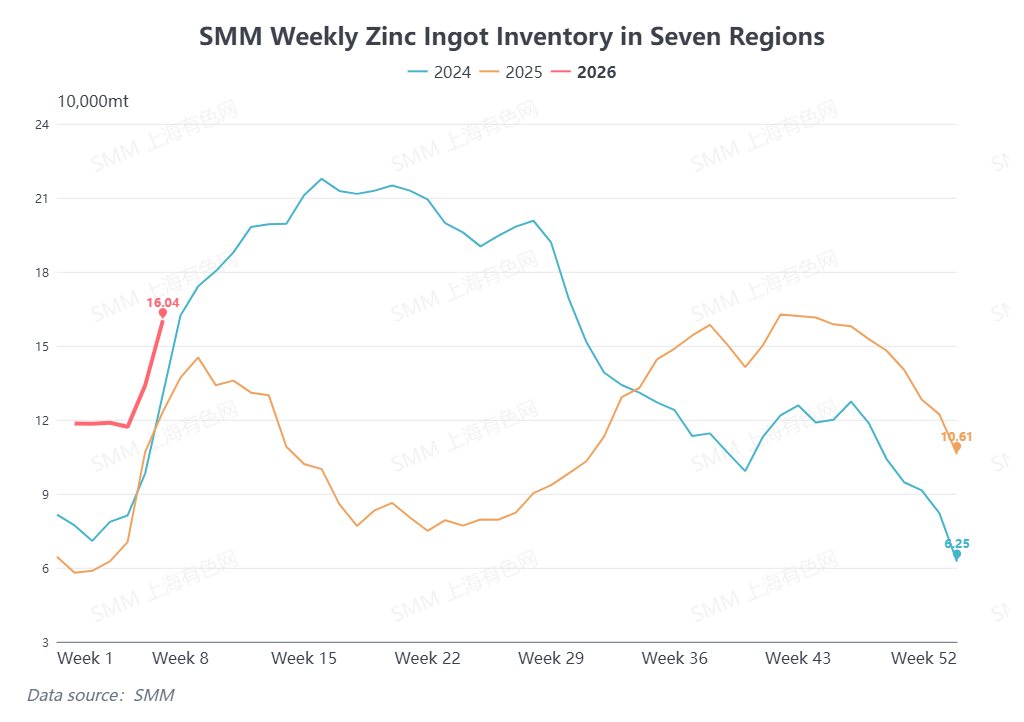

From an inventory perspective, according to SMM surveys, the domestic market is currently in the traditional seasonal inventory buildup phase during the Chinese New Year. SMM expects zinc ingot inventory to accumulate by more than 120,000 mt around the holiday, with a noticeable rebound in inventory after the holiday. Overseas, new zinc concentrate production in 2026 is projected to pull back significantly compared to 2025, coupled with persistently low zinc concentrate TCs, limiting the potential for increased refined zinc production. A substantial accumulation of zinc ingot inventory overseas is unlikely. Overall, the divergence in zinc ingot inventory between domestic and overseas markets is expected to intensify after the holiday, posing continued downside risks to the zinc price ratio.

How would a further deterioration in the price ratio impact the industry chain?

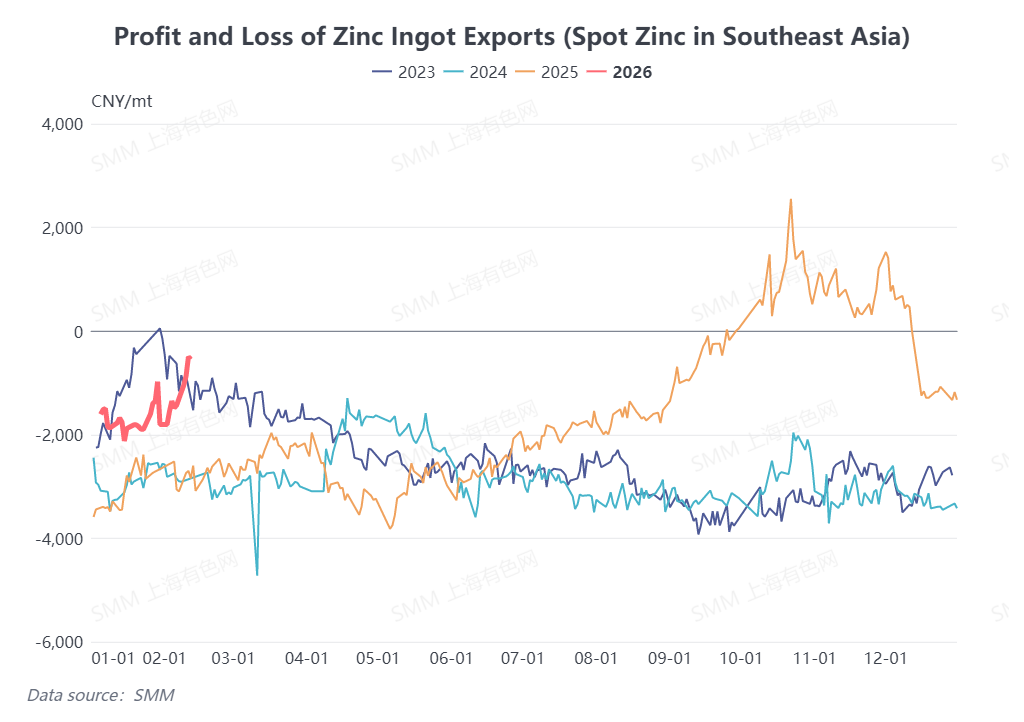

From the perspective of zinc ingot imports and exports, as of February 12, the SMM #0 zinc ingot price was quoted at 24,340 yuan/mt, and the SHFE/LME zinc price ratio pulled back to around 7.2. According to SMM calculations, the loss on shipping zinc ingot to Southeast Asian delivery warehouses narrowed to approximately 1,000 yuan/mt, while the loss on spot zinc ingot transactions with Southeast Asia narrowed to about 500 yuan/mt. Although no export arbitrage window has opened yet, if the price ratio weakens further, the export window for Chinese zinc ingot may reopen.

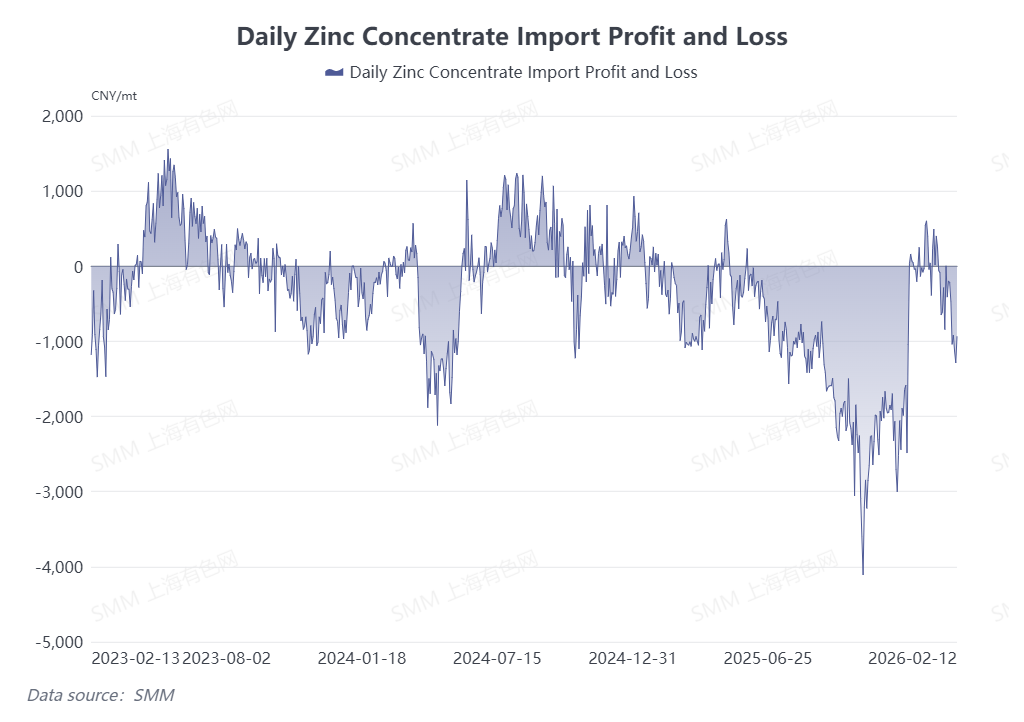

From the zinc concentrate perspective, as the zinc price ratio deteriorated in February, the loss on importing zinc concentrate into China widened to around 1,000 yuan/mt as of February 12, indicating reduced economic feasibility for imported zinc concentrate. If the price ratio continues to worsen, smelters may favour domestic zinc concentrate after the holiday, potentially curbing the extent of future TC increases.

(The above information is based on market collection and comprehensive evaluation by the SMM research team. The information provided in this article is for reference only. This article does not constitute direct advice for investment research and decision-making. Customers should make cautious decisions and should not replace their independent judgment with this information. Any decisions made by customers are not related to SMM.)

![The SHFE/LME zinc price ratio pulled back to around 7.1 and fluctuated [SMM Weekly Review of SHFE/LME Zinc Price Ratio]](https://imgqn.smm.cn/usercenter/ebBVe20251217171754.jpg)

![Non-farm payrolls data exceeded expectations, zinc prices on SHFE and LME pulled back [SMM Market Review - Weekly Price Commentary]](https://imgqn.smm.cn/usercenter/TeRBO20251217171754.jpg)