5 de febrero (SMM) -

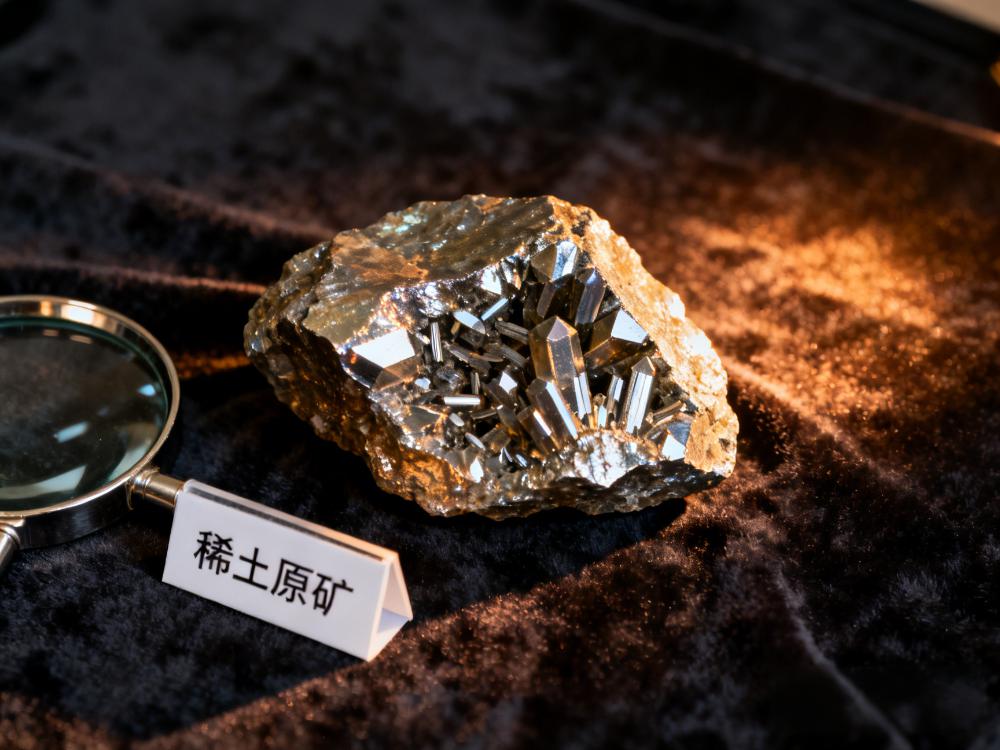

Mineral de tierras raras:

Hoy, el rango de precio del carbonato de tierras raras fue de 60.500-60.900 yuanes/t, los precios de la monacita se ajustaron a 6,13-6,43 yuanes/t, y los precios del mineral medio en itrio y rico en europio estuvieron alrededor de 247.000-248.000 yuanes/t. Recientemente, la mayoría de los comerciantes mostraron un entusiasmo relativamente bajo para los envíos previos a las vacaciones, las empresas de separación aguas abajo concluyeron el acopio, y la actividad comercial en el mercado de mineral de tierras raras fue lenta.

Óxidos de tierras raras:

Esta semana, los precios del óxido de lantano se mantuvieron estables en 4.300-4.700 yuanes/t, mientras que los precios del óxido de cerio subieron further a 11.800-12.500 yuanes/t. Las ofertas de mercado del óxido de praseodimio-neodimio se mantuvieron altas esta semana, con los proveedores manteniendo expectativas optimistas para el futuro y sin voluntad de vender a precios bajos. Sin embargo, los compradores aguas abajo gradualmente comenzaron las vacaciones y detuvieron las adquisiciones, lo que llevó a una disminución notable en la actividad de transacciones reales para el óxido de praseodimio-neodimio. Al día de hoy, los precios del óxido de praseodimio-neodimio fluctuaron al alza a 747.000-753.000 yuanes/t. En el segmento de tierras raras medias-pesadas, las transacciones reales para el óxido de disprosio fueron relativamente lentas, aunque las ofertas de los proveedores se mantuvieron firmes. Los precios de transacción para el óxido de disprosio se ajustaron ligeramente esta semana a 1,39-1,41 millones de yuanes/t. Los precios del óxido de terbio tuvieron fluctuaciones relativamente pequeñas durante la semana, con baja actividad comercial en el mercado, y las ofertas de los proveedores se ajustaron a 6,15-6,2 millones de yuanes/t. Los precios del óxido de gadolinio continuaron subiendo junto con el mercado del óxido de praseodimio-neodimio, con las ofertas de los proveedores aumentando a 215.000-220.000 yuanes/t. Las ofertas de mercado del óxido de holmio continuaron subiendo, pero la actividad de transacciones también disminuyó, con los precios ajustándose al rango de 545.000-555.000 yuanes/t. El suministro spot para el óxido de erbio se mantuvo ajustado, y las consultas del mercado se mantuvieron activas, empujando los precios further al alza a 396.000-400.000 yuanes/t. Acercándose las vacaciones del Año Nuevo Chino, la actividad de consultas en el mercado de óxidos de tierras raras cayó significativamente, pero la mayoría de los proveedores se mantuvieron firmes en sus ofertas. Los precios del óxido de itrio se mantuvieron estables dentro del rango de 68.000-70.000 yuanes/t esta semana.

Metales de tierras raras:

Esta semana, los precios de la aleación de praseodimio-neodimio mostraron una tendencia de fluctuación al alza, subiendo a 910.000-920.000 yuanes/t. Al comienzo de la semana, los precios de la aleación de praseodimio-neodimio experimentaron un retroceso notable, ya que algunos proveedores, con el objetivo de recuperar fondos antes de las vacaciones, redujeron activamente los precios para vender, lo que llevó a una disminución significativa. Sin embargo, a mediados de semana, a medida que las empresas metalúrgicas se concentraron en cumplir pedidos de contratos a largo plazo o procesar pedidos, la disponibilidad en el mercado spot se redujo y las ofertas de las empresas metalúrgicas se volvieron relativamente firmes. Junto con el aumento de los precios de las materias primas, los precios de la aleación de praseodimio-neodimio subieron. No obstante, las empresas de materiales magnéticos aguas abajo comenzaron gradualmente las vacaciones, y el desempeño general de las transacciones del mercado fue lento. En el mercado de metales de tierras raras medianas y pesadas, los precios de la aleación de disprosio-hierro se reportaron en 1,35-1,37 millones de yuanes por tonelada. Debido a la débil demanda de compra por parte de las empresas de materiales magnéticos aguas abajo y pocas consultas en el mercado, las empresas metalúrgicas mostraron poca disposición a ofertar, y los precios del mercado operaron en un estado de estancamiento. El precio del terbio metálico también se vio afectado por la disminución de consultas de compra de las empresas de materiales magnéticos. Debido a la reducción de actividades de consulta por parte de las empresas de materiales magnéticos aguas abajo, algunos proveedores bajaron proactivamente los precios para vender, pero las transacciones del mercado siguieron siendo lentas, con el precio cayendo a 7,6-7,65 millones de yuanes por tonelada. La aleación de gadolinio-hierro esta semana se vio influenciada por el continuo aumento de precio del praseodimio-neodimio, ya que los proveedores mostraron una débil voluntad de vender a precios bajos. Sumado al aumento de los precios del óxido de gadolinio, las ofertas continuaron incrementándose, con el precio subiendo a 210.000-215.000 yuanes por tonelada.

Imanes Permanentes de Tierras Raras

Actualmente, el NdFeB en bruto N38 (Ce) se cotizaba en 225-235 yuanes/kg; el NdFeB en bruto 40M se cotizaba en 271-281 yuanes/kg; el NdFeB en bruto 40H se cotizaba en 275-285 yuanes/kg; el NdFeB en bruto 45SH (Ce) se cotizaba en 325-345 yuanes/kg.

En cuanto a los precios, los precios del NdFeB se mantuvieron estables esta semana. La razón principal fue que los precios de las materias primas para el NdFeB, el óxido de praseodimio-neodimio y el metal, fluctuaron en niveles altos, lo que llevó a las plantas de materiales magnéticos a mantener cotizaciones externas altas y estables. En términos de transacciones, la actividad del mercado fue moderada esta semana. Por un lado, a medida que se acercaban las vacaciones del Año Nuevo Chino, la capacidad de procesamiento de varias plantas de materiales magnéticos disminuyó y las transacciones se suspendieron, manteniéndose solo la producción de pedidos existentes. Por otro lado, las plantas de motores se vieron limitadas por el aumento de costes debido a los altos precios de las materias primas, lo que resultó en una desaceleración general de las tasas de operación en comparación con antes, lo que a su vez condujo a una ralentización en la adquisición de acero magnético y una actividad moderada en las transacciones del mercado.

Chatarra de Tierras Raras:

Esta semana, el Pr-Nd reciclado de chatarra de NdFeB se cotizó entre 730 y 740 yuanes/kg; el disprosio reciclado de chatarra de NdFeB se cotizó entre 1.330 y 1.350 yuanes/kg; el terbio reciclado de chatarra de NdFeB se cotizó entre 5.800 y 6.000 yuanes/kg.

Esta semana, el mercado de chatarra en general estuvo deprimido, principalmente debido a la proximidad de las vacaciones del Año Nuevo Chino, ya que algunas empresas de reciclaje suspendieron las adquisiciones y la fijación de precios. Además, las empresas de materiales magnéticos comenzaron gradualmente sus vacaciones, lo que llevó a una disminución significativa de la actividad comercial en el mercado. Aunque los precios del mercado de óxidos continuaron aumentando, las transacciones reales fueron escasas. Las empresas de reciclaje mostraron poca disposición a comprar chatarra a precios elevados y comenzaron a adoptar estrategias de adquisición con precios controlados. En general, a medida que se acercaban las vacaciones del Año Nuevo Chino, la atmósfera de negociación en el mercado fue lánguida y las empresas de reciclaje tuvieron una débil voluntad de comprar a precios altos, lo que resultó en un desempeño general débil de los precios de la chatarra.

![Los precios de las tierras raras retrocedieron, con un fuerte sentimiento de espera y observación en el mercado downstream [Revisión semanal de tierras raras de SMM]](https://imgqn.smm.cn/usercenter/UXEpx20251217171743.jpeg)