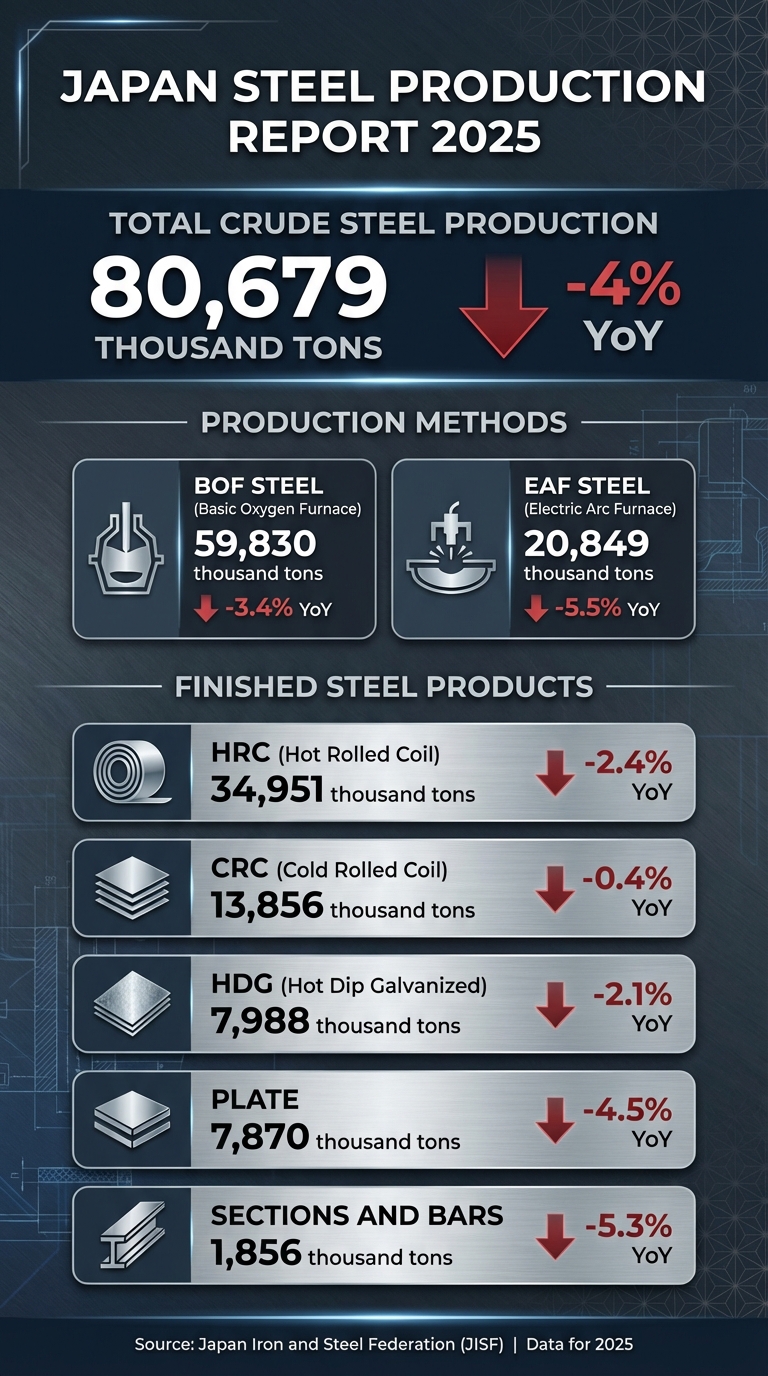

Japan's steel industry faced significant downward pressure throughout 2025. According to the latest data from the Japan Iron and Steel Federation (JISF), total crude steel production reached 80,679 thousand tonnes, marking a 4% year-on-year (YoY) decrease.

-

BOF Steel (Basic Oxygen Furnace): 59,830 thousand tonnes, ↓ 3.4% YoY.

-

EAF Steel (Electric Arc Furnace): 20,849 thousand tonnes, ↓ 5.5% YoY.

Finished Steel Products

-

Hot Rolled Coil (HRC): 34,951 thousand tonnes, ↓ 2.4% YoY.

-

Cold Rolled Coil (CRC): 13,856 thousand tonnes, ↓ 0.4% YoY.

-

Hot Dip Galvanized (HDG): 7,988 thousand tonnes, ↓ 2.1% YoY.

-

Plate: 7,870 thousand tonnes, ↓ 4.5% YoY.

Sections and Bars

-

1,856 thousand tonnes, ↓ 5.3% YoY.

Summary and Analysis

In 2025, production across all categories of the Japanese steel industry declined compared to the previous year, with the sharpest drops recorded in Electric Arc Furnace (EAF) steel, Plate, and Sections and Bars. This broad contraction is largely attributed to a persistent labor shortage that has subdued domestic construction activity—a systemic challenge unlikely to be resolved in the short term due to the current work environment. Additionally, high energy costs and the ongoing relocation of manufacturing overseas continue to pressure domestic output, signaling that the industry is shifting away from a volume-based growth model.

![[SMM Analysis] Futures Lack Momentum to Rise Further, Pre-Holiday Demand Stalls, and Stainless Steel Social Inventory Accumulation Intensifies](https://imgqn.smm.cn/usercenter/HBsPu20251217171723.jpeg)