From Q4 2025 to early 2026, the global ESS industry chain's upstream raw material market underwent significant price restructuring. The battery cell market is currently in an intense period of balancing between losses and delayed price transmission. As battery cell manufacturers generally raised their quotations, the central transaction price may continue to rise in the subsequent period.

I. Upstream Raw Material Market: Lithium Chemicals Lead the Gains, Core Materials Surge Across the Board

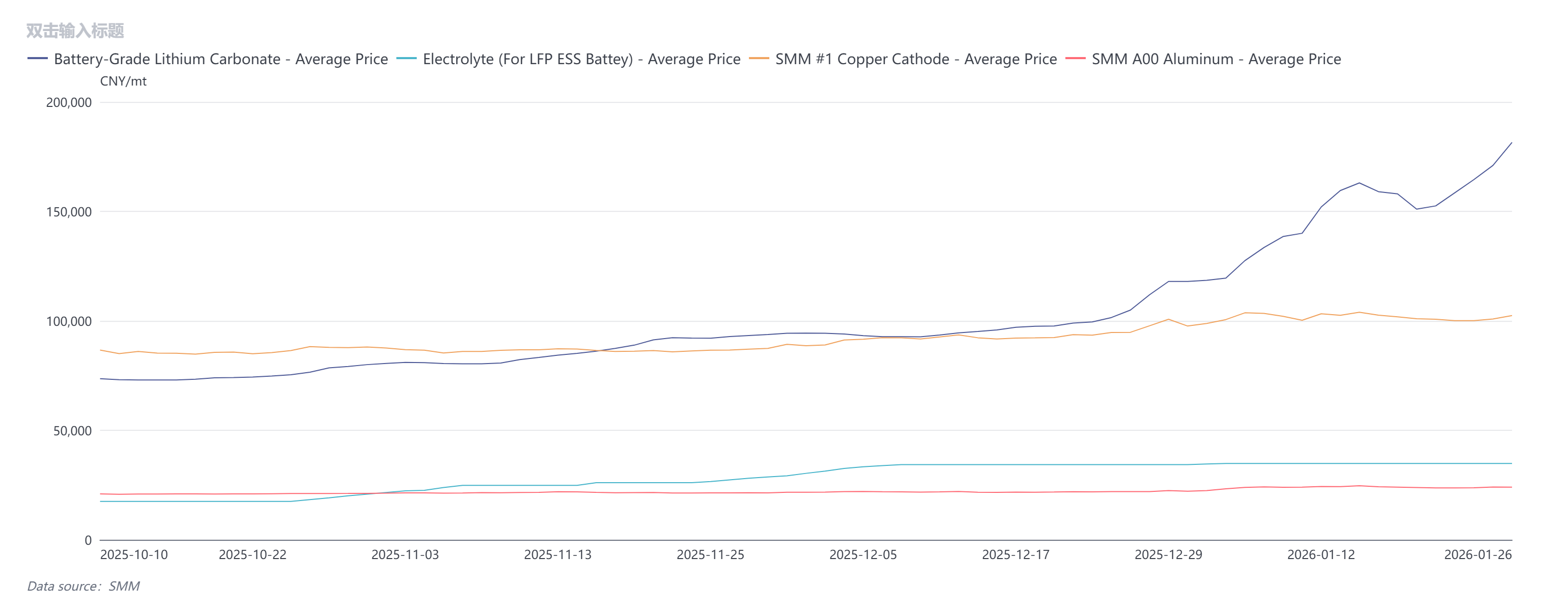

Reviewing the market performance from October 10, 2025, to January 26, 2026, the four key raw materials for ESS battery cells—cathode source (lithium carbonate), electrolyte, anode current collector (copper), and cathode current collector (aluminum)—all showed a unilateral upward trend. Among them, lithium chemicals and electrolyte exhibited explosive increases.

As the core variable determining battery cell cost fluctuations, battery-grade lithium carbonate displayed the most aggressive price movement. According to SMM, the average price of SMM battery-grade lithium carbonate surged from 73,550 yuan/mt in October 2025 to 181,500 yuan/mt on January 26, 2026, an increase of 107,950 yuan/mt, up 146.77%. This doubling growth directly reshaped the BOM cost structure of battery cells. Driven by LiPF6 and solvent prices, the price of SMM electrolyte for ESS (for LFP ESS) rose from 17,550 yuan/mt to 34,850 yuan/mt, an increase of 17,300 yuan/mt, up 98.58%, nearly doubling, significantly raising auxiliary material cost pressure in cell manufacturing.

Additionally, the steady rise in base metals further solidified the cost floor. SMM #1 copper cathode also continued to surge recently, climbing from 86,680 yuan/mt at the beginning of Q4 2025 to 102,435 yuan/mt recently, up 18.17% (+15,755 yuan/mt). During the same period, A00 aluminum prices mildly increased from 20,980 yuan/mt to 24,030 yuan/mt, up 14.54% (+3,050 yuan/mt). The steady rise in copper and aluminum prices further elevated the base cost level of current collectors and structural components, leading to a further increase in battery cell costs.

II. Significant Surge in Theoretical Cost of 314Ah Battery Cells Driven by Cost Transmission Mechanism

II. Significant Surge in Theoretical Cost of 314Ah Battery Cells Driven by Cost Transmission Mechanism

Based on the sharp fluctuations in raw material prices mentioned above, a theoretical cost model calculation was conducted for the mainstream 314Ah energy storage battery cells:

Initial Cost (October 2025): When raw material prices were relatively low, the theoretical cost of 314Ah battery cells was approximately 0.2798 Yuan/Wh.

Current Cost (January 2026): Driven directly by the doubling of lithium carbonate and electrolyte prices, coupled with increases in copper and aluminum prices, the current theoretical cost has risen to 0.3683 Yuan/Wh.

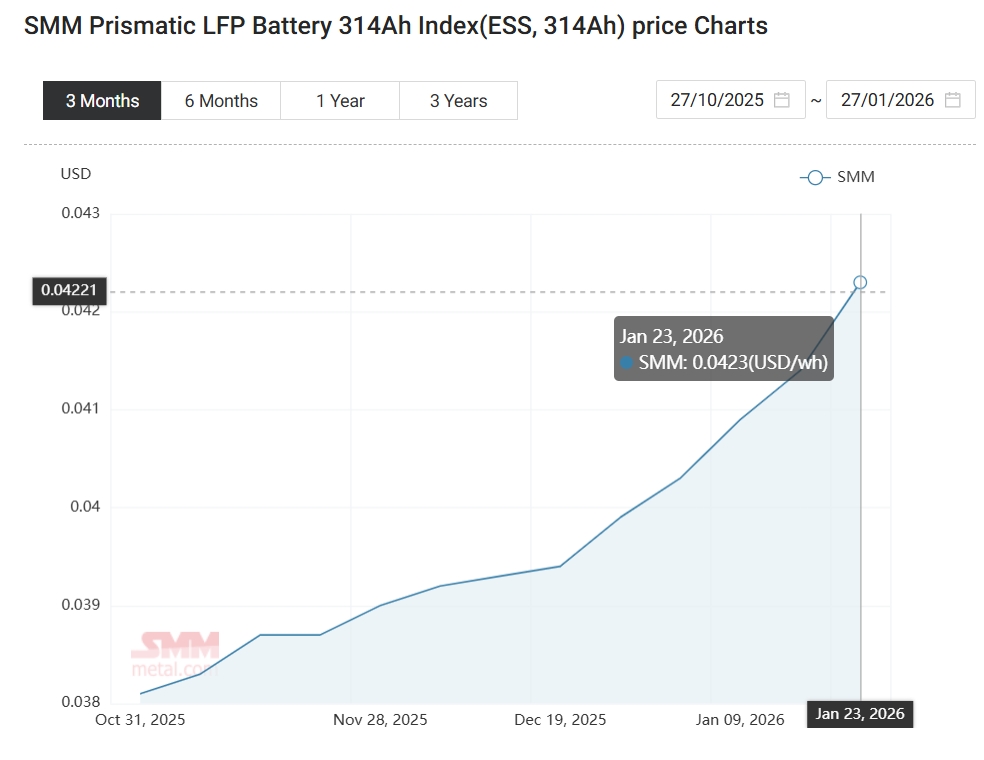

In just three and a half months, the theoretical cost per Wh surged by 0.0885 Yuan/Wh, an increase of about 31.6%. This indicates that the rise in raw material costs is not a mild linear transmission but rather a step-like sharp increase. Although a qualitative change has occurred on the cost side, the spot transaction prices of ESS battery cells have shown significant lag. According to the SMM 314Ah ESS battery cell price index, during the same period, the index rose from 0.2995 Yuan/Wh to 0.3339 Yuan/Wh, revealing a substantial gap between price and cost.

III. Cause Analysis

The current index price (0.3339 yuan/Wh) is significantly lower than the theoretical cost (0.3683 yuan/Wh). This inverted phenomenon, where “flour is more expensive than bread,” may be attributed to the following reasons:

1. The market currently relies mainly on consuming previously accumulated low-cost raw material inventory to sustain deliveries, with some battery cell manufacturers maintaining market share at the expense of profits or even by operating at a loss.

2. Downstream (integrators/end-users): There is strong resistance to rapid price increases, with low acceptance, and the market is still in a phase of price negotiation and re-establishing price benchmarks.

IV. Market Outlook

At this stage, upstream (battery cell manufacturers): Faced with irreversible increases in raw material prices, battery cell manufacturers can no longer maintain their original pricing systems. Market quotations have already reacted proactively, with some prices raised to around 0.35–0.39 yuan/Wh in an attempt to restore profit margins.

Looking ahead, as low-cost inventory is gradually cleared, cost pressures will become more apparent. With the depletion of previously accumulated low-cost lithium carbonate inventory, battery cells produced in the new cycle must bear the current high raw material costs. The price center of the 0.3339 yuan/Wh index is expected to shift upward. The current higher quotation range reflects not only the break-even demands of battery cell manufacturers but also serves as a defense against future raw material uncertainties. As downstream projects commence and rigid delivery requirements approach, the industry chain will be compelled to increase its acceptance of higher prices. The price of 314Ah ESS battery cells may conclude its delayed adjustment phase and enter a round of catch-up increases.

![[China Recalls Over 38 Million Motor Vehicles During the 14th Five-Year Plan Period]](https://imgqn.smm.cn/usercenter/fblvS20251217171729.png)

![[Vietnam's FPT Group Establishes Semiconductor Chip Packaging and Testing Facility]](https://imgqn.smm.cn/usercenter/mzgdV20251217171729.png)