Blast at Chhattisgarh Steel Plant: Potential for Short-Term Regional Iron Ore Price Correction and Steel Price Spike

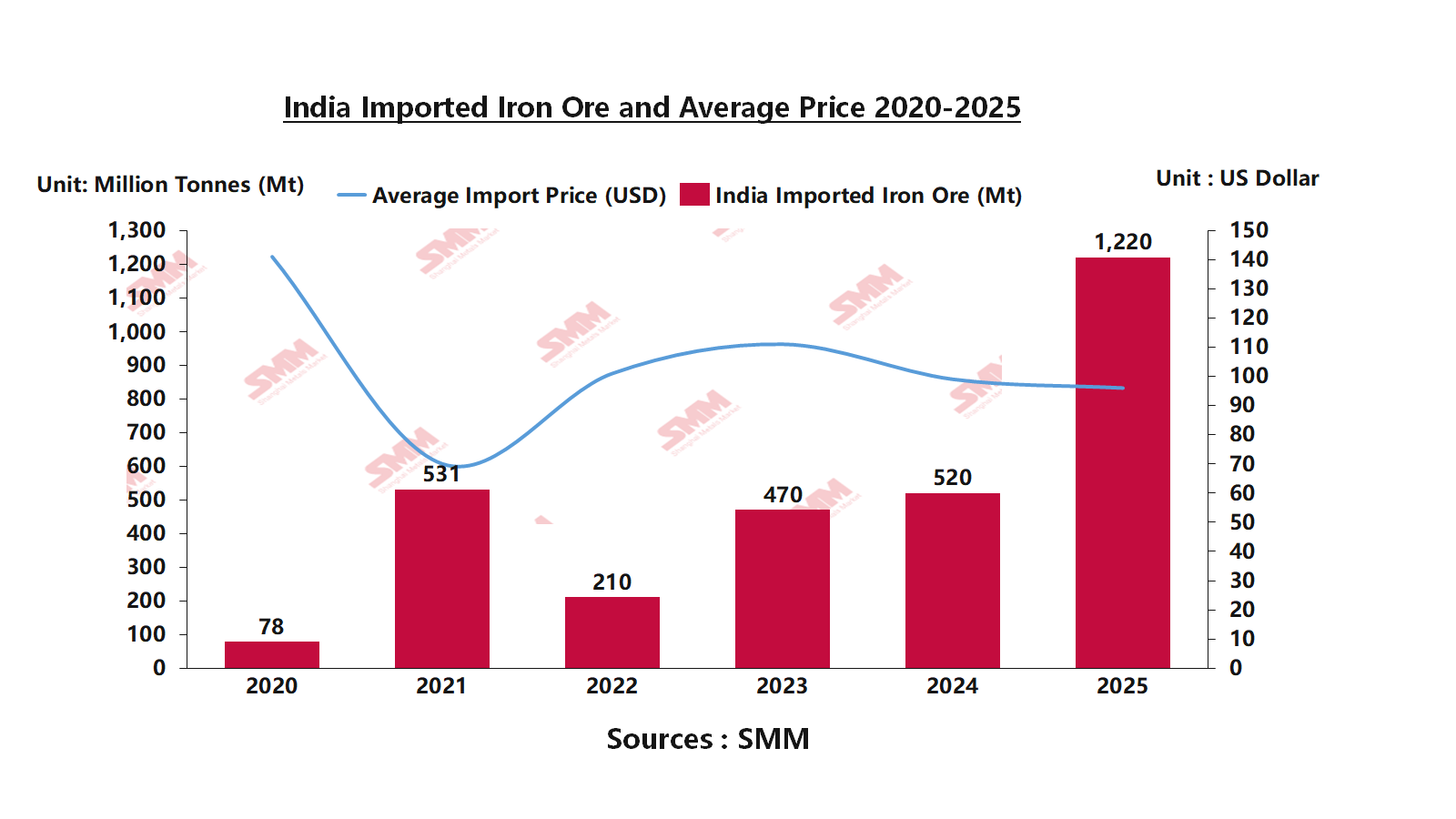

On 22 January 2026, a severe industrial incident occurred in Chhattisgarh, a critical steel hub in Central India. A major explosion at the Real Ispat & Power Ltd (RIPL) facility in the Baloda Bazar-Bhatapara district has resulted in at least six confirmed fatalities and multiple severe injuries. This event is not an isolated tragedy but occurs at a sensitive juncture for the Indian steel industry. It follows closely on the heels of India's largest miner, NMDC, cutting iron ore prices to combat weak domestic demand, despite the country recording a seven-year high in iron ore imports in 2025.

The facility is a prominent local integrated steel plant featuring coal-based DRI rotary kilns, a steel melting shop, and rolling lines. Preliminary reports and worker testimonies indicate the explosion occurred in the Dust Settling Chamber (DSC) connected to the coal-based rotary kiln.

Plant Profile: Real Ispat & Power Ltd (RIPL)

- Location: Bakulahi Village, Baloda Bazar District, Chhattisgarh (proximate to the Raipur industrial cluster).

- Core Products: Coal-Based Direct Reduced Iron (DRI), Mild Steel Billets, Long Products (TMT Rebar, Wire Rods), and Captive Power.

- Capacity Estimates:

- DRI: Estimated at 600,000 tonnes per annum (tpa).

- Steel Melting & Rolling: Equipped with Induction Furnaces and Rolling Mills.

- Mild Billets: ~750,000 tpa.

- TMT/Construction Steel: ~870,000 tpa.

- Industrial Wire Rods/Processing: ~300,000 tpa.

Core Impact Analysis

1. Regulatory Crackdown and Operational Dip With six fatalities, this is classified as a major industrial safety incident. Based on historical precedents (such as the Bhilai incidents of 2014 and 2018), there is a high probability that the state government will launch immediate, comprehensive safety inspections across private DRI plants and Induction Furnace units. Many secondary steel producers may be forced to temporarily halt operations or reduce load for compliance checks, potentially driving a 5–10% decline in regional capacity utilisation over the next 1–2 weeks.

2. DRI Supply Crunch and Price Spike Chhattisgarh is India's DRI (Sponge Iron) production hub. The suspension of RIPL is estimated to remove approximately 1,600 tonnes/day of DRI spot supply from the Raipur market. While globally negligible, this creates an immediate feedstock shortage for secondary steel mills (Raipur-Durg cluster). Prices, which had rebounded to ~₹26,400/tonne (~$293) in mid-January due to restocking, are likely to see a sharp, short-term spike due to the outage and potential inspection-led disruptions at neighbouring plants.

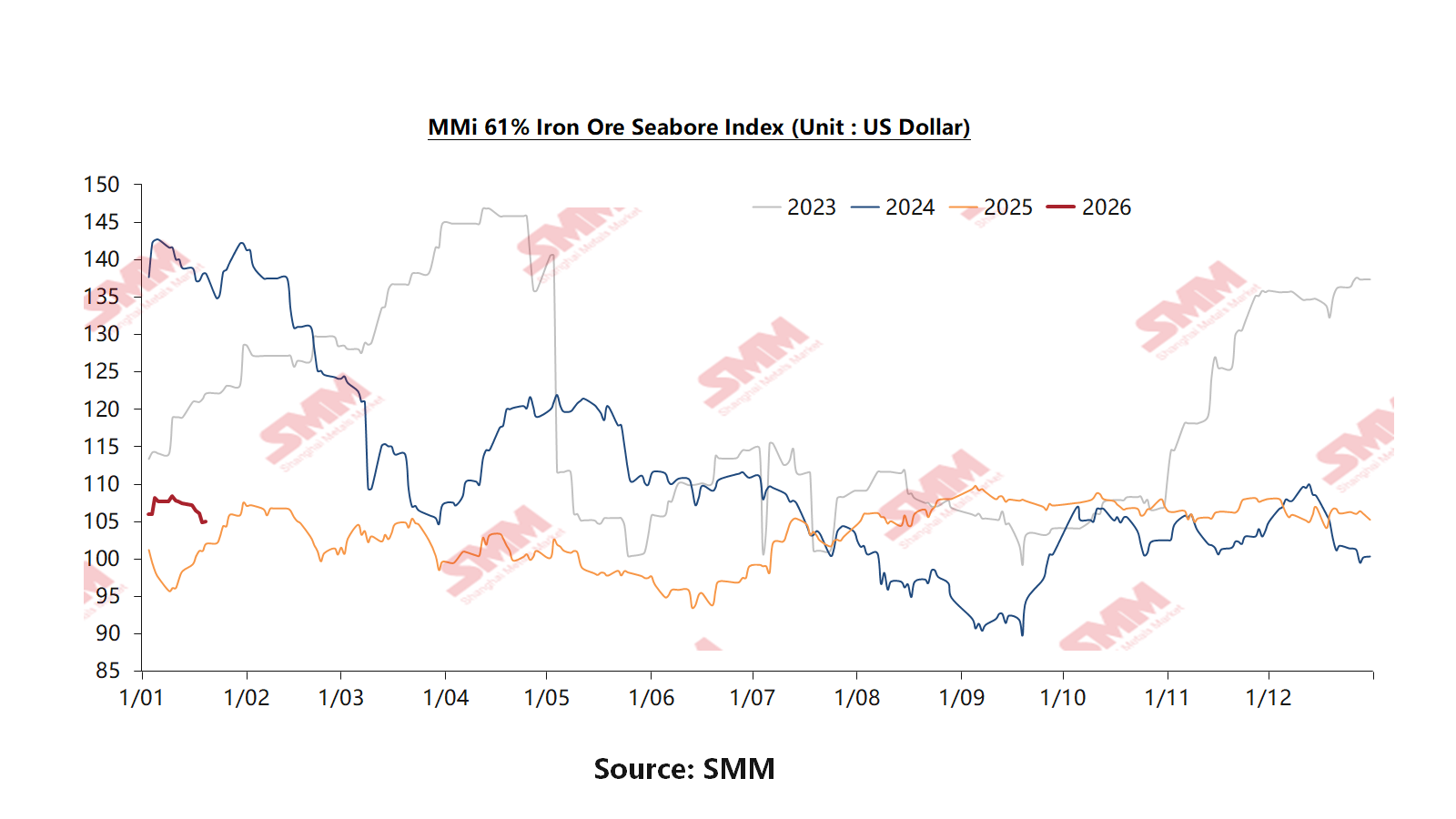

3. Iron Ore: Pressure on Lump Premiums Coal-based DRI plants like RIPL are primary consumers of iron ore Lump and Pellets. If a regional shutdown or inspection drive occurs, demand for high-grade Lump will freeze instantaneously. Consequently, the domestic Lump Premium faces downward pressure in the short term as key buyers remain offline. This highlights a supply-side bottleneck: while India's raw material demand is robust, its processing infrastructure (specifically private DRI) struggles to safely sustain high growth rates. This divergence may lead to a scenario of stagnating ore sales contrasted with rising finished steel prices.

4. Strategic Delays and Import Context Notably, India's iron ore imports hit a seven-year high of 12.2 million tonnes in 2025, with JSW Steel accounting for 80%. The market shows a stark bifurcation: coastal mills (like JSW) benefit from global price drops, while inland mills (like RIPL) are logistics-bound to NMDC. RIPL was constructing a 0.8 MTPA pellet plant (scheduled for Q1 2026 commissioning) to mitigate this raw material risk. The explosion will inevitably delay this project, leaving RIPL exposed to raw material price volatility and dependent on external pellets for longer than anticipated.

![[SMM Steel] Jindal Steel wins a new iron ore mine in Odisha with ~38 mt reserves](https://imgqn.smm.cn/usercenter/jUyJR20251217171716.jpg)

![Silicon Metal Prices Tested Higher as Market Transactions Remained in Stalemate, While Polysilicon Prices Trended Downward [SMM Silicon Industry Weekly Review]](https://imgqn.smm.cn/usercenter/zLhJl20251217171720.jpg)

![[SMM Daily HRC Trading Volume] Futures Continued to Rise, Spot Trading Continued to Recover](https://imgqn.smm.cn/usercenter/UrrTG20251217171717.jpg)