SMM, January 22

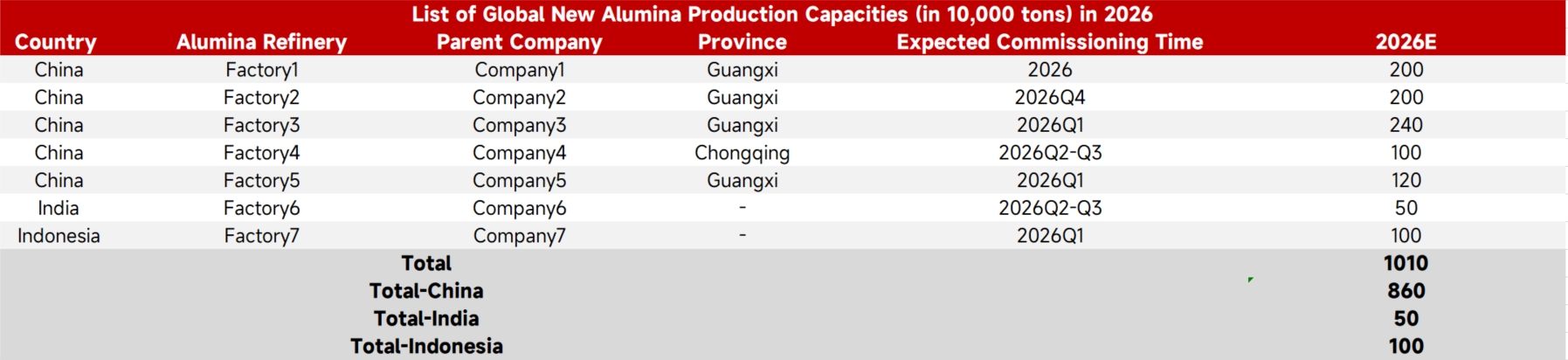

According to SMM statistics, China's alumina existing capacity reached 110.32 million mt by 2025, with operating capacity at 89.41 million mt and an overall industry operating rate of around 81%, indicating a clear state of oversupply in the market. Looking ahead to 2026, four new domestic projects are expected to commence operation successively, adding a total of 8.6 million mt of new capacity. By then, the country's total existing capacity will rise to 118.92 million mt, further intensifying supply pressure in the alumina market.

Particularly noteworthy is that approximately 7.6 million mt of the new capacity is located in Guangxi. Historically, due to relatively tight alumina supply in south China, prices in Guangxi have generally been higher than in other domestic regions. However, with the release of these new capacities, the local supply-demand pattern in Guangxi will undergo a significant shift—transitioning from tight supply toward a surplus, potentially resembling the current market conditions in Shandong. We anticipate that the concentrated commissioning of this capacity will exert strong downward pressure on regional and even national alumina prices.

Meanwhile, the overseas market continues to expand. By the end of 2025, overseas alumina existing capacity had reached 77.797 million mt, with India at 12.26 million mt and Indonesia at 7.5 million mt. In 2026, Indonesia and India are set to add 1 million mt and 500,000 mt of capacity respectively, underscoring Asia's crucial role in future global alumina supply growth. The ongoing release of overseas capacity will further intensify global market competition, posing additional pressure on domestic prices.

![Aluminum Producers' Operating Rates Rebound to 61.9%; High Prices Challenge "Golden March" Peak Season [SMM Survey]](https://imgqn.smm.cn/usercenter/tXCfs20251217171653.jpg)

![ADC12 Prices Rose Again This Week[[Weekly Review of Aluminum Scrap and Secondary Aluminum]]](https://imgqn.smm.cn/production/admin/votes/imageskkgTu20240508153005.png)