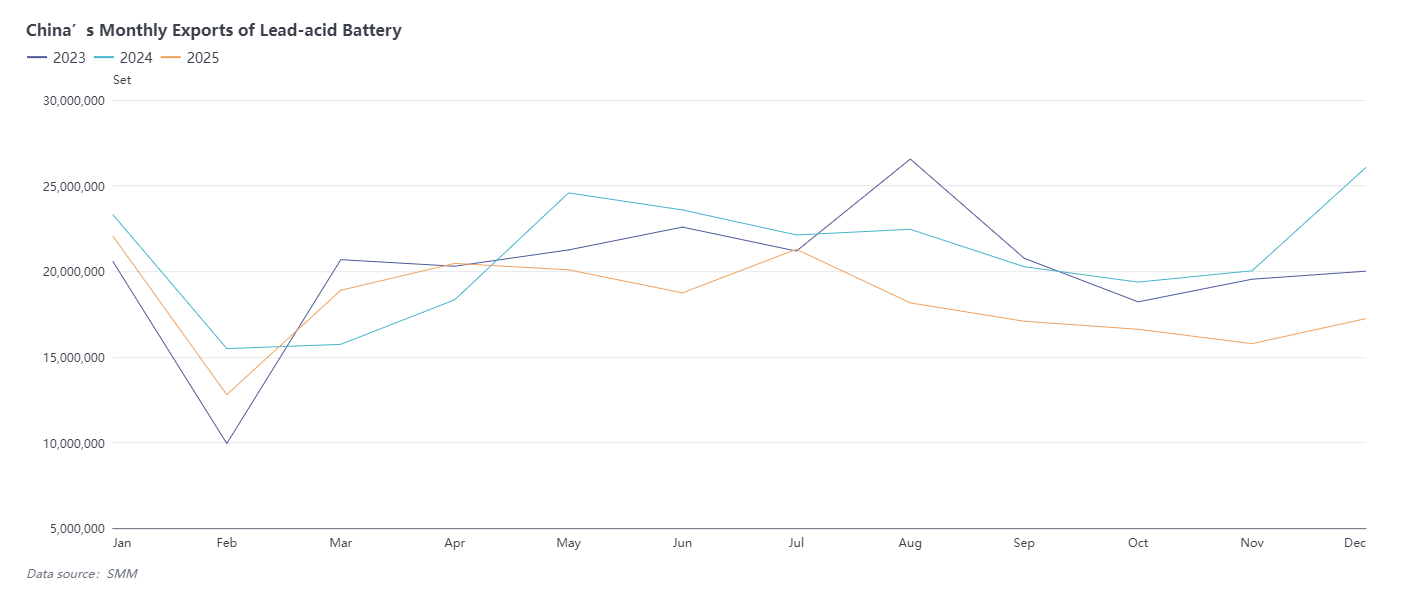

SMM, Jan. 21: According to customs data, China's lead-acid battery exports totaled 17.2406 million units in December 2025, up 9.28% MoM but down 33.86% YoY. Full-year 2025 exports reached 219 million units, a decrease of 12.79% YoY.Imports of lead-acid batteries stood at 591,600 units in December 2025, rising 24.38% MoM and surging 60.52% YoY. Cumulative imports for 2025 were 5.4926 million units, down 2.09% YoY.

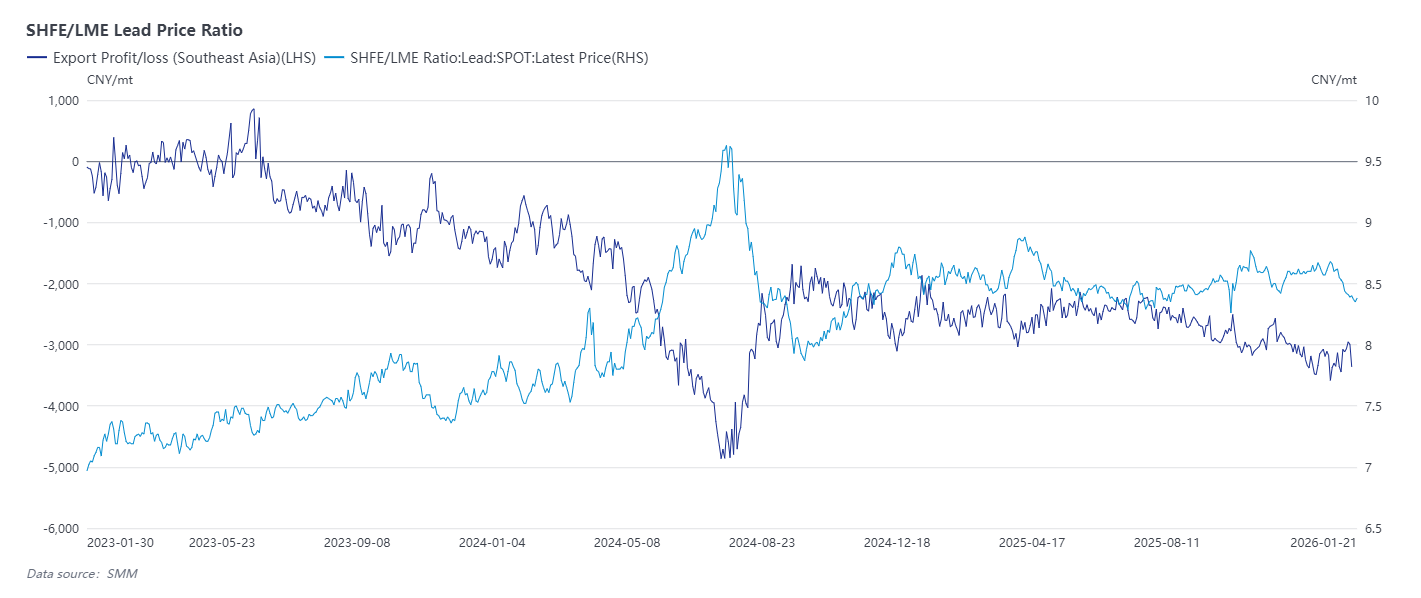

Since 2024, sharp fluctuations in lead prices domestically and overseas have led to significant price spreads (with domestic prices substantially higher than overseas), exceeding Yuan 3,000/mt during peak periods. This directly increased production costs for lead-acid batteries, reducing the competitiveness of Chinese enterprises in the international market and causing a substantial decline in overseas orders. Although the price gap narrowed somewhat in 2025, factors such as U.S. “reciprocal tariffs” and anti-dumping duties imposed by Middle Eastern countries against China contributed to an overall decline in lead-acid battery exports, with other lead-acid battery categories recording the largest drop at -16.91%. Among major export destinations, 11 countries saw reduced imports from China. India, the largest export market, recorded a 33.39% YoY decrease; Malaysia and Singapore fell 16.82% and 43.49% YoY, respectively; exports to the U.S. dropped sharply by 48.59%.

Looking ahead to 2026, given divergent lead inventory levels (higher overseas, lower domestically) and overcapacity in China’s lead smelting industry, the room for price spread improvement is expected to remain limited in the near term. Meanwhile, increased construction of overseas plants by Chinese lead-acid battery manufacturers, particularly in Southeast Asia, will boost local production and may further reduce direct exports from China. Considering these factors and potential policy adjustments, lead-acid battery exports from China are projected to continue declining in 2026.

(The above information is based on market collection and comprehensive evaluation by the SMM research team. The information provided herein is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make decisions prudently and not use it to replace their own independent judgment. Any decisions made by clients are unrelated to SMM.)

![US Dollar Index Approached 100, LME Lead Fell to a 10-Month Low [SMM Lead Morning News]](https://imgqn.smm.cn/usercenter/PKFMX20251217171721.jpg)

![Geopolitical Risks Continue to Escalate; Lead Prices Remain Under Pressure, Fluctuate, and Pull Back [SMM Lead Morning Meeting Minutes]](https://imgqn.smm.cn/usercenter/riosq20251217171722.jpg)