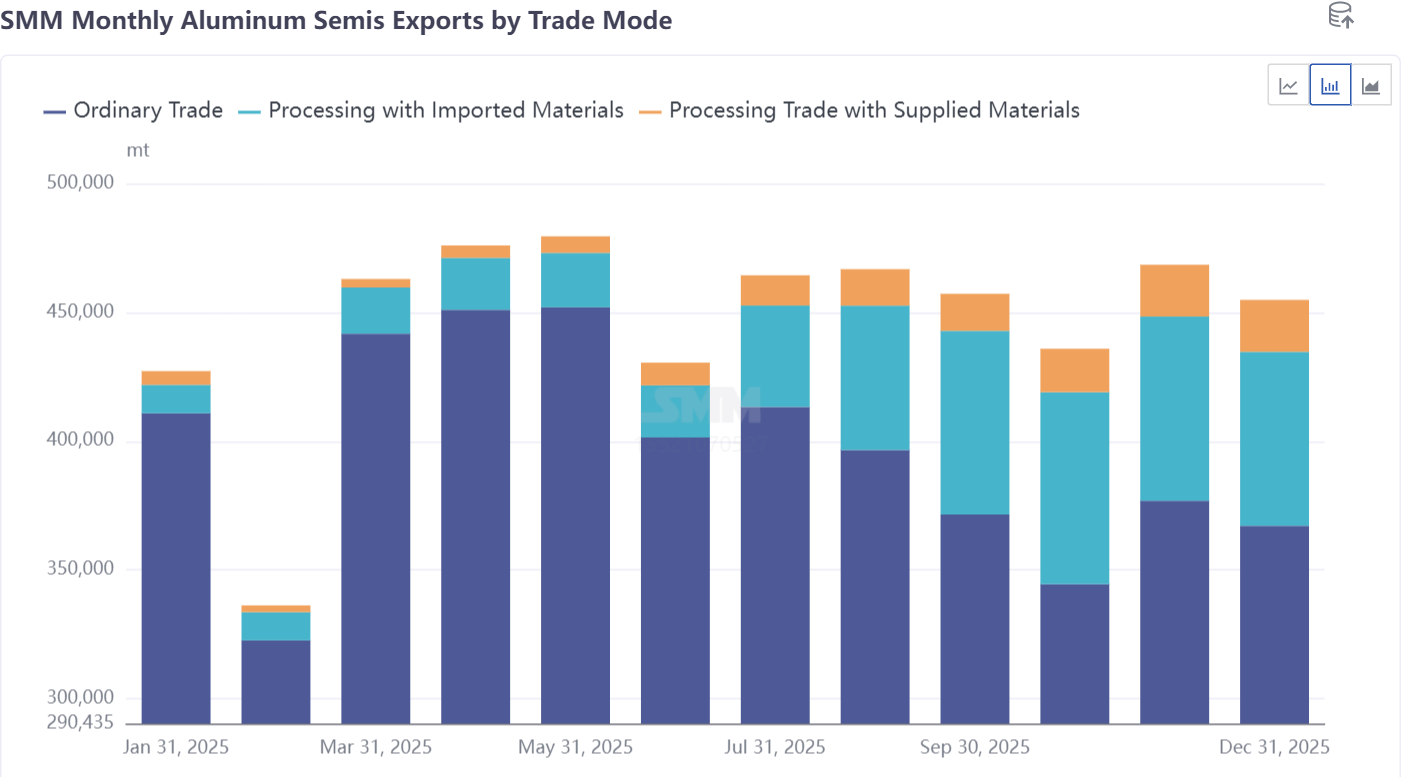

On December 1, 2024, the "Announcement on Adjusting Export Tax Rebate Policies" officially took effect, marking the end of the 13% export tax rebate for aluminum semis and copper semis products. This policy adjustment not only directly impacted the traditional export model dominated by Ordinary Trade but also quietly reshaped the trade pattern of China's aluminum semis exports. In 2025, total aluminum semis exports reached 5.5 million mt, a decrease of 750,000 mt YoY, representing a decline of 12%. However, beneath this overall contraction, the transformation of trade modes is accelerating—Processing Trade, particularly Processing Trade with Imported Materials, is moving from the periphery to the center stage, becoming a key pathway for enterprises to cope with policy changes and maintain export competitiveness.

Processing Trade is not a single model; it is mainly divided into Processing Trade with Supplied Materials and Processing Trade with Imported Materials. These two have fundamental differences in the arrangement of rights, responsibilities, and benefits, and are applicable to different business scenarios.

Processing Trade with Supplied Materials: This is a typical "pure toll processing" model. The foreign client supplies the raw materials, and the domestic processing enterprise is only responsible for processing according to the client's requirements, charging a fixed processing fee. It does not own the materials or finished products and does not bear market risks. Its core advantages are almost zero capital occupation and no market risk, but profits are relatively meager. According to customs data, exports under Processing Trade with Supplied Materials in 2025 were approximately 130,000 mt, accounting for 2.4%, with a relatively stable share, serving as a fixed link in specific customer supply chains.

Processing Trade with Imported Materials: Domestic operating enterprises use their own foreign exchange to import raw materials, process them into finished products, and then export the products themselves. The enterprise owns the materials and finished products, enjoys all profits, but also bears all market risks and price fluctuation risks from raw material procurement to finished product sales. Compared to Processing Trade with Supplied Materials, Processing Trade with Imported Materials offers greater operational autonomy and profit potential. According to customs data, exports under Processing Trade with Imported Materials reached 480,000 mt in 2025, accounting for 8.7%, becoming the main engine of growth in Processing Trade.

In terms of export volume, exports under Processing Trade with Imported Materials rose from around 11,000 mt (accounting for 2.3%) in January to approximately 74,000 mt (16.6%) in October, with an increase of 63,000 mt during the period. Moreover, when Ordinary Trade volume fluctuated or declined from September to December 2025, processing trade volume remained stable, demonstrating greater resilience. Although Ordinary Trade exports reached 4.75 million mt for the full year, still holding an absolute dominant share of 86.3%, its share is gradually being eroded. Driven by policies, some orders originally under Ordinary Trade, particularly those for cost-sensitive, supply-chain-flexible mid- to high-end products, are accelerating their shift to processing trade.

Beyond policy impetus, the price spread structure in the domestic and overseas aluminum markets in 2025 provided practical economic motivation for processing trade. For most of 2025, the import profit margin for aluminum ingot remained deeply negative, meaning that importing aluminum ingot via Ordinary Trade for domestic sales and production would incur significant losses. In contrast, under Processing Trade with Imported Materials, the ownership and cash flow of goods operate in a closed-loop US dollar system under bonded conditions, with both raw material imports and finished product exports avoiding the domestic taxable market, skillfully circumventing this dilemma.

In the short term, against the backdrop of stable export policies and maturing enterprise learning curves, the penetration rate of processing trade is expected to further increase. SMM predicts that the share of exports under Processing Trade with Imported Materials is expected to reach 25–30% in 2026, with more product orders shifting from Ordinary Trade to processing trade channels. However, at the same time, the complex customs manual management, verification processes, and compliance requirements associated with processing trade impose higher standards on enterprises' internal risk control systems. International scrutiny of rules of origin for processing trade products and potential trade investigation risks cannot be overlooked. This structural transformation in aluminum semis exports, led by processing trade, is projected to continue deepening.