SMM January 21:

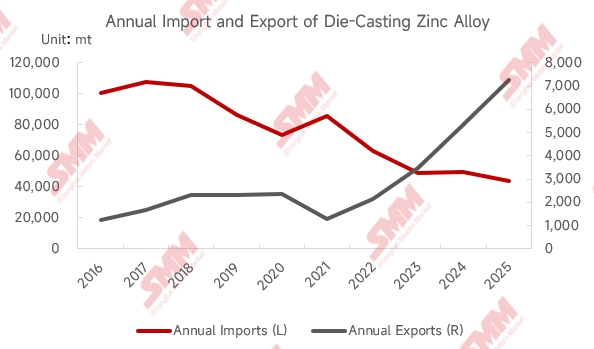

According to the latest customs data, China's die-casting zinc alloy exports in December 2025 reached 583 mt, down both YoY and MoM. However, on an annual basis, total die-casting zinc alloy exports in 2025 reached 7,259 mt, up 36.7% YoY, hitting a decade high. Meanwhile, imports fell to a ten-year low (2025 die-casting zinc alloy imports: 43,525 mt, down 12.4% YoY; December imports: 3,302 mt, also down both YoY and MoM), showing a notable pattern of rising exports and falling imports.

Why Did Die-Casting Zinc Alloy Exports Reach a Ten-Year High in 2025?

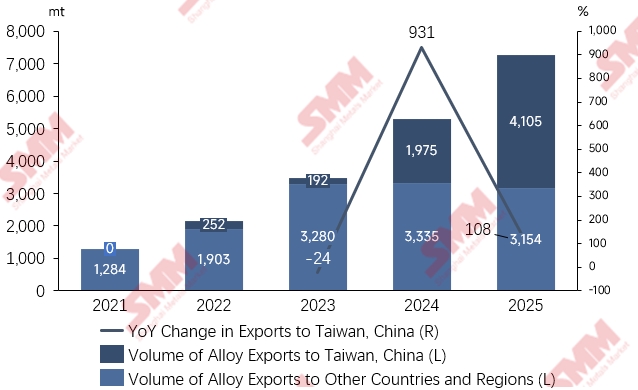

First, from the perspective of major export destinations, the market in Taiwan, China has become the core engine of export growth. From 2021 to the present, China's exports of alloy to Taiwan, China have increased year by year. In 2025, exports of die-casting zinc alloy to Taiwan, China reached 4,105 mt, accounting for 56.5% of total exports, an increase of 108% compared to 2024. Over the past four years, China's export share to Taiwan, China has risen from 11.6% to 56.5%, indicating a significant increase in market dependence.

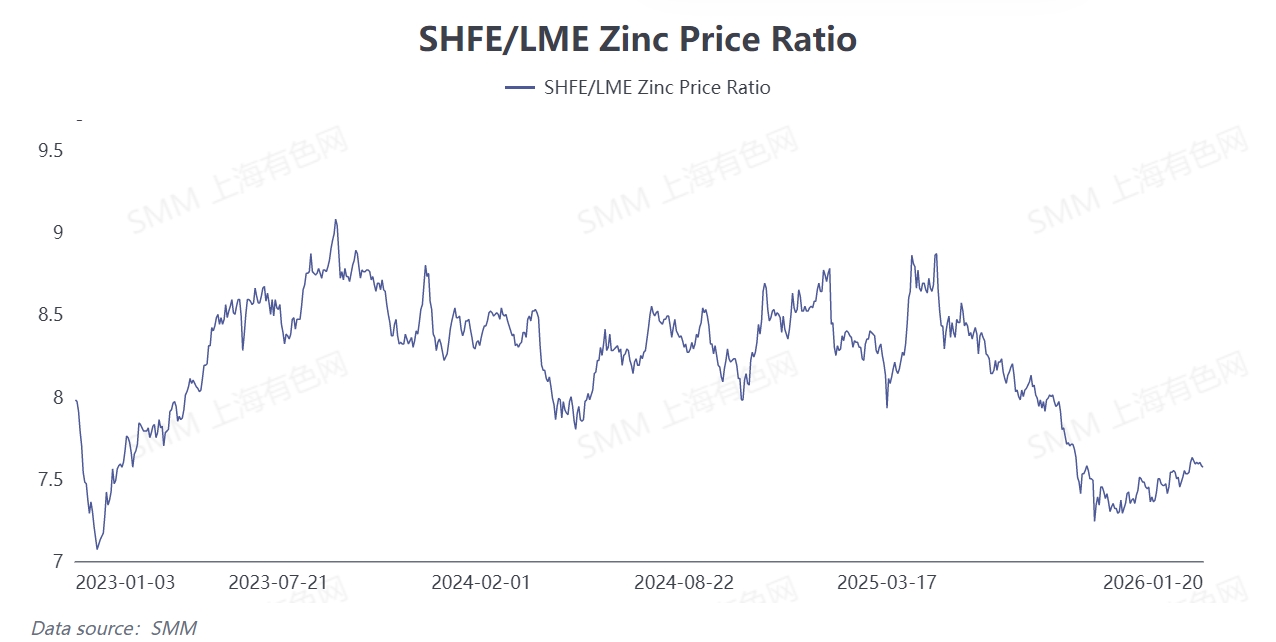

Secondly, looking at the monthly performance in 2025, exports showed a distinct "double-peak characteristic," with peaks in April and November. Considering the market conditions at the time, in April, amid international macro tariff disruptions, there was a certain "rush to export" for domestic die-casting zinc alloys and end-use products, driving the first export peak of the year. In H2, the continuously declining SHFE/LME zinc price ratio, combined with weakening international tariff disruptions, created favorable conditions for domestic alloy exports in November. Notably, Taiwan, China contributed significantly to both export peaks, further highlighting its core role in the export landscape.

From the import perspective, domestic alloy capacity has been continuously released in recent years, but market demand has gradually weakened. Under conditions of saturated supply without significant demand growth, China's motivation to import die-casting zinc alloy remains insufficient, domestic products are increasingly replacing imports, and import volumes have been declining consistently.

How will China's die-casting zinc alloy imports and exports develop in 2026?

Export side: On one hand, Taiwan, China, has been the main export destination for China's die-casting zinc alloy in recent years. Changes in its export share will undoubtedly significantly impact future exports. According to SMM, local demand in Taiwan is expected to support the export of domestic alloys. On the other hand, although tariff changes could greatly affect China's commodity exports, domestic alloy exports to Europe and the United States are relatively small, so the impact is expected to be relatively limited.

Import side: With the continuous release of domestic alloy capacity, demand for overseas die-casting zinc alloys in China will be further squeezed. It is expected that China's die-casting zinc alloy imports will continue to decline in 2026.