In 2025, SMM data shows that China's domestic production of ternary cathode materials reached 819,300 tonnes, a year-on-year increase of 19.36%. In contrast, overseas production stood at 248,000 tonnes, marking a significant decline of 23.80%. Global total production reached 1,067,300 tonnes, representing a modest overall growth of 5.48%.

During the year, NCM 6-series materials solidified their dominant position within China's EV battery market. While the high-nickel trend remains a long-term strategic direction, the dual pressures of slowing new energy vehicle sales growth and intense price competition at the terminal level led more domestic mainstream cell manufacturers and automakers to favor mid-to-high nickel materials (like the 6-series) for their optimal balance of cost and performance.

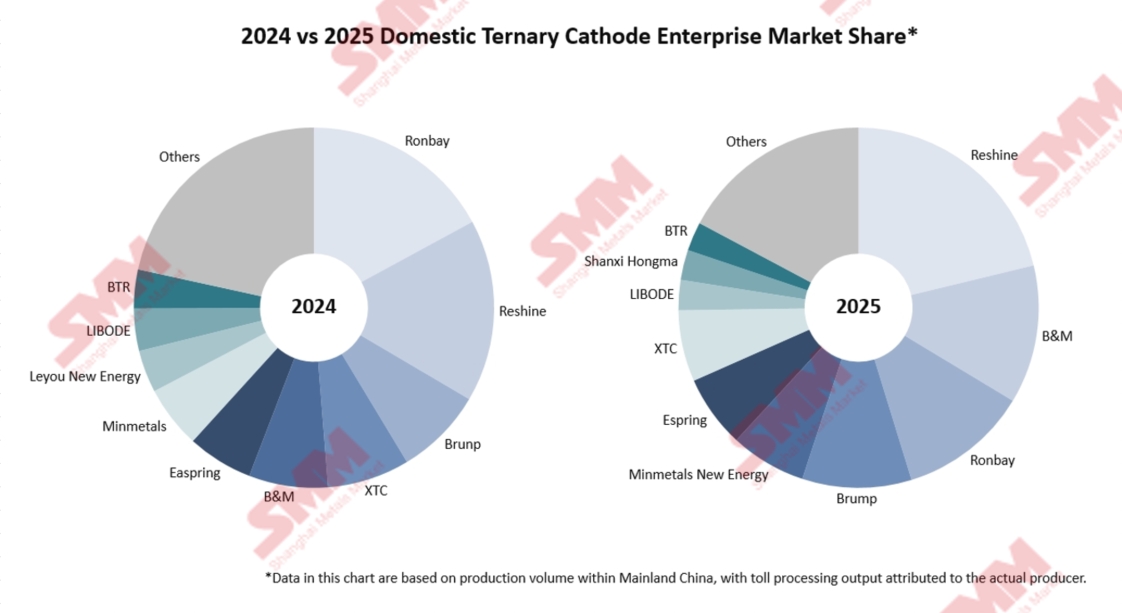

Capitalizing on this market shift, several domestic cathode material producers focusing on the mid-to-high nickel segment delivered outstanding performances. Companies like Reshine and Minmetals New Energy, through deep strategic partnerships with leading downstream cell manufacturers, achieved rapid shipment growth. Reshine's market share surged from 2024 to 2025, propelling it to the top position in both the Chinese and global ternary cathode market, establishing a significant lead. Minmetals New Energy also rapidly ascended into the domestic top-five rankings.

Simultaneously, the overseas ternary market maintained its focus on high-nickel materials. Leading South Korean and Japanese cell manufacturers continued to rely on imports of high-quality, cost-competitive ternary materials from China. Global automakers targeting the key markets of China, Europe, and the United States in their electrification transitions similarly depended on Chinese-sourced high-nickel ternary cathodes. The remaining three companies in the 2025 global top-five all targeted the high-nickel segment: B&M, leveraging its technological edge, secured key overseas ultra-high-nickel orders for rapid volume growth, emerging as the year's standout performer; Ronbay, a long-term leader in high-nickel technology, maintained its solid position within the top three; and Brunp, benefiting from deep integration with its parent company, further expanded its market share.

In 2025, the EV market, e-mobility market, and consumer electronics market accounted for 87.8%, 7.9%, and 4.3% of domestic ternary material demand, respectively, with the EV market remaining the undisputed mainstay. However, the highly concentrated competitive landscape among both domestic and overseas ternary cell manufacturers created a scenario of intense competition for limited orders. In the struggle to secure and maintain stable partnerships with key customers, it has become commonplace for domestic cathode producers to accept new clients at minimal margins or operate long-term under thin profits, or even at a loss.

The ternary materials industry has long operated in an unhealthy state. Capacity rationalization and survival of the fittest are inevitable consequences of past rapid expansion; the slowdown in terminal growth could not have been changed by the concerted efforts of just a few positive electrode factories. However, the severe imbalance in profit distribution across the industrial chain is ultimately unsustainable. The chain is interconnected; when one segment weakens, the entire system suffers.

The new year is poised to remain fiercely competitive. Overcapacity, razor-thin margins, and shifting export policies (notably the upcoming cancellation of tax rebates) collectively form a rigorous stress test for the industry. Within the established framework of uneven bargaining power across the supply chain, where does a company's true core competitiveness lie? Upstream resource security, targeting emerging e-mobility applications, accelerating overseas production localization—where should the next strategic move be directed? The answers to the industry's impending consolidation and realignment in 2026 will likely be found within these critical strategic choices. The survivors may not be the largest players today, but they will undoubtedly be those most adept at adapting to this evolving set of rules.

![[SMM Analysis] Chinese New Year Off-Season “Reset,” Sodium-Ion Battery Industry Chain Recovery Poised to Begin](https://imgqn.smm.cn/usercenter/IpglC20251217171727.jpg)