08 Jan 2026

By Jim Iuorio

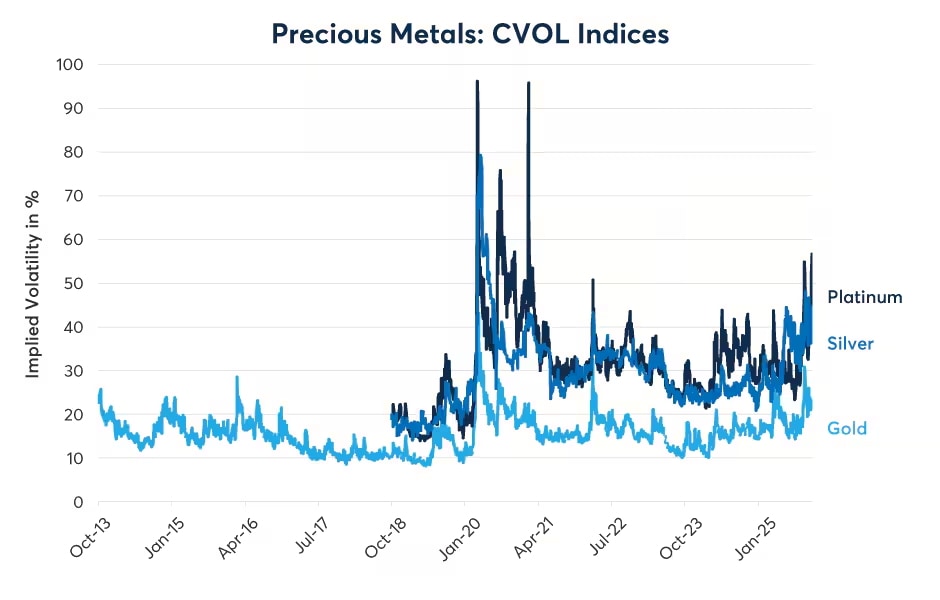

Silver's performance over the past year has been nothing short of spectacular. Between early September and early November 2025, the metal vaulted to a rally of almost 50%, a surge that eclipsed the gains of virtually every other asset. This meteoric rise was powered by a multi-layered confluence of market conditions. From its deep-rooted correlation with gold to a supply-demand imbalance driven by the global imperative for electrification, AI and crypto mining, multiple forces kicked in simultaneously. Understanding this precise moment of convergence requires a deeper look into both positioning and underlying market psychology.

The Gold-Silver Relationship

First, let’s look at silver’s relationship to gold. The gold-to-silver ratio over the last 50 years has averaged approximately 67. This means that, on average, it would take 67 ounces of silver to buy one ounce of gold. That average over the last six years has shot up to almost 84. The reasons for this seem pretty straightforward: the economic panic related to the Covid-19 pandemic caused a rush into what is often viewed as the world’s safest asset, gold. But even as the economic stress subsided, another compelling tailwind for gold emerged.

Global central banks accelerated their stockpiling of the metal as an alternative to holding reserves strictly in U.S. dollars and treasuries. For some perspective on that, in 2017, 64% of the world’s reserves were held in dollars. That number has dwindled to approximately 57%. This shift appeared to accelerate in relation to what some countries viewed as a heavy-handed approach in how the U.S. dealt with Russia in the wake of its invasion of Ukraine. The U.S. orchestrated a freezing of Russian dollar-denominated assets and blocked Russia from participating in the global SWIFT payment system.

Many will make the reasonable argument that these actions were necessary, but that certainly doesn’t mean there can’t be second-derivative ramifications. As economist Thomas Sowell said, “There are no solutions, only tradeoffs.” In this instance, the tradeoff was a global attempt at de-dollarization. Side note: the word “attempt” was carefully chosen and underscores a pervasive belief that there is no legitimate alternative to the safety and stability of dollars and that these attempts may ultimately fail. It’s also worth mentioning that the trade policies probably gave additional motivation for countries to seek a substitute.

The net result was a huge rally in gold that pushed the gold-silver ratio up to a four-year high of 104 in May of 2025. This marked the second-highest ratio in recorded history, the highest being the 120 reading in the immediate aftermath of the 2020 pandemic. An additional tailwind to gold’s rally was a growing belief that the current explosive levels of U.S. deficit spending could have a significant negative impact on the value of the U.S. dollar. This “debasement trade” has been a tailwind to all hard assets, but gold was the biggest beneficiary because of the additional geopolitical factors.

The Electrification Narrative

It’s been a noticeable characteristic of the gold-to-silver relationship, historically, that in times of stress, the market’s knee-jerk reaction is to rush into gold. Later, as the dust settles, silver often has aggressive catch-up moves. Silver’s performance in late 2025 was no exception. Although gold’s magnetic pull on silver set the ball in motion, the silver trade also had its own accelerant that fueled the meteoric rise.

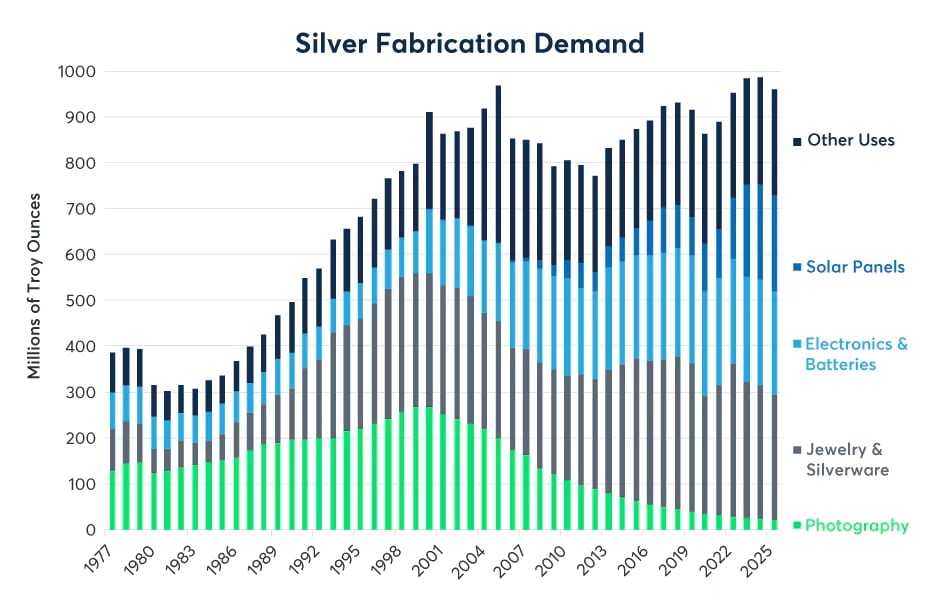

It’s often the case that an asset will begin a move that’s initially based on technical factors. Once that move is established, the fundamental narrative emerges and provides fuel for subsequent legs higher. In silver, the narrative involves structural deficits against ever-increasing demand for electrification.

Over the last two years, the prospect of evolving AI technology has been a dominant driver of equity market returns. What’s only recently been talked about is the massive amounts of energy that will be needed to power the data centers required to support the new technology. This narrative has been an additional tailwind for the industrial metals space and has supported huge gains. Copper rose 40% in 2025, while platinum jumped over 130% and palladium was up over 75%. Silver far outpaced them all over the same period, with gains of almost 155%.

The Perfect Storm

Silver’s extraordinary performance isn’t just about one factor – it’s about timing. The setup from an extreme gold-silver ratio provided the springboard. The fundamental story of structural supply deficits and surging industrial demand provided the fuel. And the broader market psychology around de-dollarization and hard assets provided the conviction. When multiple elements converge, the resulting move can be significant.

The question now becomes whether this rally represents a permanent repricing of silver’s value in an electrified, AI-powered world, or an over-correction. Given the persistent nature of the supply-demand imbalance and the continued build-out of energy infrastructure, the case for sustained strength seems compelling. But as with all markets, nothing moves in a straight line forever.

Source: https://www.cmegroup.com/openmarkets/metals/2026/The-Perfect-Storm-Behind-Silvers-Rise.html

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)