SMM January 15 News:

Key Points: This week (January 9-15, 2026), the solid-state battery industry entered a phase of comprehensive acceleration driven by national strategic initiatives. The MIIT explicitly listed "all-solid-state battery technology breakthrough" as a key task, providing top-level guidance for the industry. Critical links in the industry chain made simultaneous progress: the sulphide route achieved substantial advancements in materials, pilot production, and equipment orders; meanwhile, cutting-edge applications, represented by the low-altitude economy, led in commercialization.

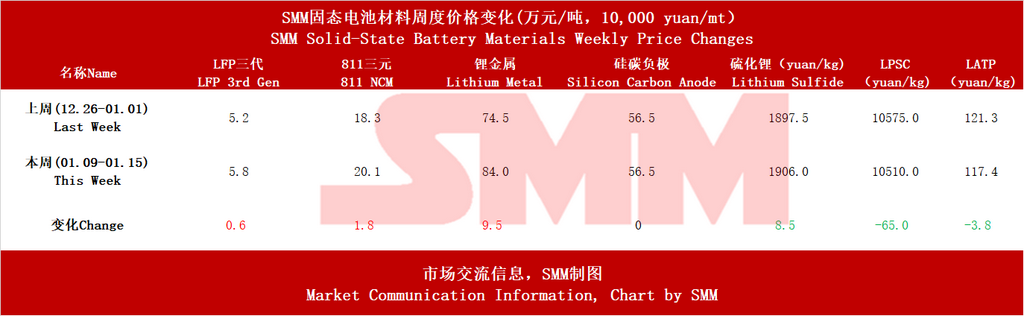

Preface: Weekly price situation, prices of traditional lithium battery shared materials in solid-state batteries increased to varying degrees due to the rise in lithium chemicals prices, while silicon carbon anode remained stable. Prices of solid-state battery-specific materials, such as lithium sulfide and electrolytes, decreased, with the market being quite active this week.

I. Clear Top-Level Design, Industry Enters National Strategic Fast Lane

On January 13, the MIIT's inter-ministerial meeting on energy-saving and new energy vehicle development first listed "accelerating the breakthrough in all-solid-state battery application technology" as a key task to enhance the self-reliance and controllability of the industry chain. This move injected the strongest policy support into the industry, indicating that solid-state battery technology research will receive more systematic national resource support and cross-departmental collaboration, greatly accelerating the process from laboratory to industrialization.

II. Multiple Technological Routes Flourish, Sulphide Pathway Leads in Industrialization

This week’s information shows that sulphide solid electrolytes, due to their high ionic conductivity and relatively good mechanical properties, have become the key path for mass production in the industry, achieving substantial progress in critical areas.

Material Production Imminent: Xingfa Group's 10kt phosphorus pentasulfide (a key precursor) project is expected to be operational in July, marking the first large-scale stable supply of core materials and a landmark event in breaking the cost bottleneck. SEMCORP's in-depth analysis of lithium sulfide processes (mainly solid-phase method) indicates that the industry is committed to reducing large-scale production costs to a commercially viable level.

Accelerated Pilot Verification: Tinci's sulphide electrolyte has entered the pilot stage, combined with Furi Co., Ltd.'s full-capacity operation of 200 tons of silicon carbon anode pilot production, indicating that the mainstream all-solid-state route of "sulphide electrolyte + silicon carbon anode" is accelerating in engineering validation.

III. Full-Chain Resonance, Commercialization Contours Becoming Clearer

From upstream materials to downstream applications, the industry chain is showing a fully activated trend.

1. Upstream Material Segment

Anode Material Scaling Environmental Assessment: Furi Co., Ltd.'s 50,000 tons/year silicon carbon anode project has completed environmental assessment, with 200 tons of pilot capacity running at full load. This aims to solve the mass production bottleneck of high-energy-density anode materials, currently in the pilot/planning stage.

Electrolyte Precursor Project Commissioning: Xingfa Group's 10kt phosphorus pentasulfide project is expected to be completed and operational by July. The project is under construction, with its strategic significance lying in securing the supply of key precursors for sulphide solid-state batteries and helping to reduce future costs.

Mature Electrolyte Process Route: SEMCORP and Tinci are conducting R&D and pilot production on lithium sulfide processes and sulphide electrolytes, respectively. This is in the pilot/R&D stage, with the core goal of establishing a reliable technical path for large-scale production.

2. Equipment and Manufacturing Segment

Equipment Manufacturers Receive Mass Production Orders: Hymson has signed the first commercial mass production order for solid-state battery equipment in the industry, marking the feasibility of core solid-state battery production equipment and a key turning point for industrial replication.

Solid-State Battery Mass Production Line Construction: Multiple mass production projects, including Jinlongyu (2Gwh), Heyuan Lithium Creation (Huai'an base), and WELION New Energy (15GWh project), are in the construction or commissioning stage. This marks the start of the industry's capacity competition, laying a physical foundation for the final product launch.

3. Cell and Product Segment

Semi-Solid Battery Sampling/Product Launch: Zijian Electronics' semi-solid battery has been sent to customers for sampling, and SVOLT Energy Technology has launched multiple semi-solid products, currently in the customer sampling/product launch stage. This shows that semi-solid batteries, as a transitional solution, are leading in commercial application.

All-Solid Patent and Prototype Testing: Qingtao Energy obtained core patent authorization for lithium-free anodes, and Dongfeng Motor initiated winter testing of 350Wh/kg solid-state battery prototypes. These developments are in the patent authorization and prototype testing stage, with the core task of tackling all-solid core technologies and verifying their reliability in real environments.

4. End-Use and Recycling Segment

End-Use (Low-Altitude Economy and Aviation Batteries): Xinjie Energy has supplied high-energy-density solid-state batteries to EHang eVTOL, and SVOLT Energy Technology has also released aviation-grade products, currently in the actual supply and product launch stage. This marks that solid-state batteries are entering high-value new tracks with extremely stringent safety and performance requirements.

Recycling (Battery Material Repair Collaboration): Qingling Huachuang and Beijing WELION signed an agreement to conduct R&D on solid-state battery material repair, currently in the R&D cooperation stage. This move aims to lay out a closed-loop industrial ecosystem in advance, reducing life cycle costs and environmental impact.

IV. Emerging Application Scenarios, Low-Altitude Economy as a High-Value Entry Point

This week, the application of solid-state batteries in the low-altitude economy and aviation fields was particularly prominent. Xinjie Energy has supplied EHang eVTOL with solid-state batteries with an energy density of 480Wh/kg, and SVOLT Energy Technology has also released semi-solid products that meet aviation safety standards. This indicates that solid-state batteries, with their absolute advantages in high safety and high energy density, are leading in commercial breakthroughs in high-performance, cost-insensitive advanced aviation fields, and feeding back into technological iteration.

V. Intensified International Competition, Europe Gathers Momentum

European companies Syensqo and Axens jointly established Argylium, focusing on the R&D and industrialization of sulphide electrolyte materials. This marks Europe's efforts to integrate chemical material advantages and build an independent supply chain for next-generation solid-state battery materials, expanding the global technology competition from East Asia to Europe and America.

According to SMM forecasts, all-solid-state battery shipments will reach 13.5 GWh by 2028, while semi-solid-state battery shipments will reach 160 GWh. Global lithium-ion battery demand is projected to reach approximately 2,800 GWh by 2030, with the EV sector's lithium-ion battery demand showing a CAGR of around 11% from 2024 to 2030, ESS lithium-ion battery demand at a CAGR of about 27%, and consumer electronics lithium battery demand at a CAGR of roughly 10%. Global solid-state battery penetration is estimated at about 0.1% in 2025, with all-solid-state battery penetration expected to reach around 4% by 2030, and global solid-state battery penetration potentially approaching 10% by 2035.

**Note:** For further details or inquiries regarding solid-state battery development, please contact:

Phone: 021-20707860 (or WeChat: 13585549799)

Contact: Chaoxing Yang. Thank you!

![[SMM Analysis] Cobalt Market Consolidates on Tight Supply, Awaits Restocking Catalyst](https://imgqn.smm.cn/usercenter/lzgUR20251217171731.jpg)

![[SMM Analysis] Weak Demand for Co3O4 Makes Prices Difficult to Rise or Fall](https://imgqn.smm.cn/usercenter/JKfXw20251217171731.jpg)