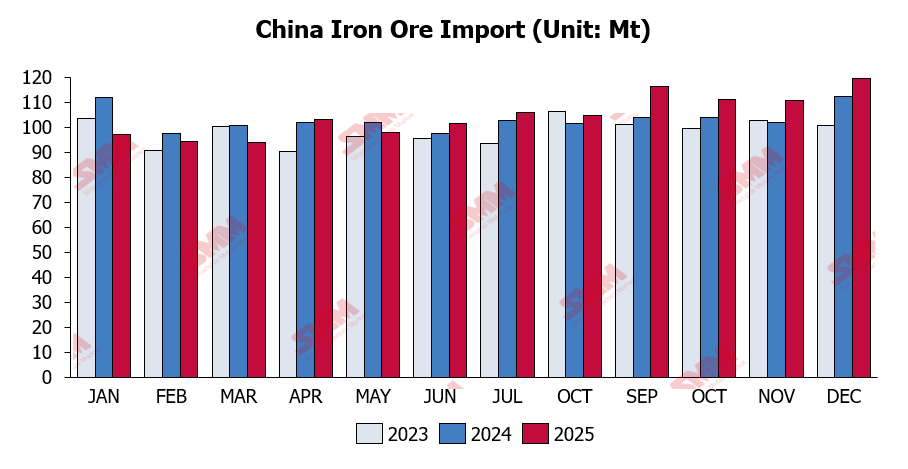

According to the latest data from the General Administration of Customs, China's total imports of iron ore and concentrates in December recorded 119.647 million tonnes, a significant increase of 9.107 million tonnes from the previous month, representing a month-on-month growth of 8.2%.

On the supply side, December served as the final sprint for the fiscal year. Overseas miners universally intensified their shipment efforts to ensure annual dispatch and sales targets were met, resulting in a pronounced year-end "tail-raising" effect. Additionally, December contained one more calendar day than November; against a backdrop of stable daily customs clearance efficiency, this objectively boosted the monthly import total.

On the demand side, the resumption of production at certain blast furnaces, coupled with the implementation of coke price reductions, has marginally repaired steel mill profit margins. This has led to a phased strengthening of willingness to restock raw materials. Furthermore, with the Lunar New Year approaching, some steel mills initiated their pre-holiday stockpiling logic early, further driving up import demand for iron ore.

Looking ahead to January, iron ore import volumes are projected to show a month-on-month recovery compared to December. The rationale is twofold: firstly, as the previous cycle of blast furnace maintenance concludes and maintenance intensity weakens, hot metal output is expected to arrest its decline and rebound, forming rigid demand support for iron ore. Secondly, although this year's Lunar New Year holiday falls relatively late, considerations for supply chain security and holiday logistics mean that steel mills' rigid pre-holiday restocking demand will be concentrated in January. Driven by the dual engines of marginal demand improvement and seasonal restocking expectations, both iron ore import volumes and apparent consumption in January are expected to retain some upside potential.

Source : GACC

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)