As we enter 2026, the Indonesian stainless steel market presents a complex landscape characterized by a mismatch between supply and demand alongside high operational costs. On one hand, driven by market trends in China and supported by raw material costs, export quotes for 304/2B have surged by nearly $200 in a short period, with mainstream quotes approaching $1,930/mt. On the other hand, demand across major global markets—with the notable exception of South Asia—remains generally weak.

Meanwhile, with the successful trial production of a new local stainless steel project in Indonesia, the supply structure is gradually shifting from an oligopoly toward diversified competition. Squeezed by both high costs and incoming capacity, the market’s focus is now locked on the future trajectory of price levels and the competitive landscape.

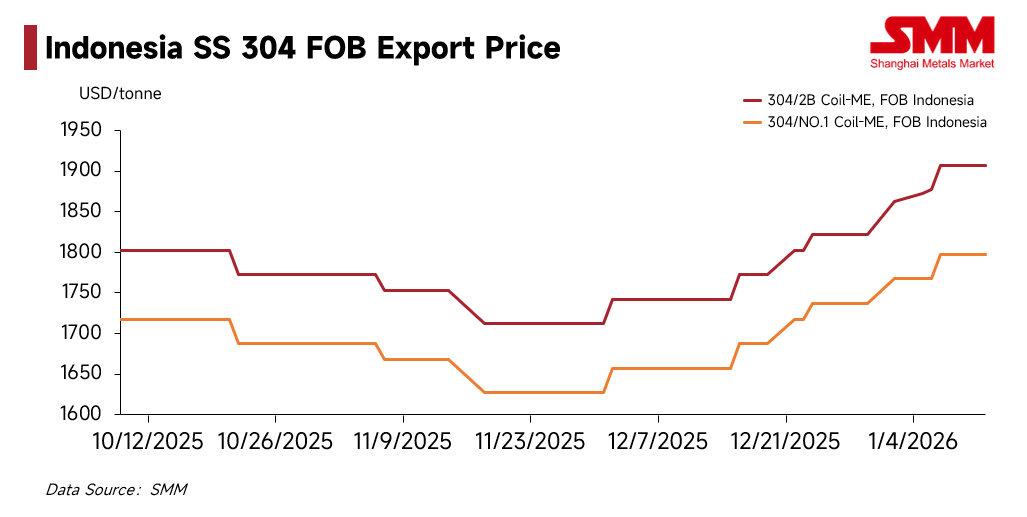

Price Review: Synchronized Gains and Cost Validation

Since December 2025, pricing strategies for Indonesian stainless steel have shown strong regional linkage and cost rigidity. According to SMM data, quotes for Indonesian 304/2B Coil (Mill Edge, FOB) have made a substantial leap. Starting from the $1,690–$1,735/mt range in early December, mainstream Indonesian mills quickly followed the rally in Chinese futures and spot prices. Currently, offshore quotes have climbed strongly to $1,885–$1,930/mt.

This upward trend has been further validated by landed prices (CIF) at the destination. SMM reports that CIF quotes for hot-rolled resources in Southeast Asia have adjusted upward to around $1,850/mt, while cold-rolled CIF quotes have broken through the $2,000/mt barrier. These levels confirm that upstream cost pressures are successfully being passed down to overseas end-users.

The underlying logic behind this rally remains solid. Due to delays in Indonesia’s RKAB (mining quota) approval process and the impact of the rainy season, nickel ore supply has tightened. SMM data shows that the Indonesian NPI (Nickel Pig Iron) FOB index has soared from $109.61 per nickel point on December 1, 2025, to the current $122.63 per nickel point (as at 12 Jan 2026).

Although the significant rise in raw material costs (up over 11%) hasn't severely eroded mill margins—thanks to the simultaneous jump in finished goods prices—mills remain firm on pricing. Their strong willingness to hold prices is based on expectations of continued tight nickel iron supply and rising costs, effectively limiting any room for price drops.

Demand Divergence: High Premiums in India Support the Market

Global buyer reaction to the $2,000/mt CIF price for cold-rolled steel has been sharply divided.

-

Europe, US, & East Asia: End-user demand has yet to show signs of a substantial recovery. Facing high quotes, downstream buyers are hesitant ("fear of heights"), mostly adopting a strategy of purchasing only on an as-needed basis or delaying orders.

-

South Asia: In contrast, this region has become the absolute pillar for current export orders. SMM understands that CIF transaction prices for cold-rolled steel in India have reached $2,050/mt, approximately $50 higher than the Southeast Asian average. Driven by pre-holiday stocking cycles (fiscal year-end or religious festivals), Indian clients have shown a much higher tolerance for premium-priced resources. This robust regional purchasing power is currently the core force sustaining export volumes for Indonesian mills.

Supply Shift: New Players and Value Chain Deepening

While prices and demand play tug-of-war, a structural expansion on the supply side is reshaping the Indonesian market ecosystem.

SMM has learned that a new Indonesian stainless steel producer recently succeeded in trial production and plans to officially launch products in Q2 2026, with an expected annual capacity of 1.2 million tons. The realization of this project signals a break in the existing concentration of power, as new participants physically increase market supply.

Simultaneously, the industry value chain is deepening. A large multinational joint venture project is making steady progress, positioning itself for the mid-to-high-end market. Furthermore, as the industrial ecosystem matures, more cold-rolling and processing centers are becoming operational in Indonesia.

This trend does two things:

- Tactically: It shortens response times for the Southeast Asian market.

- Strategically: It reflects a move by mid-stream and downstream processors to reduce reliance on single upstream resources. By building independent deep-processing capabilities, companies are attempting to build a "supply chain moat," enhancing their autonomy and gaining more bargaining power against upstream pricing.

External Variables: China’s Policy Shift and Macro Benefits

Beyond fundamental supply and demand, two potential external macro variables are fueling expectations for further price increases:

- Substitution Effect under China’s Export Constraints: Recently, policy direction in China’s stainless steel sector has shifted. Expectations are rising regarding the re-implementation of export license management, combined with internal industry policies against "excessive competition." The market widely expects China’s export volumes to contract and the price floor to rise due to policy support. SMM believes this will narrow the channels for overseas buyers to access low-price resources, forcing global demand to shift further toward Indonesia, thereby enhancing Indonesia's irreplaceability and pricing power in the global supply chain.

- Macro Support from the Fed’s Rate Cut Cycle: As the US enters a rate-cutting cycle, the US Dollar Index is under pressure. Commodities usually priced in dollars (including nickel and stainless steel) are expected to see valuation repairs. Additionally, the liquidity released by rate cuts is likely to guide capital back into emerging markets, benefiting the trade finance environment and downstream restocking willingness in resource-rich nations like Indonesia.

Outlook: Short-Term Strength vs. Mid-Term Competition

Looking ahead, SMM expects the market to transition from short-term firmness to a mid-term standoff.

- Short-Term: Supported by regional price linkage and rigid demand from South Asia for stocking, and compounded by the supply contraction expectations from pending RKAB approvals, Indonesian stainless steel prices are expected to maintain high levels before the Lunar New Year.

- Mid-Term Risks: The challenge lies in absorbing new capacity. As new projects ramp up production and processing centers increase shipments, supply availability in Indonesia will rise significantly. If the South Asian stocking wave fades after the holidays, while other major overseas markets still reject current high prices, a mismatch between "new supply" and "dip in demand" could trigger price competition.

Currently, the progress of Indonesia's RKAB approval has evolved from a simple supply indicator into a key source of risk premium in the pricing model. As the window for the 2026 quota announcement approaches, the market is in a sensitive period of balancing policy expectations against reality. For all players in the industry chain, while adapting to the "new normal" of high costs, it is crucial to remain vigilant against the "expectation gap" that may occur the moment policies are finalized, which could lead to a sudden repricing risk.

Written by: Bruce Chew | bruce.chew@metal.com

![[SMM Stainless Steel Flash] Fu'an Aims for $246B in Stainless Steel Output by 2026, Advances 600,000-Ton CR Project](https://imgqn.smm.cn/usercenter/KFwsY20251217171734.jpg)

![[SMM Stainless Steel Flash] Fujian Tsingshan's Stainless Steel Deep Processing Project Receives Construction Permit](https://imgqn.smm.cn/usercenter/Btmsv20251217171733.jpg)

![[SMM Stainless Steel Flash] EU Fastener Distributors Warn CBAM Acts as Penalty Tariff; Import Costs Surge Up to 50%](https://imgqn.smm.cn/usercenter/qLeLR20251217171733.jpg)