In mid-December 2025, the Passenger Car Association and CAAM successively released data on the automotive industry and passenger car market for December 2025 and the full year of 2025. According to CAAM analysis, in 2025, automobile production and sales reached 34.531 million and 34.4 million units, respectively, setting new historical records and maintaining the top global position for the 17th consecutive year... SMM compiled relevant data on the automotive market and power battery market for December 2025 for readers' reference.

Automotive Sector

CAAM: Automobile Production and Sales Hit New Record High in 2025, Leading Globally for 17th Consecutive Year

In December, automobile production and sales reached 3.296 million and 3.272 million units, respectively,down 6.7% and 4.6% MoM, and down 2.1% and 6.2% YoY, respectively.

In 2025, automobile production and sales reached 34.531 million and 34.4 million units, respectively,up 10.4% and 9.4% YoY, exceeding initial expectations, setting new historical records, and maintaining the top global position for the 17th consecutive year.

CAAM: NEV Production and Sales Exceeded 16 Million Units in 2025, Leading Globally for 11th Consecutive Year

In December, NEV production and sales reached 1.718 million and 1.71 million units, respectively,up 12.3% and 7.2% YoY,with NEV sales accounting for 52.3% of total new automobile sales.

In 2025, NEV production and sales reached 16.626 million and 16.49 million units, respectively,up 29% and 28.2% YoY,with NEV sales accounting for 47.9% of total new automobile sales, an increase of 7 percentage points compared to the same period last year.China's NEVs maintained the top global position for the 11th consecutive year.In 2025, driven by favorable policies, abundant supply, and continuous infrastructure improvements, NEVs continued to grow, with production and sales exceeding 16 million units.

CAAM: Annual Automobile Exports Surpassed 7 Million Units

In December, automobile exports reached 753,000 units, up 3.5% MoM,and up 49.2% YoY.

In 2025, enterprises placed greater emphasis on exploring overseas markets, the international competitiveness of Chinese brands continued to improve, joint venture exports also performed well, and NEV exports grew rapidly, driving China's automobile exports to a new level. Annual automobile exports exceeded 7 million units, reaching 7.098 million units,up 21.1% YoY.

CAAM: NEV Exports Reached a New Level

In December, NEV exports reached 300,000 units, down 0.1% MoM,and up 1.2 times YoY;traditional fuel vehicle exports reached 453,000 units, up 6% MoM,and up 22% YoY.

In 2025, NEV exports reached 2.615 million units, doubling YoY; exports of internal combustion engine vehicles totaled 4.483 million units, down 2% YoY.

The China Passenger Car Association (CPCA) recently released data on the passenger vehicle market for December 2025. According to CPCA data, retail sales in the national passenger vehicle market in December reached 2.261 million units, down 14.0% YoY, but up 1.6% MoM. Cumulative retail sales from January to December reached 23.744 million units, up 3.8% YoY.

For passenger NEVs, production in December 2025 reached 1.56 million units, up 7.6% YoY but down 11.2% MoM. Cumulative production from January to December reached 15.348 million units, an increase of 26.1%.

Regarding exports, the CPCA stated that with the scale advantages and market expansion needs of Chinese NEVs becoming apparent, Chinese-made NEV brand products are increasingly going global, with their recognition overseas continuing to rise. Passenger NEV exports in December were 273,000 units, up 119.8% YoY, but down 4.0% MoM, accounting for 46.4% of passenger vehicle exports, an increase of 15.4 percentage points compared to the same period last year. Among these, pure electric vehicles accounted for 57.9% of NEV exports (compared to 62.5% in the same period last year), with A00+A0 segment pure electric vehicles, as the core focus, accounting for 68% of pure electric vehicle exports (compared to 52% in the same period last year).

Regarding the December passenger vehicle market, the CPCA stated that the national passenger vehicle wholesale growth rate for 2025 was 8.8%, and the passenger NEV wholesale growth rate was 25.2%, successfully achieving the NEV market growth target set in the "14th Five-Year Plan". With the NEV purchase tax exemption policy set to expire at year-end, the vehicle market should have entered a year-end rush-buying phase in December. However, budget funds for trade-in policies in most provinces and cities were depleted, creating a hedging effect on car purchase incentives. Coupled with adjustments to the automotive trade-in policy, market trends diverged significantly. Recently, most provinces across the country have implemented varying degrees of deep adjustments to replacement and trade-in subsidies, intensifying consumer wait-and-see sentiment and also bringing significant deceleration and momentum building to the December vehicle market. With upstream speculation driving lithium carbonate price increases and widespread price hikes for non-ferrous raw materials, coupled with weak downstream demand, the survival pressure on automakers is increasing. Some producers promptly adjusted their production pace downward and reduced inventory to accumulate momentum for a strong start to the "16th Five-Year Plan".

The CPCA believes the characteristics of the December 2025 passenger vehicle market were as follows: First, passenger vehicle manufacturer production and wholesale trends were steady in December, with mainstream manufacturers reducing pressure accordingly; Second, the expiration of the vehicle purchase tax exemption drove outstanding NEV retail performance for automakers, with NEV retail sales hitting a record high; Third, the batch launch of new models this year, combined with the advancement of "anti-involution" efforts curbing disorderly price cuts, kept NEV promotions in December at around 10%, without significant volume discount trends; Fourth, domestic retail sales of internal combustion engine vehicles in December fell 30% YoY, pure electric vehicle market retail sales grew 2.5% YoY, extended-range electric vehicles grew 15.4% YoY, and plug-in hybrid electric vehicles fell 1.1% YoY. The structural share of pure electric versus extended-range among new automakers changed from 59%:41% last year to 71%:29%; Fifth, the domestic retail penetration rate of NEVs in December was 59.1%. As the NEV purchase tax exemption policy is expected to expire, NEVs showed strong growth momentum, 32.6 percentage points higher than internal combustion engine vehicles. A NEV penetration rate approaching 60% also signifies the market's entry into a new "NEV-dominated" stage, requiring timely policy adjustments to promote harmonious and high-quality industry development; Sixth, from January to December 2025, exports of self-owned brand internal combustion engine passenger vehicles were 2.87 million units, down 7%, while exports of self-owned brand NEVs were 2.04 million units, up 139%. NEVs accounted for 49.5% of self-owned brand exports. With the growth of CKD exports, Chinese passenger vehicle exports have extended from "simply selling cars" to "industry chain going global", upgrading from high-speed growth in "volume" to a leap in "quality".

For the full-year passenger vehicle market, the CPCA stated that the national auto market trend in 2025 showed an "inverted U-shaped pattern of low at the beginning, high in the middle, and low at the end," with the release of replacement demand continuously promoted from 2024 to 2025 being relatively sufficient. The original forecast was for a 2% growth in domestic auto retail sales in 2025, but actual growth reached 4%. Retail sales of passenger NEVs in 2025 were projected to grow by 20%, with a penetration rate of 57%, and the actual trend was similar.

CAAM indicated that in 2025, auto production and sales cumulatively reached 34.531 million and 34.4 million units, respectively, setting new historical records and maintaining the top global position for 17 consecutive years. Among these, the passenger vehicle market grew steadily, effectively boosting the overall auto market as the core component of auto consumption; the commercial vehicle market recovered positively, with production and sales achieving growth of over 10%, returning to above 4 million units; new momentum accelerated its release, with NEV production and sales exceeding 16 million units, accounting for over 50% of domestic new vehicle sales, becoming the dominant force in China's auto market; foreign trade demonstrated strong resilience, with auto exports exceeding 7 million units and NEV exports reaching 2.615 million units, scaling new heights in export volume.

Regarding power batteries,

from January to December, cumulative sales of China's power and ESS batteries reached 1,700.5 GWh, up 63.6% YoY.

In December, sales of China's power and ESS batteries were 199.3 GWh,up 11.1% MoM and 57.5% YoY.Among these, power battery sales were 143.8 GWh, accounting for 72.1% of total sales, up 7.3% MoM and 49.2% YoY; ESS battery sales were 55.6 GWh, accounting for 27.9% of total sales, up 22.4% MoM and 84.0% YoY.

From January to December, cumulative sales of China's power and ESS batteries were 1,700.5 GWh,up 63.6% YoY.Among these, cumulative power battery sales were 1,200.9 GWh, accounting for 70.6% of total sales, up 51.8% YoY; cumulative ESS battery sales were 499.6 GWh, accounting for 29.4% of total sales, up 101.3% YoY.

From January to December, cumulative domestic power battery installations were 769.7 GWh, up 40.4% YoY.

In December, domestic power battery installations were 98.1 GWh,up 4.9% MoM and 35.1% YoY.Among these, ternary battery installations were 18.2 GWh, accounting for 18.6% of total installations, up 0.2% MoM and 40.5% YoY; LFP battery installations were 79.8 GWh, accounting for 81.3% of total installations, up 5.9% MoM and 33.7% YoY.

January-December, China's power battery installations totaled 769.7 GWh, up 40.4% YoY. Among them, ternary battery installations totaled 144.1 GWh, accounting for 18.7% of total installations, up 3.7% YoY; LFP battery installations totaled 625.3 GWh, accounting for 81.2% of total installations, up 52.9% YoY.

2025 Auto Market Wraps Up Successfully! BYD Overtakes Tesla for the First Time to Become Global Pure EV Sales Champion; Multiple New Automakers Achieve Sales Targets

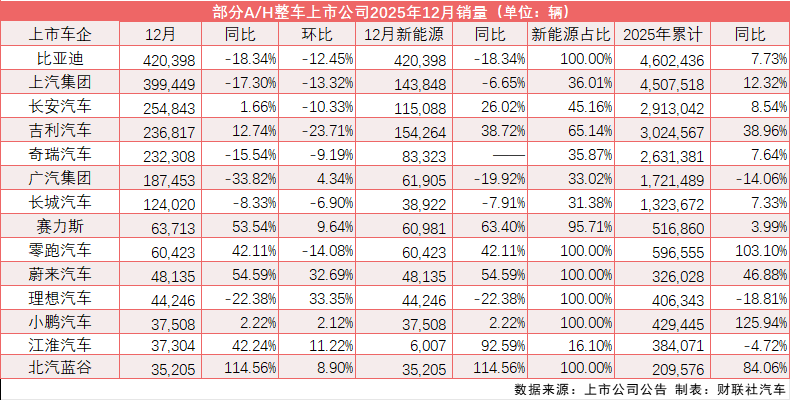

Following major automakers successively releasing their December 2025 sales data, the 2025 auto market successfully concluded. The chart below, compiled by a Cailian Press reporter, shows the sales figures for December 2025 and the full year 2025 for 14 A/H-share listed automakers, as follows:

In December 2025, domestic EV leader BYD led with sales of 420,398 units, down approximately 18.2% YoY; its cumulative sales for 2025 exceeded 4.602 million units, up 7.73% YoY. Among these, pure EV sales reached 2.257 million units, up 27.86% YoY, allowing BYD to overtake Tesla for the first time and become the global pure EV sales champion; cumulative plug-in hybrid sales were 2.289 million units, down 7.91% YoY.Previously, BYD had set a 2025 sales target of 4.6 million units, which it has now exceeded.

For the full year, Tesla's global cumulative deliveries in 2025 were 1.64 million units, a pullback from 1.79 million units in 2024. According to Reuters, Tesla's sales decline in 2025 was mainly due to intensified market competition, the expiration of U.S. EV tax credits, and weakened demand from brand image issues.

Entering the new year, BYD continues its push, launching new variants of the 2026 BYD Qin L DM-i and Qin PLUS DM-i, with the 2026 Qin L DM-i offering a limited-time NEV purchase tax subsidy, starting at a subsidized price of 92,800 yuan.

SAIC followed BYD with sales of 4.507 million units, up 12.32% YoY, showing a significant rebound. Its NEV transition, upgrades of proprietary brands, and overseas market expansion were cited as three key drivers for this sales growth.

Among new automakers, Leapmotor emerged as the final "winner" of 2025 among new automakers. Since March 2025, its sales consistently ranked first among new automakers, achieving nine consecutive months of leading monthly sales and exceeding 70,000 units for two consecutive months, with full-year deliveries of 597,000 units, up 103.1% YoY, setting a new annual sales record for new automakers.

It is worth mentioning that Leap Motor previously set a sales target of 500,000 units for 2025,and as early as November 15, it had already achieved this target ahead of schedule, 45 days early.Leap Motor Chairman Zhu Jiangming set a higher goal for 2026, aiming to reach 1 million units.

In December 2025, NIO ranked second among new automakers with 48,135 units, up 42.11% YoY; for the full year 2025, it achieved total sales of 326,000 units, up 46.88% YoY. It is reported that NIO's previously set sales target was 440,000 units, with a final achievement rate of 74.1%. NIO Chairman Li Bin stated that the company's sales target for 2026 is to maintain steady growth at a rate of 40%-50% and improve the quality of growth. With NIO's cumulative sales of approximately 326,000 units in 2025, its sales target for 2026 is calculated to be 456,000-489,000 units.

Moreover, Li Bin mentioned during the Q3 2025 earnings call that the company's operational goal for 2026 is to achieve full-year profitability. He also noted that the halved purchase tax on NEVs in 2026 would have a relatively small impact on NIO, "because the battery price deducted under the BaaS leasing scheme is not included in the tax base, which gives us some relative advantage. As for how to respond to market changes next year, we will adopt flexible strategies based on the overall market situation."

XPeng Motors ranked third in the 2025 sales ranking among new automakers, with full-year deliveries of 429,000 units, up 125.94% YoY; in December 2025, it delivered 37,508 new units, up 2.22% YoY.It is reported that XPeng Motors' previously set sales target for 2025 was 380,000 units, and it also achieved its annual sales target ahead of schedule in November 2025.

Entering 2026, XPeng Motors is also going all out. On January 8, XPeng Motors launched four new models. XPeng Motors CEO He Xiaopeng stated at the launch event that all four new models would be equipped with the company's second-generation VLA (Vision-Language-Action) large model. He Xiaopeng claimed that this is the industry's first physical world large model capable of initial L4-level functionality. In 2026, XPeng will see the implementation and mass production of physical AI, begin operating Robotaxi, and mass-produce humanoid robots and flying cars.

Li Auto delivered a total of 406,000 new units in 2025, with a slight decline YoY; in December 2025, it delivered 44,246 new units, down 22.38% YoY. It is reported that Li Auto's previous sales target was 640,000 units, with a final achievement rate of 63.44%.

On January 9, Li Auto i8 launched a limited-time financial policy featuring "0 interest" and "0 down payment"! Users who lock in orders for the Li Auto i8 from now until January 31 (inclusive) can enjoy a 3-year zero-interest policy, saving up to 18,000 yuan in interest; the down payment starts from 99,800 yuan, with daily payments as low as 220 yuan.

In addition, Li Auto Supercharging Stations provided over 19.53 million charging sessions to all users in 2025, including over 8.71 million sessions for Li Auto users. In 2025, the number of Li Auto supercharging piles grew from over 9,000 at the beginning of the year to over 20,000, and the number of stations increased from over 1,700 to over 3,900.

Xiaomi Auto delivered over 50,000 units in December. Xiaomi CEO Lei Jun previously stated that Xiaomi delivered a total of 410,000 vehicles in 2025,exceeding its annual sales target of 350,000 units set at the beginning of the year as early as November.On January 3, 2026, Lei Jun mentioned that he will devote more effort to the automotive business this year. The delivery target, set neither too high nor too low, is 550,000 units, with the hope of surpassing this figure by the end of 2026.

On January 1, 2026, Xiaomi Auto's official Weibo account announced that customers who place orders before 24:00 on February 28 can enjoy a "3-year zero interest" policy across the entire Xiaomi YU7 series, with a down payment starting from 74,900 yuan and monthly payments as low as 4,961 yuan.

Looking ahead to the passenger vehicle market in January 2026, the China Passenger Car Association (CPCA) predicts that there will be 20 working days in January 2026, one more than the same period last year but three fewer than the 20 working days in December. Since the 2026 Chinese New Year falls on February 16, and considering the early holiday period last year, production and sales time in January this year is relatively ample.

Additionally, it was mentioned that the national vehicle retirement and renewal policy and various local trade-in policies implemented in 2025 to stimulate auto consumption have achieved good results, but the retail growth rate of passenger vehicles turned negative in Q4, contracting by 5%. Some consumers' wait-and-see sentiment towards car purchases intensified towards the year-end, but this also accumulated some momentum for the auto market at the beginning of 2026. Although the subsidy intensity of the 2026 trade-in policy will be gradually reduced, it started earlier compared to last year. Overall, this is conducive to stabilizing consumption expectations and achieving a "good start" in January. Achieving a "good start" in January has been a goal pursued by local governments and automakers for many years. Combined with the impact of the Spring Festival in February, a certain volume of wholesale transfers is expected in January. Considering the current market pre-order model, some enterprises still have a considerable number of orders awaiting delivery. As the beginning of the "15th Five-Year Plan" period and given that this year is a significant one for auto consumption, a slight YoY sales increase is anticipated for January.

2026 Outlook

For 2026, the CPCA stated that the subsidy intensity for commercial vehicle renewal under policy encouragement will remain unchanged, while passenger vehicle retirement and renewal subsidies are estimated to decrease by 20% based on the 2025 structure, and the maximum estimated decline for trade-in subsidies is 30. The growth effect for commercial vehicles in 2026 is expected to be better than that for passenger vehicles. The passenger vehicle market in 2026 is projected to follow a "U-shaped" trajectory—high at the beginning, low in the middle, and high again toward the end—with overall vehicle sales remaining flat compared to the domestic retail volume in 2025. Exports are expected to maintain medium-to-high growth of over 10%, yet domestic destocking pressure remains substantial. As a result, total wholesale sales by passenger vehicle producers are forecast to grow by 1%.

In addition, CAAM stated that in 2026, China’s economic work will adhere to the principles of seeking progress while maintaining stability, improving quality, and enhancing efficiency, with a continued focus on domestic demand. Relevant national ministries and commissions have concentrated on key tasks outlined at the Central Economic Work Conference, seized the time window, and taken proactive and front-loaded measures. The program of large-scale equipment upgrades and consumer goods trade-ins was released by the end of 2025, ensuring a smooth and orderly policy transition. Recently, nine departments, including the Ministry of Commerce, jointly issued the "Notice on Implementing the Green Consumption Promotion Initiative," accelerating the green transformation of development modes and consumption patterns, and fostering new growth points for green consumption during the 15th Five-Year Plan period.With the implementation of these policies, confidence in development is expected to be strengthened, market expectations stabilized, and automobile consumption boosted. In 2026, China’s automotive industry will continue to advance high-quality development, with the overall market maintaining steady operation.

In recent years, the "price war" in the automotive sector has intensified. Amid the government's intensified efforts to curb involutionary competition, the State Administration for Market Regulation held a special press conference on January 9, 2025, on the top ten institutional achievements in the comprehensive regulation of involutionary competition. Zhu Meina, Deputy Director-General of the Standards and Technology Department of the State Administration for Market Regulation, stated at the conference that the administration will further accelerate the development of national standards related to NEVs, lithium batteries, and the PV industry. It will also collaborate with the Ministry of Industry and Information Technology to conduct on-site standard promotion sessions, helping the industry accurately grasp standard content, implement and apply standards in a timely manner, and facilitate the swift and effective adoption of standards, thereby driving high-quality development of PV, lithium-ion battery, and NEV sectors through standardization.

Previously, on December 12, 2025, the State Administration for Market Regulation solicited public comments on the "Compliance Guidelines for Pricing Behavior in the Automotive Industry (Draft for Comment)" (referred to as the "Guidelines"). Subsequently, 11 companies, including BYD, BAIC Group, XPeng Motors, Chery, Great Wall, Changan, Leap Motor, and Seres, responded one after another, committing to optimize price management and compliance systems, eliminate price fraud and unfair competition, and play an exemplary role in the industry.

On the afternoon of January 13, the 2026 annual work conference of the Inter-ministerial Joint Conference on Energy-saving and New Energy Vehicle Industry Development was held in Beijing. The convener of the joint conference, Li Lecheng, Secretary of the Party Leadership Group and Minister of the Ministry of Industry and Information Technology, presided over the meeting and delivered a speech. The meeting thoroughly studied and implemented the spirit of General Secretary Xi Jinping's important instructions and directives, followed the arrangements of the Central Economic Work Conference, summarized the work in 2025 and during the "14th Five-Year Plan" period, discussed and deliberated on the "15th Five-Year Plan for the Development of the Intelligent Connected New Energy Automotive Industry" (hereinafter referred to as the "Plan"), and made arrangements for key tasks in 2026.

The meeting pointed out that the development of NEVs is a major strategic decision made by the Party Central Committee and the State Council, and an important part of China's efforts to build a modern industrial system. Over the past year, all member units resolutely implemented General Secretary Xi Jinping's important instructions on promoting the high-quality development of the automotive industry, worked together with close coordination, and promoted the industry to develop towards new and better directions. During the "14th Five-Year Plan" period, the entire industry faced challenges head-on and worked hard, completing all tasks under the "14th Five-Year Plan" beyond expectations. China's NEV market size increased by 3.6 times, automotive exports surged to rank first globally, the cost of individual power batteries decreased by 30%, their lifespan increased by 40%, and their charging rate improved by more than threefold, further enhancing international competitive advantages. In addition, the meeting also emphasized that it is necessary to further expand automobile consumption, advance the trade-in policy for automobiles, promote the large-scale application of new energy heavy trucks, deepen the reform of NEV insurance, and stimulate diverse consumption potential.

In addition, on January 14, the No.1 Equipment Industry Department of the Ministry of Industry and Information Technology, the Industrial Development Department of the National Development and Reform Commission (NDRC), and the Price Supervision, Inspection and Anti-Unfair Competition Bureau of the State Administration for Market Regulation (hereinafter collectively referred to as the three departments) jointly held a symposium with enterprises in the NEV industry to arrange work related to regulating the competitive order of the NEV industry. Relevant responsible comrades from the Equipment Industry Development Center of the Ministry of Industry and Information Technology, CAAM, and 17 key automakers attended the meeting.

The meeting required thorough implementation of the decision-making arrangements of the Party Central Committee and the State Council, adhering to innovation-driven development and quality first principles, resolutely resisting disorderly "price wars", and promoting the establishment of a market order featuring high quality and fair competition. The three departments will further strengthen work coordination, enhance cost investigations and price monitoring, increase supervision and law enforcement efforts, strengthen supervision and inspection of product production consistency, and deal seriously with non-compliant enterprises in accordance with laws and regulations to maintain a fair and orderly market environment and promote the high-quality development of the automotive industry.