SMM January 12 News,

Key Points: In 2025, China's iron phosphate industry entered a phase of structural tight balance. The total designed capacity is expected to reach 5.6 million mt by year-end, but effective capacity will fall short of 5 million mt. The market is supported by both the "external sales" model (54%) and the "integrated" model (46%), with top-tier enterprises such as Brunp, Tinci, and CNGR dominating the supply landscape. Entering 2026, as companies like Guizhou Yayou shift toward internal supply, new capacity releases lag, and key raw materials such as sulfur and ferrous sulphate face tightening supply, the industry will confront more severe supply pressures and cost challenges. Iron phosphate prices are expected to remain above 12,000 yuan/mt, with enterprises operating at break-even to marginal profitability.

I. Evolution of the External Sales Iron Phosphate Supply Landscape

1. Current Status of Major External Sales Enterprises

Iron phosphate enterprises currently engaged in external sales mainly include Guizhou Anda, Guizhou Yayou, Chaocai, Guizhou Phosphate Chemical, Brunp Recycling, and Hubei Xingfa. Among them:

Guizhou Anda adopts a flexible strategy of "partial external sales + significant external purchase"

Guizhou Yayou and Brunp Recycling will significantly reduce their external sales proportion in 2026, shifting toward internal consumption

2. 2025 Supply Tier Analysis

Tier 1 (>200,000 mt): Brunp Recycling leads in production and will substantially increase its internal supply proportion in the future

Tier 2 (100,000-200,000 mt): Includes Tinci Materials, CNGR, and Guizhou Yayou

Yayou will gradually reduce external sales in H2, focusing on supplying its parent company Youshan's LFP plants (three major bases in Ordos, Hohhot, and Yulin)

Tier 3 (50,000-100,000 mt): Features a relatively large number of enterprises and intense competition

3. Market Structure Characteristics

The iron phosphate market in 2025 exhibited a distinct dual-track characteristic:

"External Sales" Model: Accounting for 54%, it constitutes the core supply in the circulation market

"Integrated" Model: Accounting for 46%, enterprises use self-produced iron phosphate for their own cathode production lines

Some integrated enterprises, due to large LFP capacity or high self-production costs and single product offerings, have actually increased their external purchase proportion, creating a two-way flow market characteristic.

II. 2026 Supply Situation: Dual Highlighting of Capacity Constraints and Cost Pressure

1. Significant Lag in Capacity Release

The total industry designed capacity is projected to reach 5.6 million mt by the end of 2025, but actual effective capacity will be less than 5 million mt due to multiple constraints:

Delayed Capacity Release: New capacity requires 3-6 months for ramp-up and customer validation cycles

Product Iteration Cycle: Meeting market demand upgrades requires adjustment periods of over 3 months

Low Capacity Utilization Rate: Affected by industry-wide challenges such as complex process control, high customization requirements, and difficulty in improving yield rates, most enterprises struggle to achieve their designed capacity in actual production

New capacity additions in 2026 are primarily concentrated in H2, offering limited contribution to that year's output, with substantive impact delayed until 2027.

2. Persistent Increase in Raw Material Cost Pressure

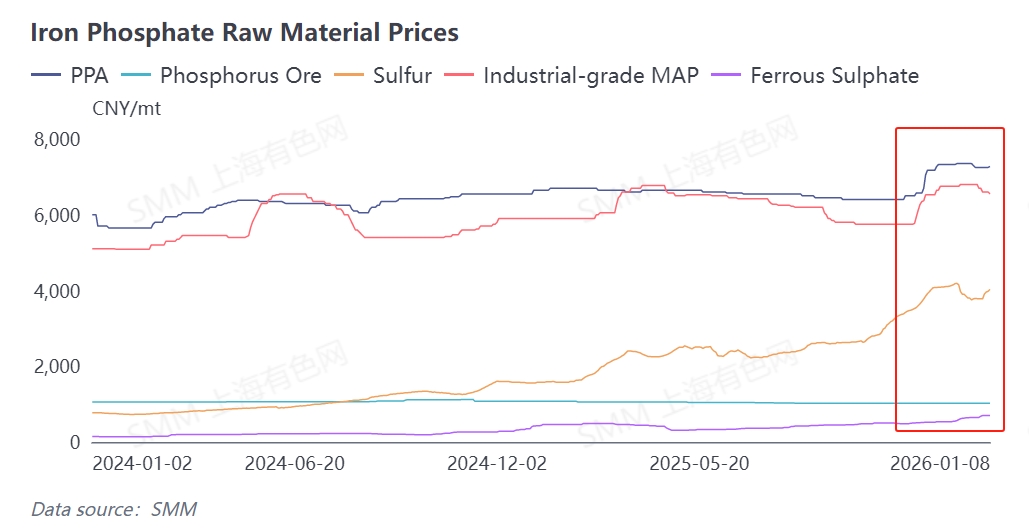

The cost side in 2025 showed a pattern of "stable first half, rising second half," with significant price increases for key raw materials from year-end into early 2026:

Key raw materials include phosphorus source and iron source. Sulfur, a key raw material for phosphorus source production, saw substantial price increases, directly driving up the cost of phosphorus sources (phosphoric acid, industrial-grade MAP). Ferrous sulphate, the main iron source, faced tight supply and rising prices, pushing up production costs for ammonium-method and sodium-method iron phosphate. Phosphate ore prices fluctuated relatively little throughout the year, becoming a relatively stable factor on the cost side.

Cost pressure will intensify further in 2026:

Continued Tight Sulfur Supply: The global sulfur tightness persists, keeping sulfuric acid prices high

Reduced Ferrous Sulphate Supply: The titanium dioxide industry is cutting production due to high sulfur costs and weak demand, leading to tighter supply of the by-product ferrous sulphate

Sharpening Supply-Demand Imbalance: Iron phosphate demand is in a growth phase, while ferrous sulphate raw material supply is in a decline phase

III. Supply-Demand Characteristics: Price and Profitability Outlook Under Tight Balance

1. 2025 Supply-Demand Tight Balance

Demand Side: Sustained strength from the NEV sector (increased penetration rate of LFP car models) and the ESS market (growth in installations of LFP ESS batteries)

Supply Side: External sales capacity and integrated capacity are expanding simultaneously, but there is a risk of imbalance between the supply pace and downstream procurement demand

2. 2026 Supply-Demand Forecast and Price Outlook

Demand: Forecasted LFP production of 5.5-5.6 million mt, with liquid-phase process, ferrous oxalate process, and iron oxide red process accounting for 20%, corresponding to an iron phosphate demand of approximately 4.5 million mt.

Supply Capability: 5 million mt capacity operating at 80-90%, yielding actual production of about 4-4.5 million mt.

Supply-Demand Relationship: Maintains a tight balance

Price Trend: The per-mt price is expected to remain above 12,000 yuan

Profitability: Iron phosphate enterprises will operate at break-even to marginal profitability

IV. Conclusion and Outlook

The iron phosphate industry will face the dual tests of structural transformation and cost-side challenges in 2026:

Supply Landscape: Top-tier external sales enterprises are shifting toward internal supply, contracting supply in the circulation market.

Capacity Release: New capacity additions are concentrated in H2, offering limited contribution to the year's output.

Cost Pressure: Tight supply of key raw materials such as sulfur and ferrous sulphate is pushing up production costs.

Price Increase: Under tight balance conditions, iron phosphate prices will receive strong support.

**Note:** For further details or inquiries regarding solid-state battery development, please contact:

Phone: 021-20707860 (or WeChat: 13585549799)

Contact: Chaoxing Yang. Thank you!