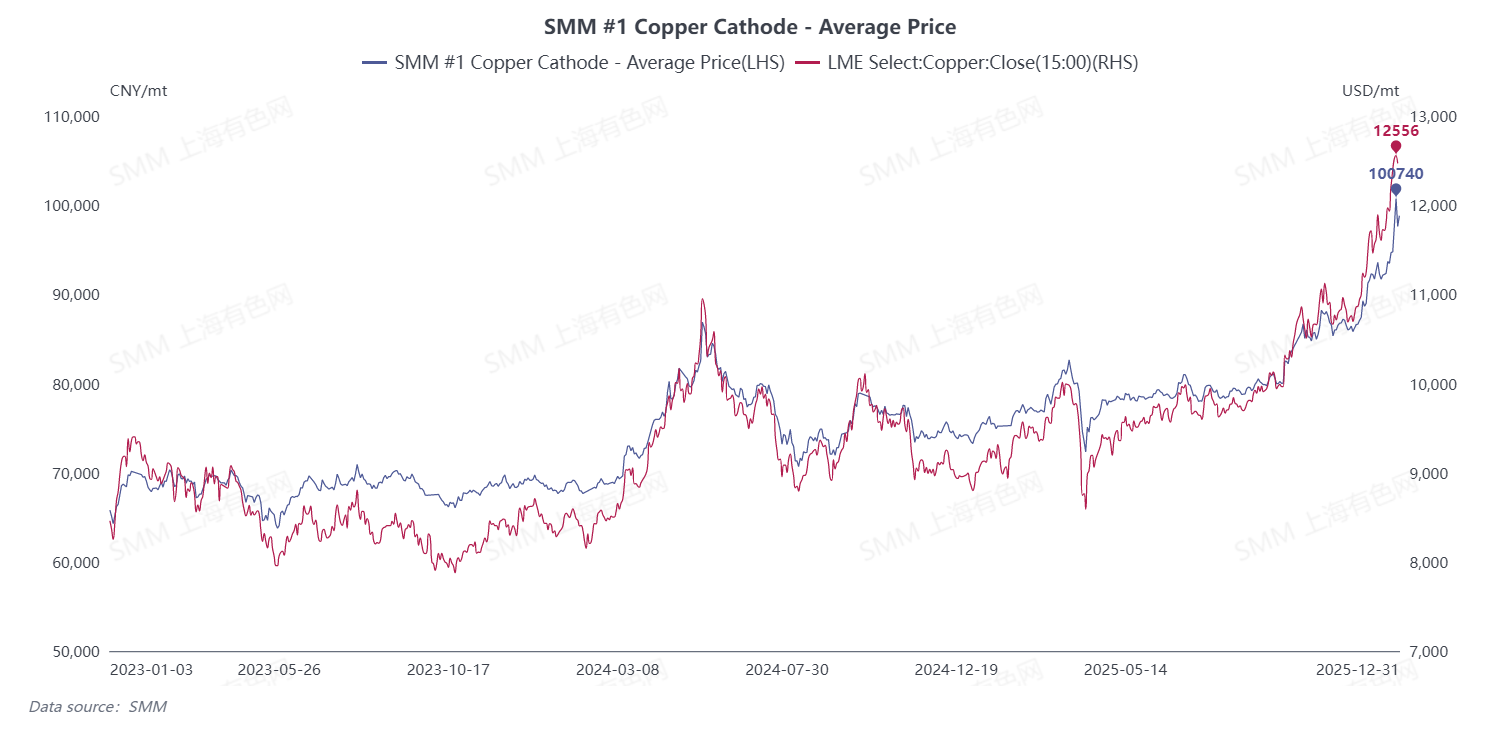

Recently, copper prices have continued to fluctuate at highs, with LME copper once hitting a historical peak of $12,960/mt, and SHFE copper also breaking through the key level of 100,000 yuan/mt. However, the rising copper prices have had a significant impact on demand, as domestic copper cathode consumption has shown notable weakness. Through intensive communication with copper processing enterprises, SMM found that the suppressive effect of high copper prices on downstream demand has fully emerged. Operating rates in copper processing sectors such as copper rod, copper plate/sheet and strip, copper pipe & tube, and brass billet have generally declined, order sizes have significantly contracted, and domestic copper cathode social inventory has accelerated its accumulation, continuously highlighting the supply-demand imbalance in the market.

High copper prices, combined with year-end financial settlement pressures, created a compounding effect. Domestic copper processing enterprises saw both production willingness and downstream demand weaken under pressure, leading to varying degrees of declines in operating rates and order shrinkage across all segments. The specific performance is as follows:

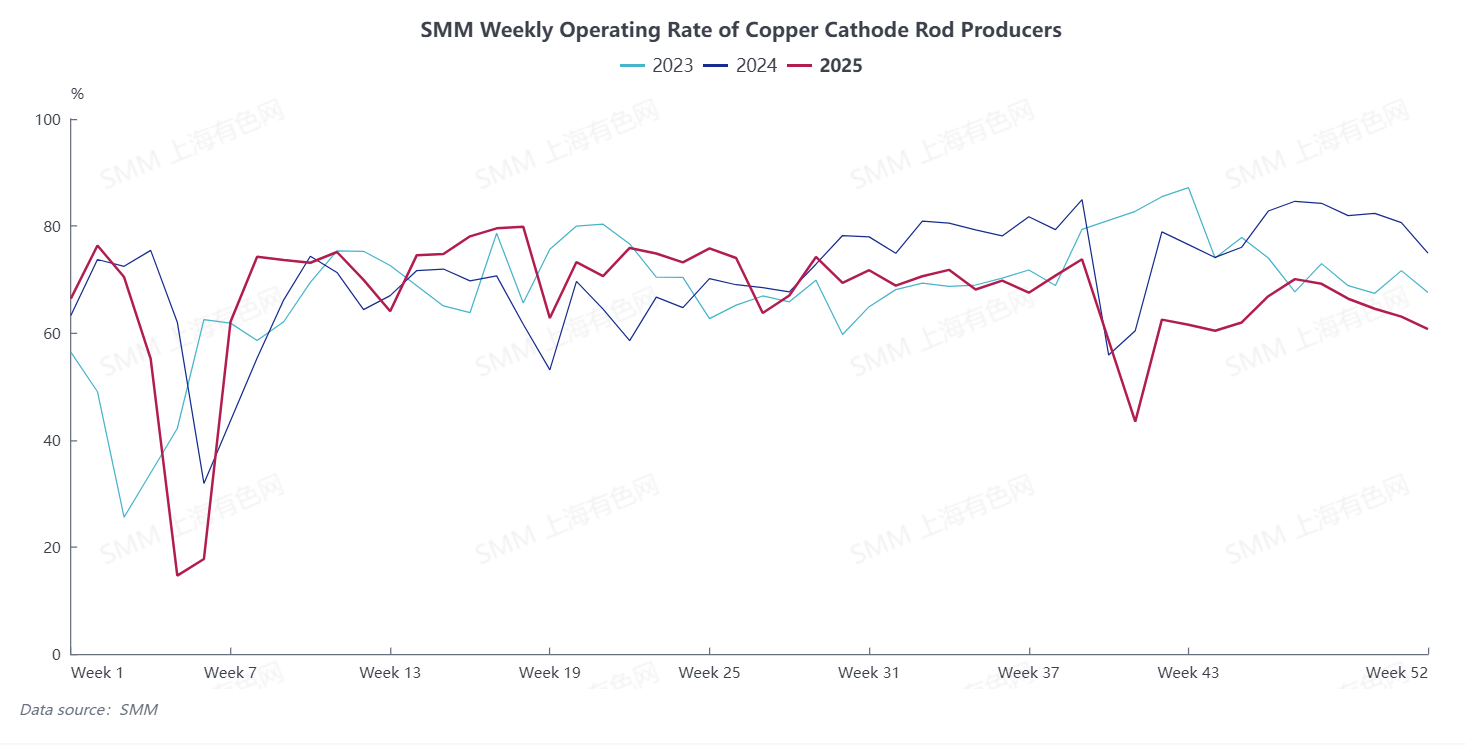

Copper Rod: Operating Rate Plunged Below 50%! Weak Demand and New Year Holiday Production Cuts Intensify Industry Contraction

The suppression of high copper prices on copper cathode rod market demand continued to deepen, with weak consumption in downstream sectors such as wire and cable, leading to a significant YoY reduction in enterprise orders. Coupled with year-end settlement pressures, copper cathode rod enterprises' willingness to produce was constrained, with some having already reduced or halted production in advance. This week, the average price spread between copper cathode rod and secondary copper rod widened to 2,400 yuan/mt, prompting wire and cable enterprises to switch to secondary copper rods to maintain essential demand, further squeezing demand for copper cathode rods. Weak demand, combined with high levels of finished product inventories and slow turnover, forced copper cathode rod enterprises to cut production. The current operating rate fell to 48.83%, down 17.6 percentage points YoY. Under the dual pressures of high and consolidating copper prices and persistently weak demand, more enterprises planned further production cuts during the New Year holiday. SMM expects the operating rate to pull back to 45.46% WoW next week (January 2 - January 8), with the YoY decline widening to 30.9 percentage points, highlighting the intensified contraction in industry production.

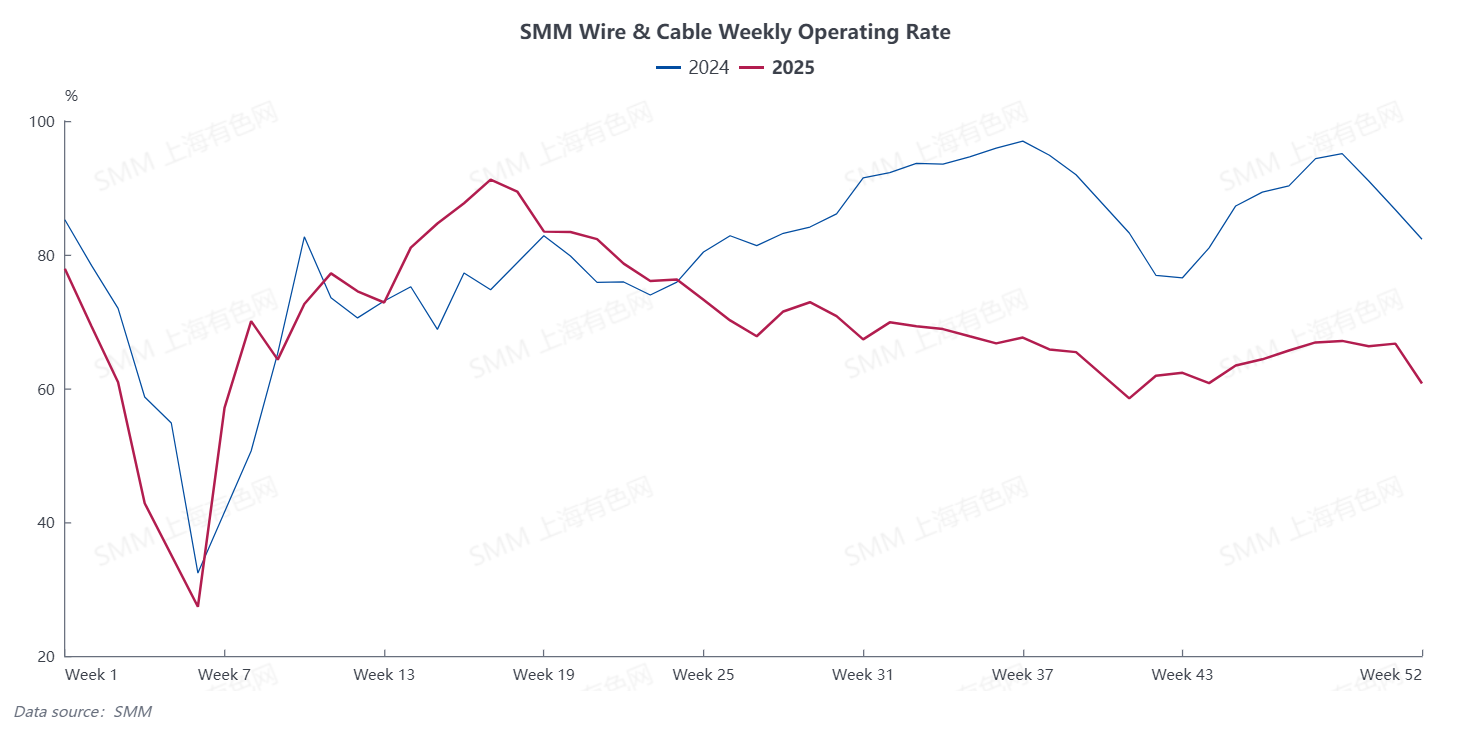

Wires and Cables: Facing Losses! Operating Rate Plunged 18.95 Percentage Points YoY

Persistently rising copper prices significantly dampened downstream purchase willingness, with new orders remaining weak. Coupled with the approaching New Year holiday, most wire and cable enterprises faced inverted pricing between orders on hand and current copper prices, leading to losses upon operation. As a result, they proactively opted for holiday shutdowns to mitigate risks. This week, the industry's operating rate dropped to 58.95%, marking a YoY decline of 18.95 percentage points. Currently, enterprises exhibit a strong wait-and-see sentiment after the holiday, and combined with the holiday impact, the operating rate may further decline to 56.88% next week.

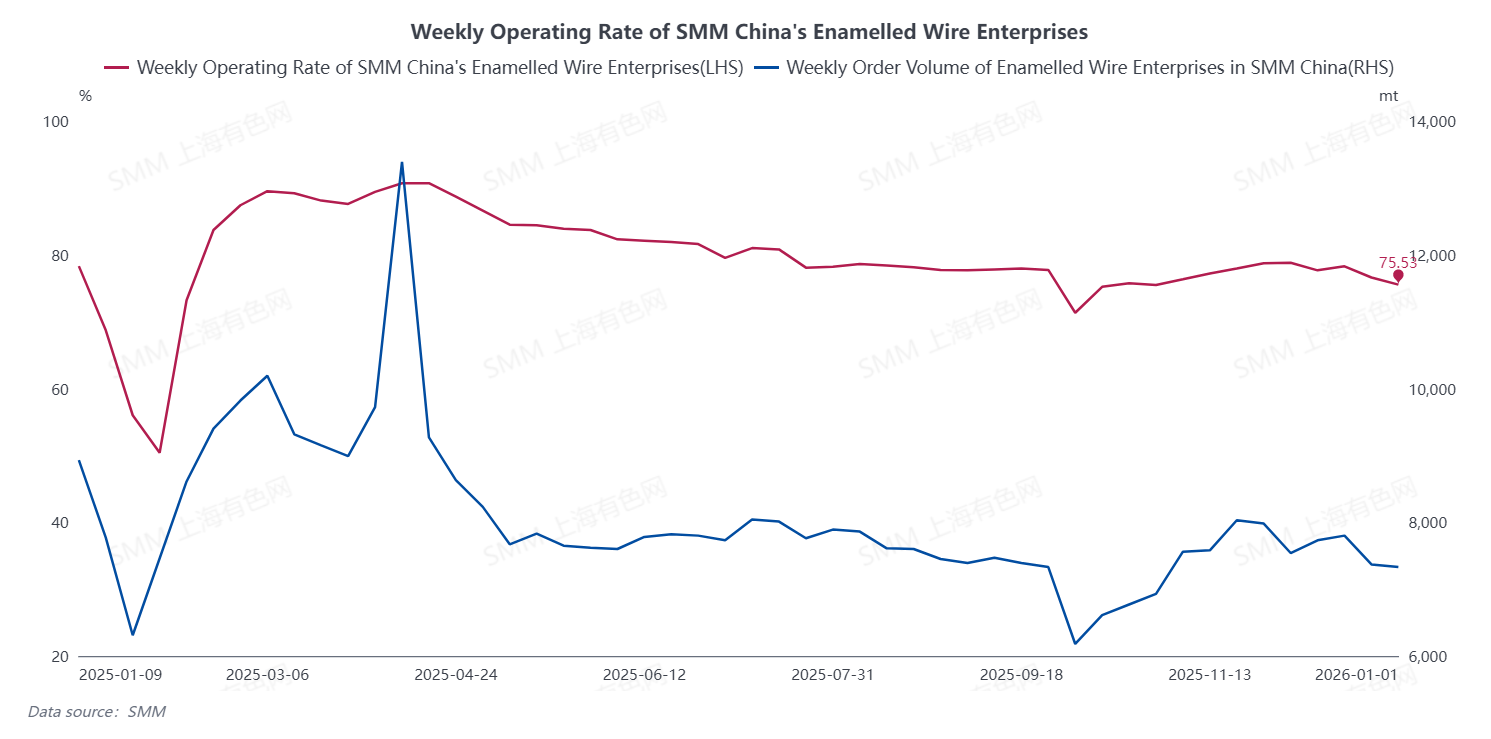

Enamelled Wire: Demand Remains Suppressed! High Copper Prices Drive Three Consecutive Declines in Operating Rates, New Year's Day Production Cuts Add Further Pressure

Enamelled Wire: Demand Remains Suppressed! High Copper Prices Drive Three Consecutive Declines in Operating Rates, New Year's Day Production Cuts Add Further Pressure

The suppressive effect of high copper prices on end-use demand for enamelled wire is also prominent, with enterprise order performance significantly lagging behind the same period in previous years. Approaching year-end, downstream markets already exhibit seasonal characteristics of weak purchase willingness, while copper prices fluctuating at highs further dampen procurement enthusiasm, creating a dual suppression on the demand side. SMM data show that the operating rate in the enamelled wire industry has pulled back continuously from 78.8% at the beginning of the month to 75.53%, highlighting the ongoing demand suppression effect. Currently, some enterprises have clearly planned to cut production during the New Year's Day holiday, and the industry's operating rate is expected to decline further.

Copper Pipe & Tube: Overseas Orders Remain Weak and High Copper Prices Weigh Down Operating Rate for Three Consecutive Weeks of Decline

In December, overseas orders for copper pipe & tube weakened YoY, and combined with the impact of tariffs, overall industry orders performed poorly. Meanwhile, a significant rise in the center of copper prices further exacerbated weak demand. Enterprise orders declined noticeably, and the operating rate has fallen for three consecutive weeks, dropping to 67.26% in the latest week. Some enterprises, facing high finished product inventories, planned a three-day holiday during the New Year's Day period to digest inventories. The industry's operating rate is expected to decline further next week. Additionally, after copper prices broke through the 100,000 yuan/mt mark, the home appliance industry collectively promoted the use of aluminum as a substitute for copper to cope with cost pressure. Although large-scale substitution has not yet occurred, this trend has raised market concerns about copper demand.

Copper Plate/Sheet and Strip: Order Decline Coupled with Funding Pressure Leads Enterprises to Proactively Reduce Production and Control Inventory

The recent surge in copper prices significantly weakened purchase willingness in the downstream market for copper plate/sheet and strip. Enterprises saw a noticeable decline in new orders received, forcing a slowdown in production pace. This week, the industry's operating rate was recorded at 68.39%. In terms of order structure, new order follow-up is currently weak, with orders for copper strip and brass strip declining particularly noticeably. Some enterprises have seen order declines reach 20% YoY. Furthermore, against the backdrop of high copper prices, enterprises' capital occupation costs have risen sharply. To alleviate funding pressure, enterprises generally maintain raw material inventory at low levels. Currently, most enterprises plan to reduce material input and lower production during the New Year's Day holiday to cope with weak market demand and funding turnover pressure.

Brass Billet: Operating Rate Drops to 48.52%, Demand in Traditional Sectors Nearly Stagnant

Affected by the continued upward fluctuation of copper prices, the downstream market for brass billet exhibits strong wait-and-see sentiment. Enterprises generally face insufficient new orders, and current production largely relies on previous orders for support. However, for some enterprises, previous orders are nearing completion, leaving a significant gap in subsequent production momentum. This week, the operating rate for the brass billet industry fell to 48.52%. Market orders show significant divergence: only during periodic declines in copper prices are there small releases of rigid demand orders from emerging sectors like new energy and connectors. In contrast, demand from the traditional bathroom hardware industry is extremely weak, with most enterprises seeing new order volumes halved, and some even reporting zero new orders. Additionally, influenced by high and volatile copper prices and increased market demand uncertainty, enterprise inventory strategies have become more conservative. Both raw material and finished product inventories are maintained at low levels, with enterprises hesitant to increase stockpiling rashly. Overall industry operations lean towards caution.

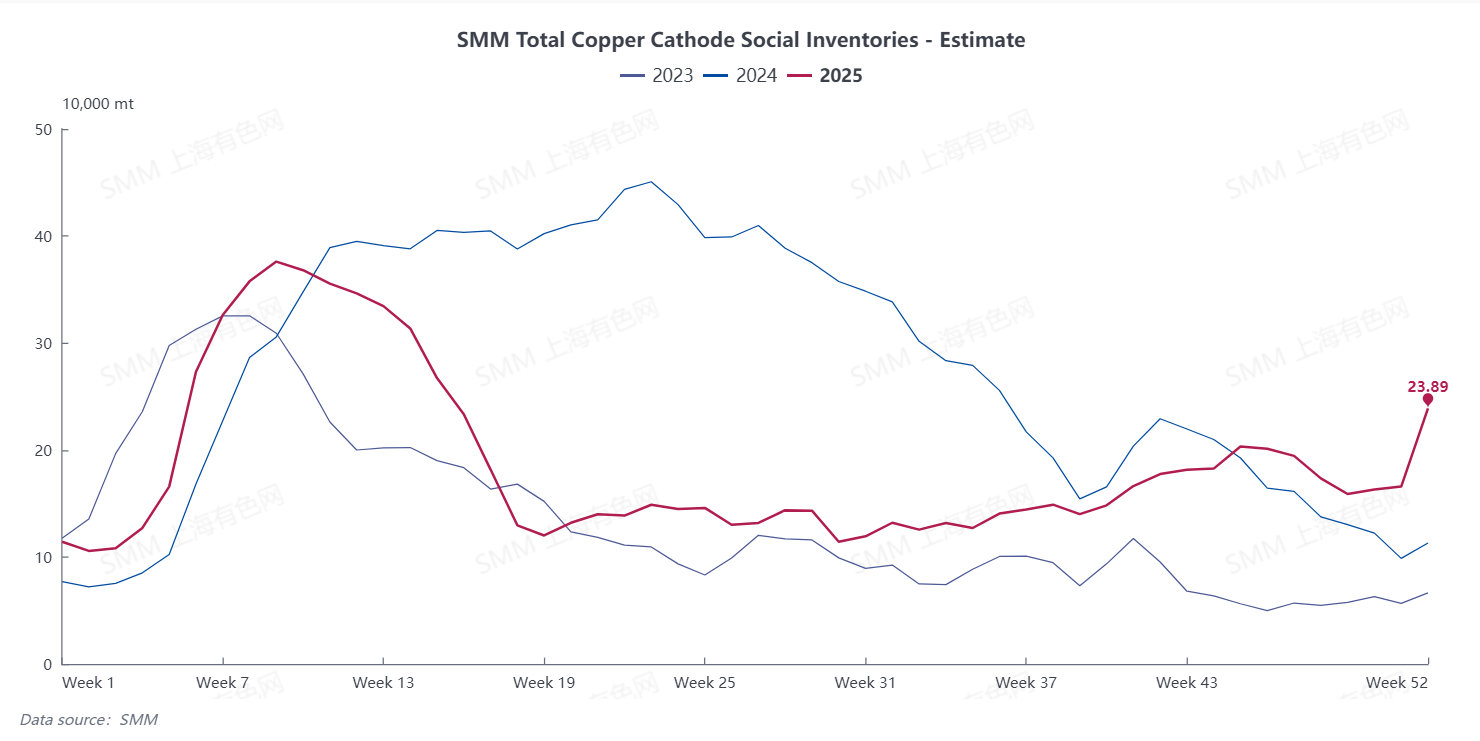

Accelerated Rise in Social Inventory Highlights Weakness in Consumption

Inventory data further confirms the weakness in domestic copper cathode consumption. Currently, affected by price ratio losses, domestic smelters have increased their export efforts. However, even against the backdrop of rising exports and declining imports, the domestic copper cathode social inventory continues to show a rapid upward trend. According to SMM data, the domestic copper cathode social inventory surged from 159,000 mt at the beginning of the month to the current 238,900 mt, with an increase of 70,500 mt in the past nine days, indicating a significant short-term inventory growth. The rapid inventory accumulation fully reflects the insufficient downstream consumption capacity, and the weakness on the demand side has become one of the core contradictions in the current copper market.

Comprehensively, the current domestic copper market has formed a typical supply-demand imbalance pattern characterized by "high prices, weak demand, and high inventory." This round of high copper prices, fluctuating at highs, has significantly deviated from fundamental support, imposing unbearable operational pressure on processing enterprises. The soaring cost of raw materials cannot be quickly passed on to end-users, coupled with weak downstream demand. Enterprises dare not rashly raise prices for fear of losing orders, yet must endure the profit squeeze from rising raw material costs. Many enterprises have fallen into the dilemma of "operating at a loss." Under the dual pressure of high copper prices, the decline in operating rates and contraction in orders among processing enterprises have formed a negative feedback loop. The industry will face more severe operational challenges in 2026.

Comprehensively, the current domestic copper market has formed a typical supply-demand imbalance pattern characterized by "high prices, weak demand, and high inventory." This round of high copper prices, fluctuating at highs, has significantly deviated from fundamental support, imposing unbearable operational pressure on processing enterprises. The soaring cost of raw materials cannot be quickly passed on to end-users, coupled with weak downstream demand. Enterprises dare not rashly raise prices for fear of losing orders, yet must endure the profit squeeze from rising raw material costs. Many enterprises have fallen into the dilemma of "operating at a loss." Under the dual pressure of high copper prices, the decline in operating rates and contraction in orders among processing enterprises have formed a negative feedback loop. The industry will face more severe operational challenges in 2026.