The National Bureau of Statistics (NBS) and the China Federation of Logistics & Purchasing released China's manufacturing PMI for December today (31st). Data showed that manufacturing market demand was released, enterprise production expanded well, and market prices operated favorably in December. China's manufacturing PMI was 50.1% in December, up 0.9 percentage points MoM, rising into expansion territory, indicating a rebound and improvement in manufacturing. The manufacturing new orders index was 50.8% in December, up 1.6 percentage points MoM. The release of demand and improved policy expectations drove better expansion of manufacturing enterprise production activities, with the production index at 51.7%, up 1.7 percentage points MoM. Besides steady scale expansion, manufacturing also showed positive structural changes. The high-tech manufacturing PMI was 52.5%, up 2.4 percentage points MoM, indicating a significantly accelerated expansion momentum. The consumer goods manufacturing PMI was 50.4%, up 1 percentage point MoM. The manufacturing production and business activity expectations index was 55.5% in December, up 2.4 percentage points MoM, hitting a new high since April 2024. In 2025, supported by positive factors such as macroeconomic policy efforts and the manifestation of domestic economic resilience, China's economy operated with overall stability. The annual average manufacturing PMI was 49.6%, basically flat compared with the full-year 2024 average. It is expected that in 2026, driven by the linkage of multiple positive factors, manufacturing is expected to achieve stable growth with increases.

China Purchasing Managers Index Operation for December 2025

I. China Manufacturing Purchasing Managers Index Operation

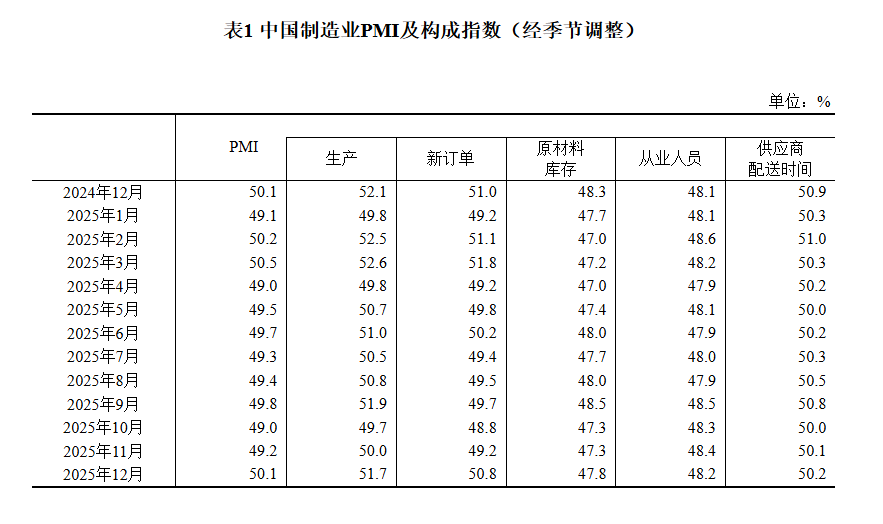

In December, the manufacturing Purchasing Managers' Index (PMI) was 50.1%, up 0.9 percentage points from the previous month, rising into expansion territory.

By enterprise size, the PMI for large enterprises was 50.8%, up 1.5 percentage points from the previous month, above the threshold; the PMI for medium-sized enterprises was 49.8%, up 0.9 percentage points from the previous month, still below the threshold; the PMI for small enterprises was 48.6%, down 0.5 percentage points from the previous month, below the threshold.

By sub-index, among the five sub-indices that constitute the manufacturing PMI, the production index, new orders index, and supplier delivery time index were all above the threshold, while the raw material inventory index and employment index were both below the threshold.

The production index was 51.7%, up 1.7 percentage points from the previous month, indicating accelerated production activities among manufacturing enterprises.

The new orders index was 50.8%, up 1.6 percentage points from the previous month, indicating some improvement in manufacturing market demand.

The raw material inventory index was 47.8%, up 0.5 percentage points from the previous month, indicating a narrowing decline in the inventory of major raw materials in the manufacturing sector.

The employment index was 48.2%, down 0.2 percentage points from the previous month, indicating a slight drop in the employment climate of manufacturing enterprises.

The supplier delivery time index was 50.2%, up 0.1 percentage points from the previous month, indicating that the delivery time of raw material suppliers in the manufacturing sector continued to accelerate.

II. Operation of China's Non-Manufacturing Purchasing Managers' Index

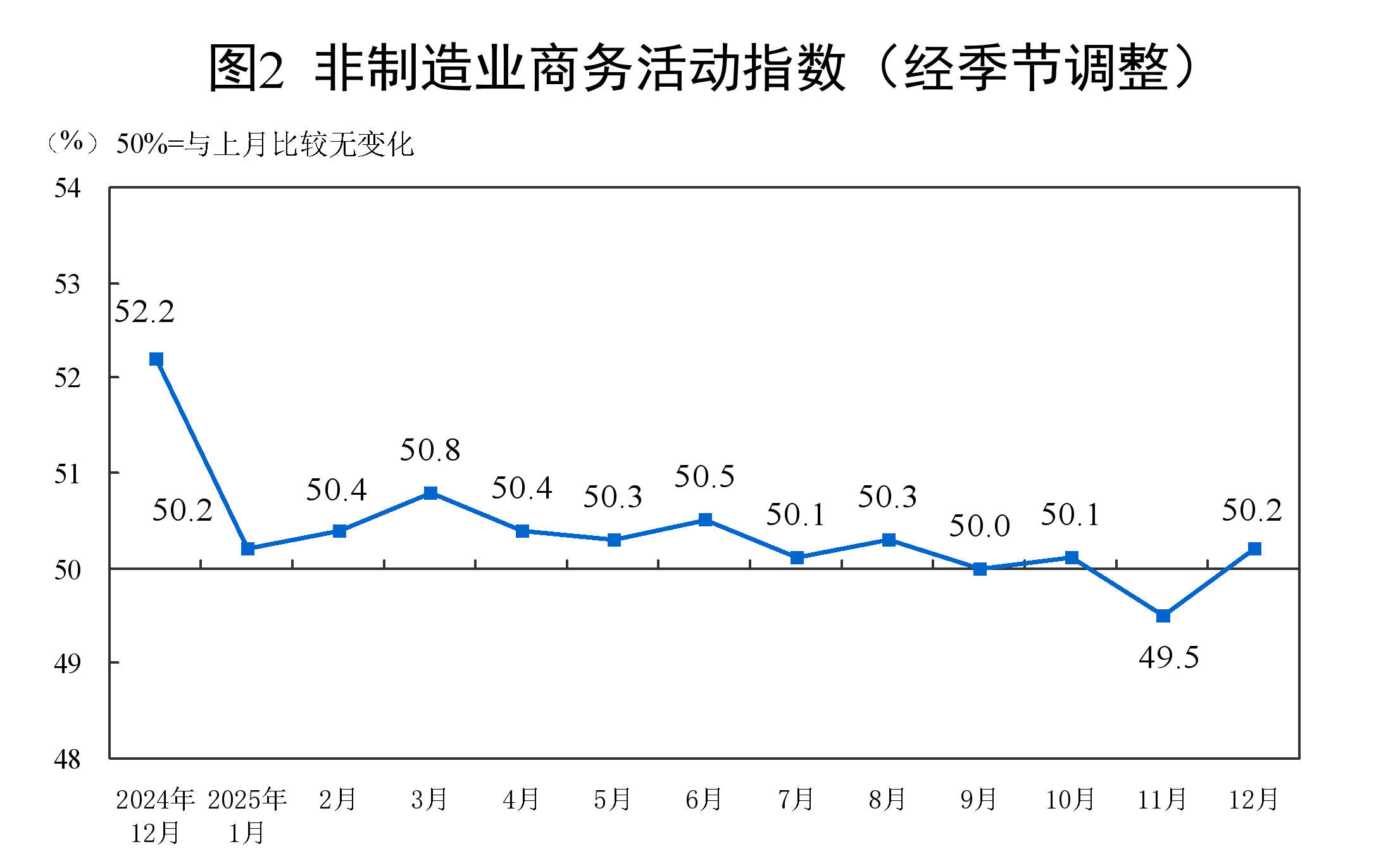

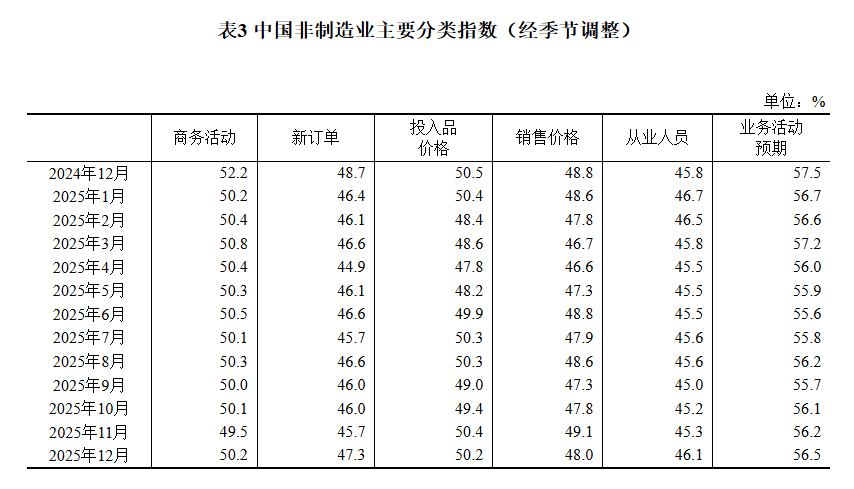

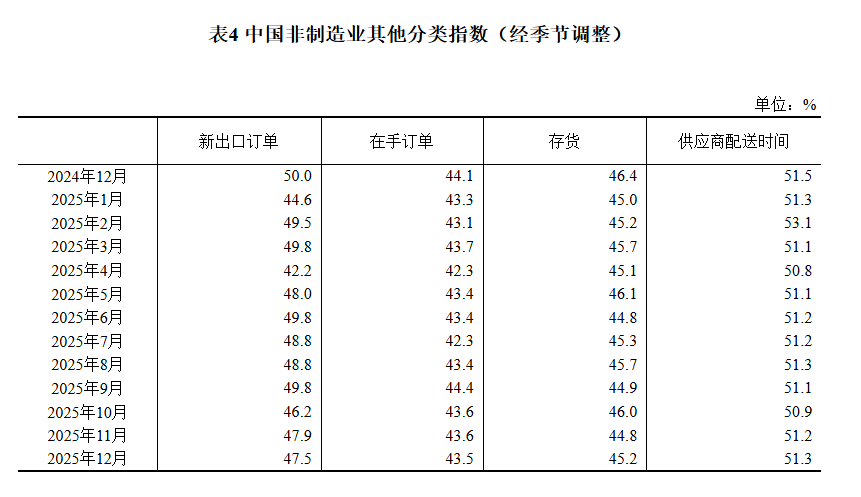

In December, the non-manufacturing business activity index was 50.2%, up 0.7 percentage points from the previous month, returning to expansion territory.

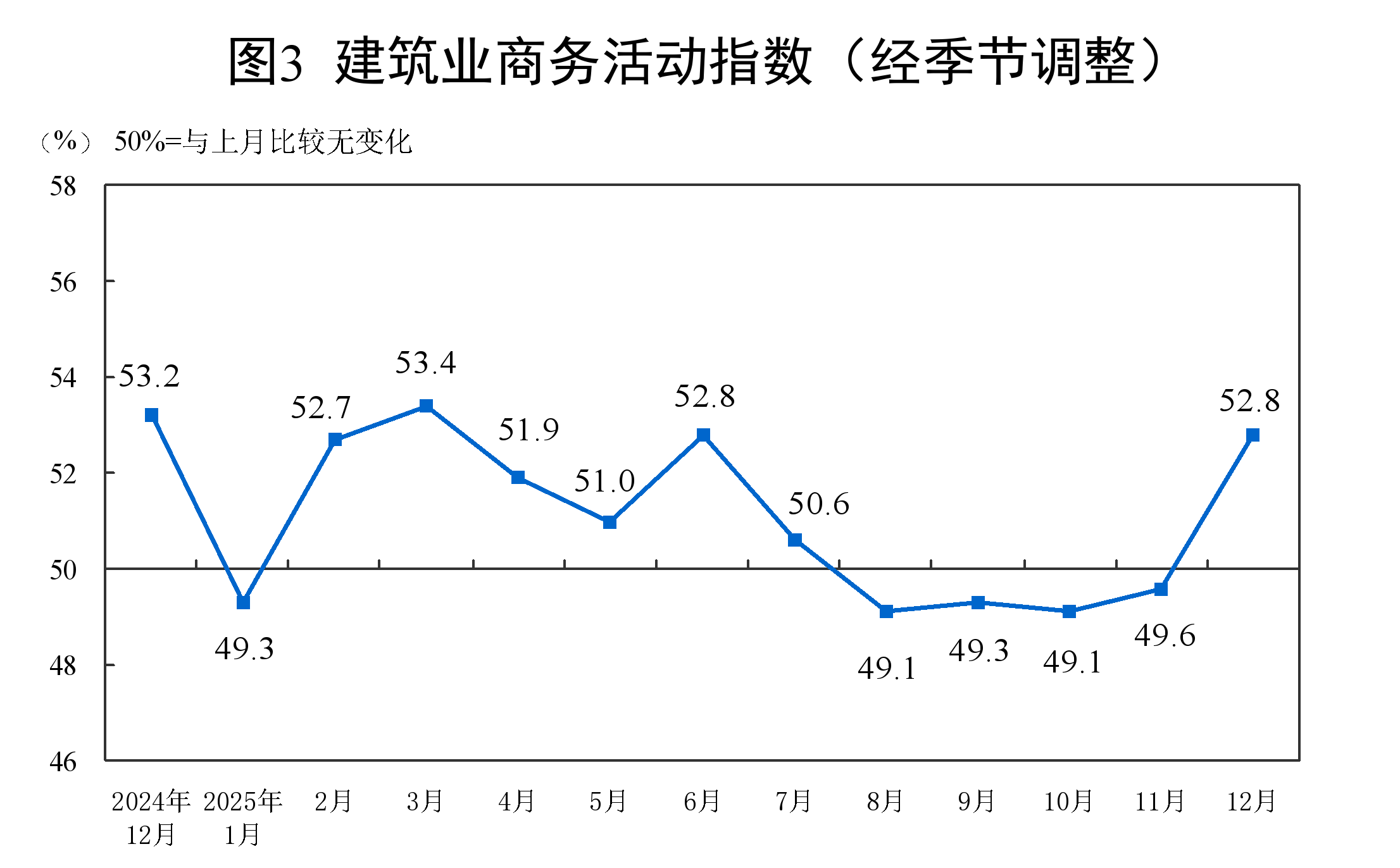

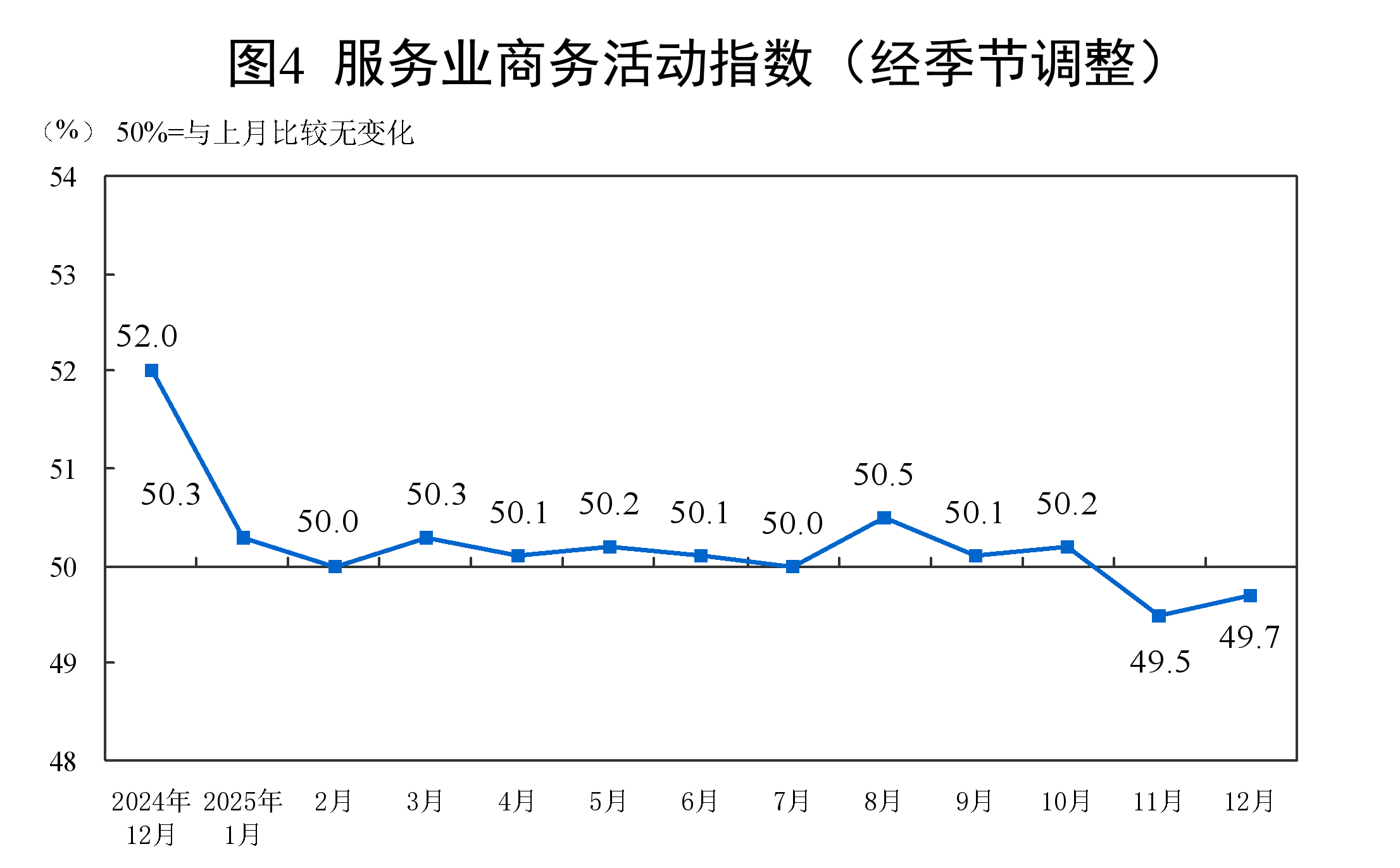

By sector, the business activity index for the construction sector was 52.8%, up 3.2 percentage points from the previous month; the business activity index for the service sector was 49.7%, up 0.2 percentage points from the previous month. In the service sector, the business activity indices for industries such as telecommunications, radio and television, and satellite transmission services, monetary and financial services, and capital market services were all in the high prosperity range above 60.0%; the business activity indices for retail, catering, and other industries were below the threshold.

The new orders index was 47.3%, up 1.6 percentage points from the previous month, indicating a rebound in the demand climate of the non-manufacturing market. By sector, the new orders index for the construction sector was 47.4%, up 1.3 percentage points from the previous month; the new orders index for the service sector was 47.3%, up 1.7 percentage points from the previous month.

The input price index was 50.2%, down 0.2 percentage points from the previous month, still above the threshold, indicating an increase in the overall price level of inputs used by non-manufacturing enterprises for business activities. By sector, the input price index for the construction sector was 50.8%, up 1.1 percentage points from the previous month; the input price index for the service sector was 50.1%, down 0.4 percentage points from the previous month.

The selling price index was 48.0%, down 1.1 percentage points from the previous month, indicating a decline in the overall selling price level of the non-manufacturing sector. By sector, the selling price index for the construction sector was 47.4%, down 1.0 percentage points from the previous month; the selling price index for the service sector was 48.1%, down 1.1 percentage points from the previous month.

The employment index was 46.1%, up 0.8 percentage points from the previous month, indicating a rebound in the employment climate of non-manufacturing enterprises. By sector, the employment index for the construction sector was 41.0%, down 0.8 percentage points from the previous month; the employment index for the service sector was 47.0%, up 1.1 percentage points from the previous month.

The business activity expectations index was 56.5%, up 0.3 percentage points from the previous month, indicating that non-manufacturing enterprises' overall confidence in market development continues to strengthen. By industry, the construction sector's business activity expectations index was 57.4%, down 0.5 percentage points from the previous month; the services sector's business activity expectations index was 56.4%, up 0.5 percentage points from the previous month.

III. Operation of China's Composite PMI Output Index

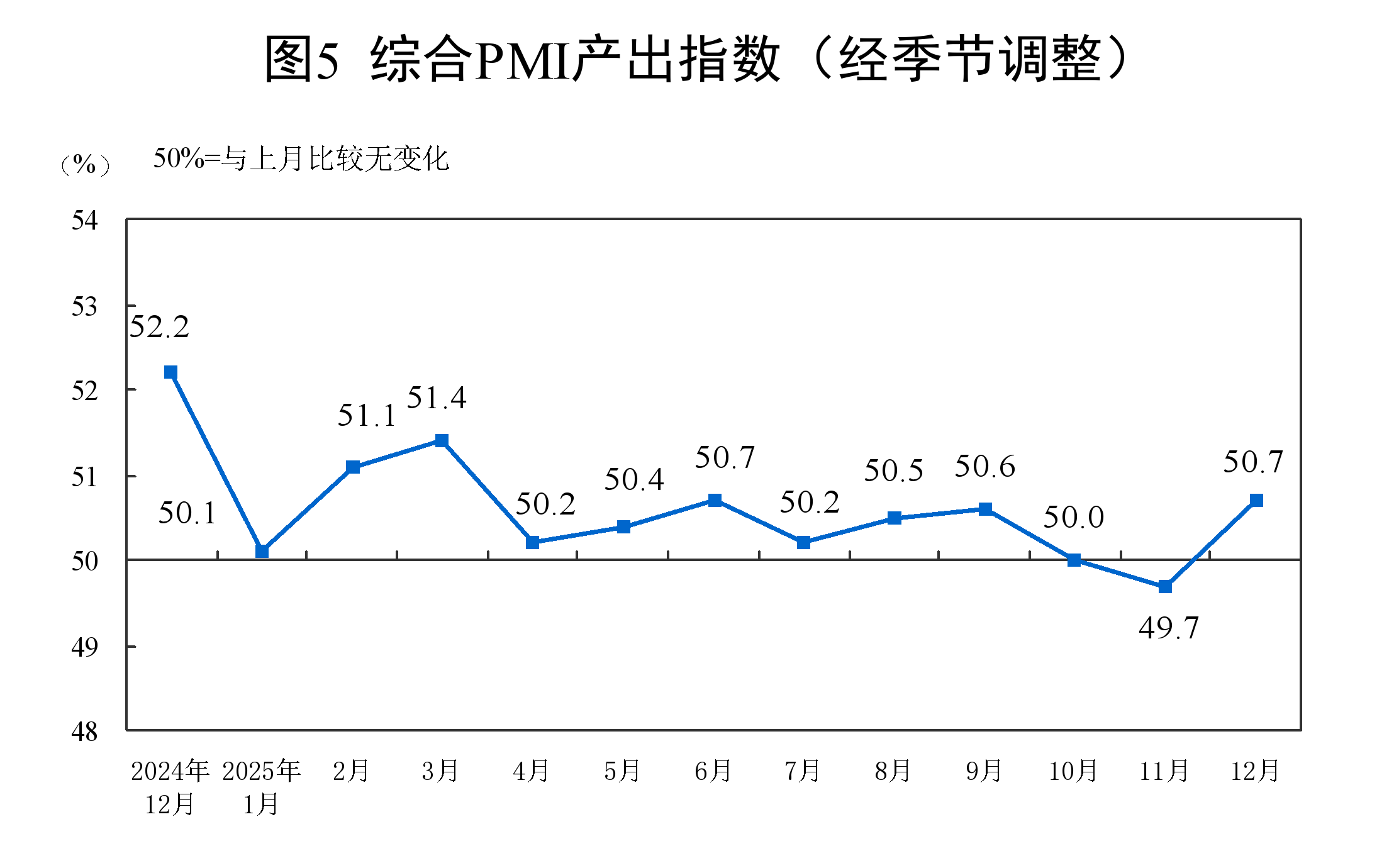

In December, the composite PMI output index was 50.7%, up 1.0 percentage point from the previous month, indicating that China's enterprise production and business activities expanded overall compared to the previous month.

In December, all of China's purchasing managers' indices rose to the expansion territory

—Interpretation by Huo Lihui, Chief Statistician of the NBS Service Survey Center, on China's Purchasing Managers' Index for December 2025

On December 31, 2025, the NBS Service Survey Center and the China Federation of Logistics and Purchasing released China's purchasing managers' index. In response, Huo Lihui, Chief Statistician of the NBS Service Survey Center, provided an interpretation.

In December, the manufacturing PMI, non-manufacturing business activity index, and composite PMI output index were 50.1%, 50.2%, and 50.7% respectively, up 0.9, 0.7, and 1.0 percentage points from the previous month. All three indices rose to the expansion territory, indicating a general rebound in China's economic prosperity level.

I. The Manufacturing PMI Rises Above the Critical Point

In December, the manufacturing PMI was 50.1%, rising to the expansion territory for the first time since April. Out of the 21 industries surveyed, 16 saw their PMIs rise from the previous month, with related enterprises showing improved production and business conditions.

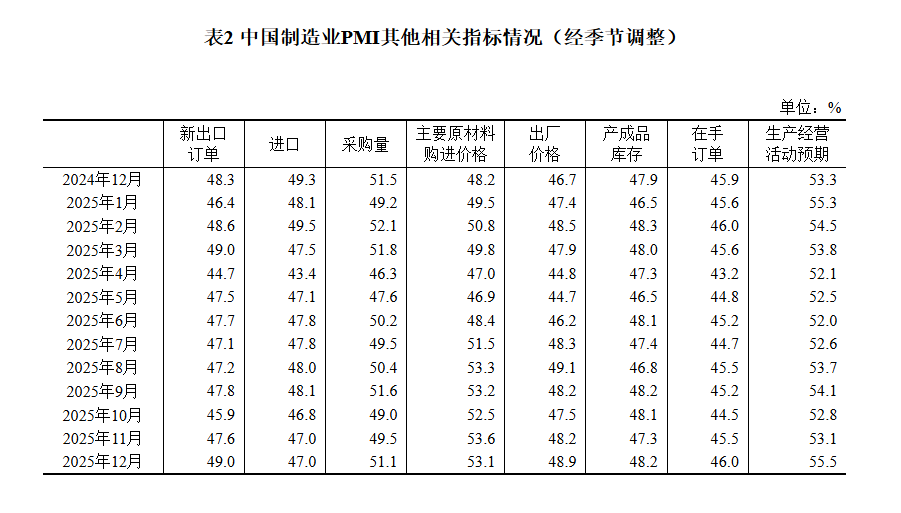

(i) Both supply and demand ends showed a significant rebound. The production index and new orders index were 51.7% and 50.8% respectively, up 1.7 and 1.6 percentage points from the previous month. Notably, the new orders index rose above the critical point for the first time in H2, indicating a clear expansion in both supply and demand ends of the manufacturing sector. By industry, the production and new orders indices for agricultural and sideline food processing, textile and garment, and computer, communication, and electronic equipment sectors were all above 53.0%, with accelerated release at both supply and demand ends. Meanwhile, the two indices for non-metallic mineral products and ferrous metal smelting and rolling processing sectors were below the critical point, suggesting these industries still face certain pressures. Driven by the recovery in manufacturing supply and demand, enterprises sped up their procurement activities, with the procurement volume index rising to the expansion territory at 51.1%.

(ii) The PMI for large enterprises returned to the expansion territory. The PMI for large enterprises was 50.8%, up 1.5 percentage points from the previous month, rising above the critical point; the PMI for medium-sized enterprises was 49.8%, up 0.9 percentage points from the previous month, with an improvement in the prosperity level; the PMI for small enterprises was 48.6%, down 0.5 percentage points from the previous month, with a slight pullback in the prosperity level.

3. PMI of key industries all higher than last month. The PMI for high-tech manufacturing was 52.5%, up 2.4 percentage points from the previous month, indicating a positive growth trend. The PMI for equipment manufacturing and consumer goods industries both stood at 50.4%, rising by 0.6 and 1.0 percentage points respectively, both entering the expansion territory. The PMI for energy-intensive industries was 48.9%, up 0.5 percentage points, with the business climate continuing to rebound.

4. Expectations index rose to a higher prosperity interval. The business activity expectations index was 55.5%, up 2.4 percentage points from the previous month, showing that manufacturing enterprises' confidence in market development continues to strengthen. By industry, driven by factors such as pre-holiday stockpiling, the business activity expectations index for agricultural and sideline food processing, food and beverage refining, and tea industries all rose to above 60.0% in the high prosperity interval, with related enterprises more optimistic about recent industry development.

II. Non-manufacturing business activity index returned to the expansion territory

In December, the non-manufacturing business activity index was 50.2%, up 0.7 percentage points from the previous month, indicating an improvement in the non-manufacturing business climate.

1. Service sector business climate slightly improved. The service sector business activity index was 49.7%, up 0.2 percentage points from the previous month. By industry, the business activity indices for telecommunications, radio, television, satellite transmission services, monetary financial services, and capital market services were all above 60.0% in the high prosperity interval, with rapid growth in total business volume; the retail and catering industries' business activity indices were in the contraction territory, with a lower business climate. In terms of market expectations, the service sector business activity expectations index was 56.4%, up 0.5 percentage points from the previous month, indicating enhanced confidence among service enterprises in future market development.

2. Construction sector business climate significantly improved. Affected by higher temperatures in some southern provinces recently and the rush to complete construction projects before the two festivals, the construction sector business activity index was 52.8%, up 3.2 percentage points from the previous month, with a marked improvement in the construction sector's business climate. In terms of market expectations, the construction sector business activity expectations index was 57.4%, remaining in a higher prosperity interval, indicating that construction enterprises are optimistic about recent industry development.

III. Composite PMI output index reached a recent high

In December, the composite PMI output index was 50.7%, up 1.0 percentage point from the previous month, indicating that China's enterprise business activities expanded overall compared to the previous month. The manufacturing production index and non-manufacturing business activity index, which make up the composite PMI output index, were 51.7% and 50.2% respectively.