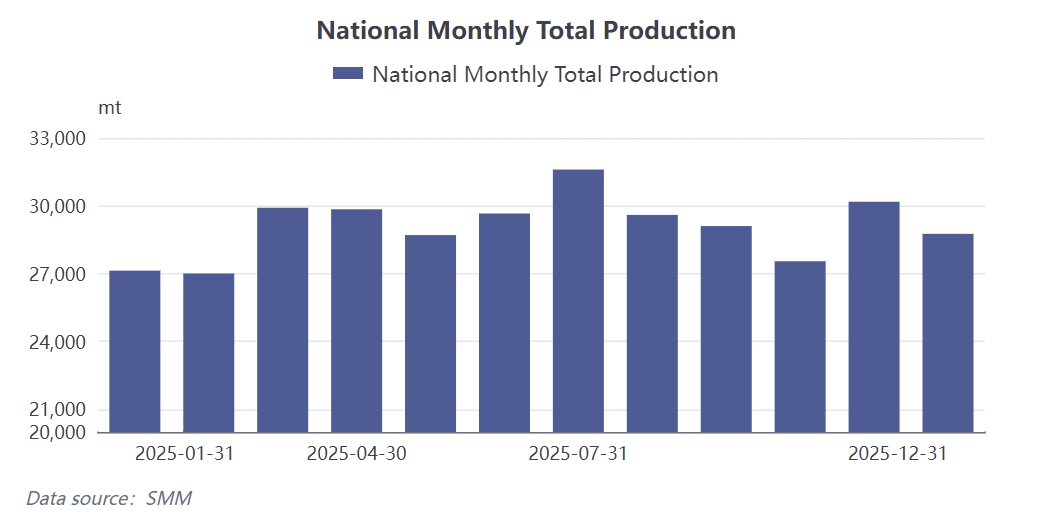

SMM News: According to statistics from SMM, China's NdFeB blank production reached approximately 28,700 mt in December 2025, with the average industry operating rate maintained at 67.3%, down 5 percentage points MoM. This brought the full-year 2025 NdFeB production to a cumulative total of approximately 330,000 mt. Looking back at 2025, the rare earth magnetic material industry experienced a remarkable year filled with multiple challenges and opportunities. As a critical link connecting upstream rare earth raw materials and downstream end-use applications, magnetic material enterprises faced dual pressures: on one hand, bearing the impact of sharp price fluctuations in key raw materials like Pr-Nd alloy, and on the other hand, confronting persistent cost-reduction demands from end-users, which squeezed profit margins. Meanwhile, policy changes such as export controls also introduced uncertainties to the sector. Amid a complex environment, magnetic material enterprises struggled to survive while actively seeking breakthroughs.

Driven by both cost pressures and policy changes, the rare earth magnetic material industry in 2025 has demonstrated significant technological innovation and structural evolution. To address Pr-Nd price fluctuations, advanced processes such as grain boundary diffusion technology and heavy rare earth-free technology have accelerated their popularization, while substantial progress has been made in the R&D and application of low-cost, high-abundance rare earth magnets like Ce-Fe-B. Through continuous formula optimization and process improvements, top-tier enterprises have effectively reduced the addition of heavy rare earths while maintaining magnetic performance, thereby alleviating cost pressure.

Industry concentration has significantly increased, and the market structure has undergone a profound restructuring. During the phase of relying on low-cost raw material inventory to sustain operations, tail-end enterprises with weak financial strength and insufficient orders accelerated their exit from the market. Data shows that the capacity share of top-tier enterprises rose from 69.5% in January to 73.52% in December, an increase of nearly 4 percentage points. Meanwhile, increasingly transparent blank prices have compressed traders' profit margins, forcing many traders to exit the market. Conversely, top-tier enterprises expanded production against the trend based on strategic needs. For example, JL MAG Rare-Earth plans to build a capacity of 40,000 mt of high-performance rare earth permanent magnets by 2025, further intensifying industry polarization. This "the strong get stronger" pattern has concentrated resources in leading enterprises, enhancing the overall competitiveness of the industry.

Structural Transformation in Application Fields and Accelerated Layout in Emerging Sectors. Against the backdrop of narrowing profit margins in traditional sectors such as neodymium magnets for new energy vehicles, emerging fields including humanoid robots, the low-altitude economy, and industrial automation have become key battlegrounds for magnetic material enterprises. Taking humanoid robots as an example, a single Optimus robot requires over 40 servo motors, with a total NdFeB usage of 2–4 kg, injecting new momentum into magnetic material demand. Top-tier enterprises have taken the lead in collaborating with end-users on R&D, focusing on the high-performance NdFeB permanent magnet sub-market.

Overseas markets are undergoing realignment amid policy adjustments. The rare earth export control policies implemented in 2025 disrupted the export pace of magnetic material enterprises, leading to cargo backlogs at ports and putting pressure on corporate cash flows. In response to these changes, well-funded top-tier enterprises accelerated their efforts to compete for overseas customer resources, exploring new international market strategies within compliance frameworks. As exports of magnetic materials containing no medium-heavy rare earth gradually resumed and products containing medium-heavy rare earth underwent sequential approval, rare earth permanent magnet exports showed signs of recovery, though a return to previous levels remains unlikely in the short term. Against the backdrop of a domestic market slowdown, overseas market expansion will become a key focus for the industry in 2026, representing a long-term contest that tests both corporate strength and patience.

Looking ahead to 2026, the rare earth magnetic material industry is expected to undergo continuous transformation through technological upgrades, structural optimization, and application expansion. Magnetic material enterprises must strike a balance between cost control and product performance, position themselves precisely across traditional and emerging markets, and deploy resources flexibly between domestic and international markets. Only by doing so can they seize the initiative amid the waves of change and secure a promising future.