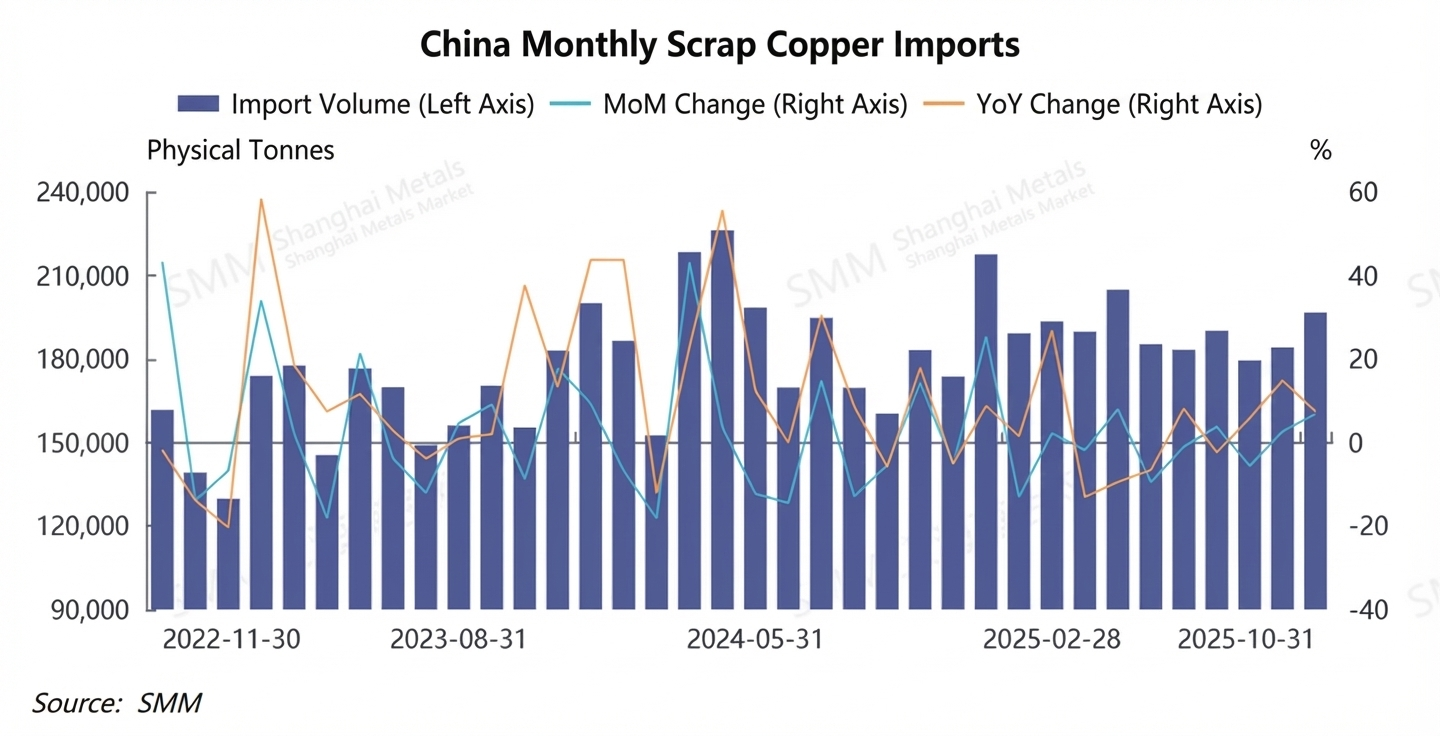

I. Import Scale Analysis: Total Volume Growth and Structural Shifts

According to data from the General Administration of Customs, China's cumulative import volume of recycled copper raw materials reached 1.8956 million physical tonnes from January to October 2025, representing a year-on-year increase of 1.97% and maintaining a relatively stable overall scale. In October 2025, imports saw a significant surge, rising from 179,000 physical tonnes in September to 196,000 physical tonnes. While import volumes had previously declined between May and July due to trade frictions, particularly affecting supply from the United States. The market recovered steadily from August through October. This rebound was primarily driven by disruptions in copper concentrate supply and high primary copper prices which increased the demand for scrap as a substitute, alongside increased exports from major non-US suppliers such as Japan, Thailand, and South Korea. Furthermore, a slight improvement in China-US trade relations and a bullish sentiment among enterprises leading to aggressive stockpiling contributed to the spike in volume. Although domestic prices did not fully mirror international gains, the inability of overseas consumers to absorb the high supply volume forced international yards to continue exporting to China. However, SMM predicts a pullback in November as downstream inventories reach saturation and processors resist higher prices amid a generally loose supply environment.

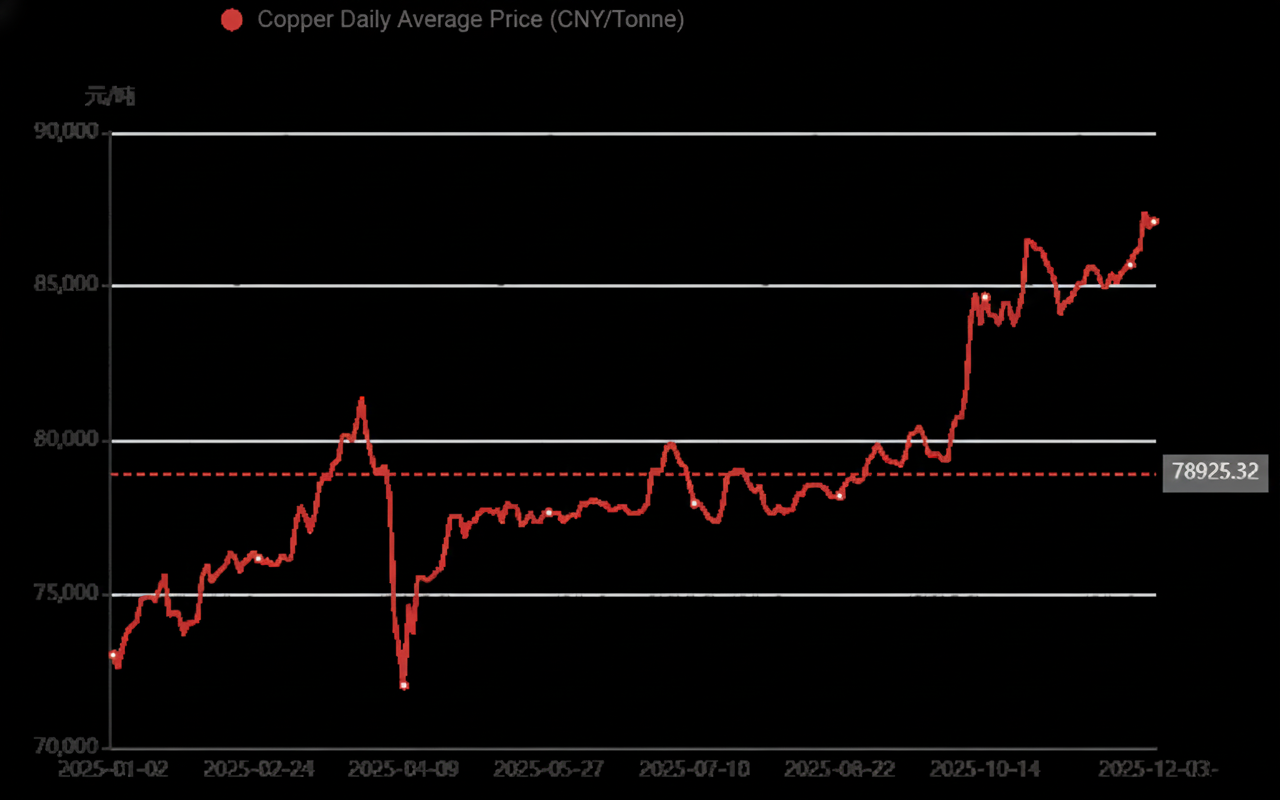

II. Annual Price Trends of Imported Copper Scrap

Throughout 2025, the price of imported copper scrap remained closely linked to LME copper prices, characterized by intense volatility followed by a powerful upward trajectory. During the first quarter, prices experienced a significant rally in February and March fueled by optimistic global macroeconomic expectations and loose liquidity, only to plummet in April as escalating China-US trade tensions triggered panic across the commodities market. By the second and third quarters, the market bottomed out and began an oscillating ascent, with Zhejiang Millberry prices stabilizing between 77,000 and 79,000 RMB per tonne. This recovery was bolstered by positive macro sentiment and expectations of Federal Reserve rate cuts, which enhanced market liquidity and speculative demand.

The trend culminated in a during the fourth quarter, where Zhejiang Millberry prices surged from approximately 79,400 RMB per tonne in September to a historic peak of 87,400 RMB per tonne. This cumulative increase of 8,000 RMB per tonne was catalyzed by a combination of frequent mining accidents tightening raw material supply, ongoing macro rate-cut expectations, and anticipated production cuts by Chinese smelters, all of which drove LME copper to new heights and pulled scrap prices up in tandem.

III. Future Outlook: Policy Risks and Resource Protectionism

Looking toward the future, the landscape of the recycled copper market is being reshaped by significant shifts in international trade policy that introduce long-term uncertainty. The United States has not only imposed tariffs on copper semi-finished products but has also announced a mandate starting in 2027 requiring at least 25% of high-quality recycled copper to remain within its domestic market. Simultaneously, the European Union has begun restricting the export of untreated or "problematic" recycled metals to non-OECD countries, requiring stringent pre-treatment before any cross-border movement. These actions signal a rising tide of resource protectionism as major economies move to secure their internal supply chains, which is expected to accelerate the regionalization of the global recycled copper trade and potentially limit the volume of transoceanic circulation. Under these complex and evolving conditions, many traders are preparing for a volatile and fragmented market in 2026, anticipating a period characterized by heightened confusion and structural uncertainty.