On December 19, 2025, China's Ministry of Commerce officially confirmed that it had submitted a request for consultations with the World Trade Organization (WTO) regarding India's subsidy measures for photovoltaic (PV) products and tariff measures on information and communication technology products. China stated that India's relevant measures are suspected of violating WTO rules on "national treatment" and constitute prohibited "import substitution subsidies." This marks another significant trade action following China's challenge against India's subsidy measures for electric vehicles (EVs) and cells in October 2025

In recent years, the Indian government has continuously employed a dual stimulus policy package of "tariff barriers" and "non-tariff barriers" in an attempt to sever its dependence on China's PV supply chain.

1. Tariff Policies: From BCD to Anti-Dumping Duties

* Basic Customs Duty (BCD) Adjustment: In the federal budget released in February 2025, India temporarily reduced the import duty on solar cells from 25% to 20%, and on modules from 40% to 20%, aiming to alleviate cost pressure on domestic projects. Despite the nominal rate reduction, these still represent high trade barriers.

* Implementation of Anti-Dumping Duties (ADD): On September 30, 2025, the Indian Ministry of Commerce and Industry issued a final ruling recommending the imposition of anti-dumping duties on solar cells and modules originating in or imported from China for a period of three years. The duty rates were set at three tiers ranging from 23% to 30%, depending on the enterprise. This means Chinese products face additional anti-dumping penalties on top of the BCD.

2. Non-Tariff Barriers: ALMM and PLI

* Approved List of Models and Manufacturers (ALMM): The Indian government currently strictly enforces ALMM "List-I" (for modules), effectively excluding the vast majority of Chinese module manufacturers from government-funded and utility-scale projects. The mandatory enforcement date for ALMM "List-II" (for cells) has been set for July 1, 2026. Until then, Indian module manufacturers can still import cells from China.

* Production-Linked Incentive (PLI) Scheme: This is the core issue of China's WTO challenge. Through the PLI scheme, India provides subsidies amounting to billions of US dollars to domestic manufacturers, conditional upon production in India achieving a certain "local value addition." The market widely perceives these subsidies, linked to "localization rates," as discriminatory import substitution subsidies.

Under strong policy protection, India's PV industry has developed a distorted structure characterized by "module overcapacity, insufficient cell capacity, and high costs." On the module side, India's domestic module capacity experienced explosive growth, with ALMM-listed module capacity exceeding 120 GW by mid-2025. This far exceeds India's annual installation demand of approximately 40–50 GW. In contrast, the expansion of India's solar cell capacity has been slow. According to public data, India's cell capacity was only about 29 GW by mid-2025. India possesses substantial module assembly capability but lacks a core supply of solar cells. This has led to an awkward situation: Indian module manufacturers must import large quantities of cells from China to sustain production.

The cost of policy protection is high system expenses. In 2025, due to tariffs and a lack of economies of scale, the price of modules manufactured domestically in India was significantly higher than international market levels. According to SMM data, the price of Indian-made modules was nearly 100% higher than that of imported Chinese modules (excluding taxes). Recently, the price of non-DCR Topcon modules in India was USD 0.15/W, while DCR Topcon modules were even more expensive, at approximately USD 0.28–0.29/W. During the same period, the FOB price for SMM Topcon modules was quoted at USD 0.088/W on December 23, highlighting the significant price advantage of Chinese exported modules.

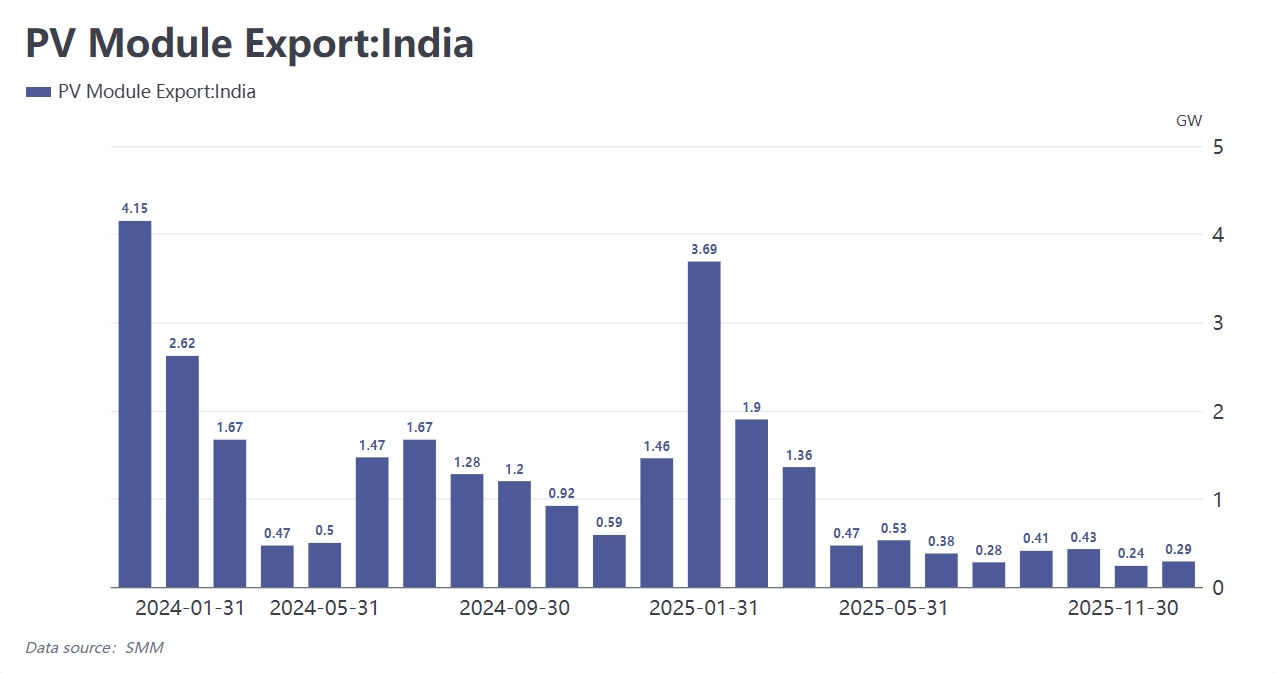

Trade data for 2025 clearly reflects the impact of Indian policies: exports of finished products (modules) were hindered, while exports of semi-finished products (cells) surged sharply. From January to November 2025, China's PV module exports to India amounted to only 9.98 GW, down 39.66% YoY. Compared to previous years, India is no longer a major export destination for Chinese modules. Due to ALMM list restrictions, Chinese modules face difficulties entering mainstream power plant projects in India and can only access the market through some unrestricted commercial and industrial (C&I) rooftop projects or during the window period before new policies take effect.

Exports of solar cells experienced explosive growth. In H1 2025, China's solar cell exports surged, with India absorbing approximately 50% of the total. According to SMM data, from January to November 2025, China's solar cell exports to India increased to over 49 GW from 33 GW in the same period last year, up 47.17% YoY. India's massive module capacity requires substantial solar cells as raw material, but its domestic cell capacity (29 GW) is severely insufficient. Consequently, despite India's significant efforts to block Chinese modules, its reliance on Chinese cells has deepened.

Amid India's frequent policy changes, China continues to transform its export structure. Chinese enterprises have been forced to shift their strategy toward India from "selling products (modules)" to "selling raw materials (cells/wafers)." In the short term, India will remain the largest market for Chinese solar cells. After losing market share in India's module sector, Chinese companies are accelerating their penetration into the Middle East (Saudi Arabia, UAE), Africa, and South America. According to import and export data for 2025, imports of Chinese modules by Middle Eastern countries such as Saudi Arabia, though fluctuating, are increasing in proportion. However, as Chinese enterprises still maintain a significant lead in high-efficiency N-type cell technologies like TOPCon and HJT, it will be difficult for India to achieve complete decoupling in high-end capacity in the short term.

In summary, an analysis of India's series of trade barriers and restrictions on Chinese PV modules and solar cells suggests that these measures may have a more negative impact on India's PV industry.

First, they increase installation costs. Trade barriers force Indian PV project developers to procure expensive domestic modules, which raises PPA (Power Purchase Agreement) electricity prices and could hinder India's progress toward its "500 GW non-fossil energy target by 2030."

Second, they deepen supply chain vulnerability. India's current prosperity is built on a model of "importing Chinese cells + domestic assembly." Due to insufficient domestic cell supply, if the ALMM list begins restricting cell imports in July 2026, India's PV manufacturing industry could face a severe raw material shortage crisis.

Third, there is a risk of WTO litigation. If the WTO rules against India, India may face pressure to modify its PLI scheme or confront trade retaliation, but the process is typically protracted. In the short term, SMM expects no change in India's protectionist stance.

![[SMM PV News] Armenia Hits 1.1 GW Solar Capacity,](https://imgqn.smm.cn/usercenter/qQwIB20251217171741.jpg)

![Spot Market and Domestic Inventory Brief Review (February 5, 2026) [SMM Silver Market Weekly Review]](https://imgqn.smm.cn/usercenter/tSwaX20251217171735.jpg)