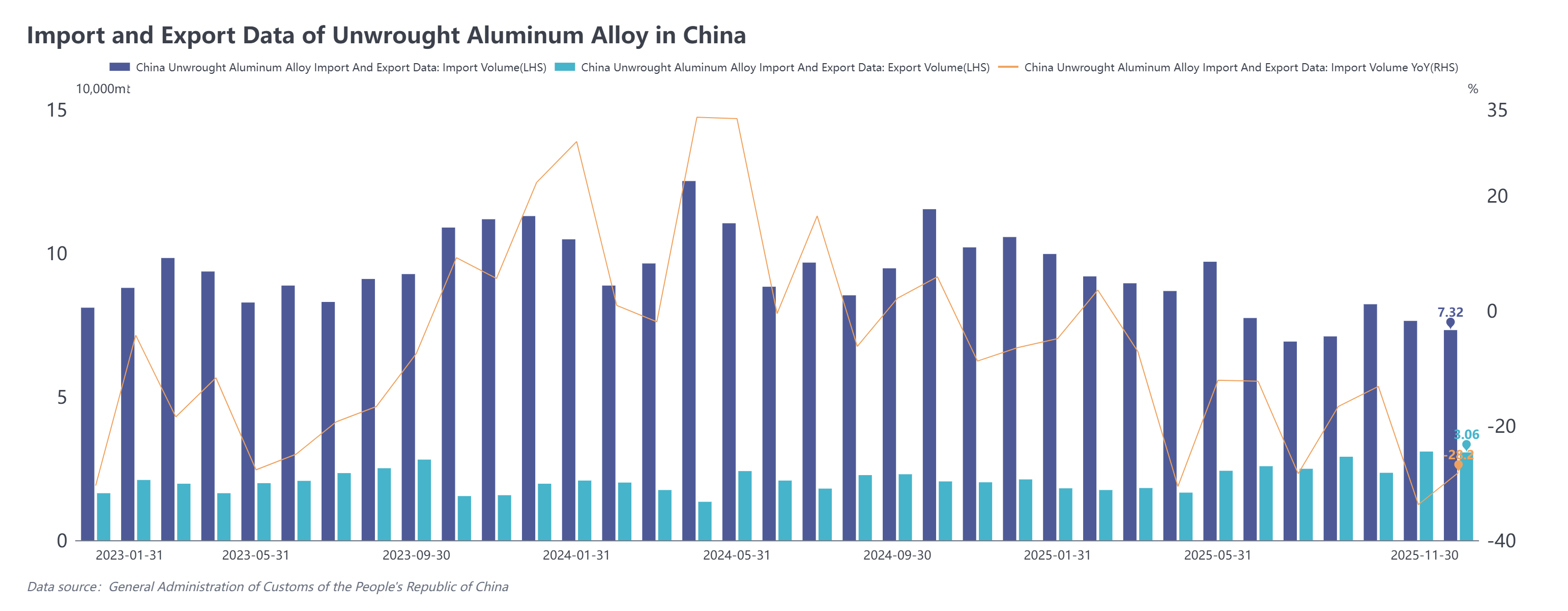

The General Administration of Customs recently released import and export data for November 2025. Customs data showed that:

In November 2025, unwrought aluminum alloy imports were 73,200 mt, down 28.2% YoY and down 4.1% MoM. Cumulative imports from January to November 2025 were 914,200 mt, down 17.5% YoY.

In November 2025, unwrought aluminum alloy exports were 30,600 mt, up 51.6% YoY and down 1.1% MoM. Cumulative exports from January to November 2025 were 259,300 mt, up 17.3% YoY.

By import source, the top five countries for China's unwrought aluminum alloy imports in November 2025 were Russia (21,000 mt, 29%), Malaysia (19,700 mt, 27%), Thailand (9,800 mt, 13%), Vietnam (4,600 mt, 6%), and South Korea (4,600 mt, 5%), with the remaining sources accounting for a combined 20%. MoM, among the top five import sources, South Korea's imports increased by 2,900 mt, showing a significant rebound; Thailand's imports edged up by 100 mt MoM; imports from the other three countries all dropped back slightly.

By import source, the top five countries for China's unwrought aluminum alloy imports in November 2025 were Russia (21,000 mt, 29%), Malaysia (19,700 mt, 27%), Thailand (9,800 mt, 13%), Vietnam (4,600 mt, 6%), and South Korea (4,600 mt, 5%), with the remaining sources accounting for a combined 20%. MoM, among the top five import sources, South Korea's imports increased by 2,900 mt, showing a significant rebound; Thailand's imports edged up by 100 mt MoM; imports from the other three countries all dropped back slightly.

Notably, following September, Russia surpassed Malaysia again in November to become China's largest source of unwrought aluminum alloy imports. China's imports of unwrought aluminum alloy from Russia are dominated by Processing with Imported Materials, accounting for 60%, with 80% of these goods flowing to Henan; followed by Entrepot Trade by Customs Special Control Area at 24%; while Ordinary Trade accounted for only 3%.

In November 2025, China's exports of unwrought aluminum alloy reached 30,600 mt, dropping back slightly by 300 mt MoM, but remained at a relatively high level above 30,000 mt overall. The top three export markets were Japan (44%), Mexico (14%), and India (13%), with the remaining markets accounting for approximately 29% combined. By trade mode, processing trade continued to dominate China's exports of unwrought aluminum alloy.

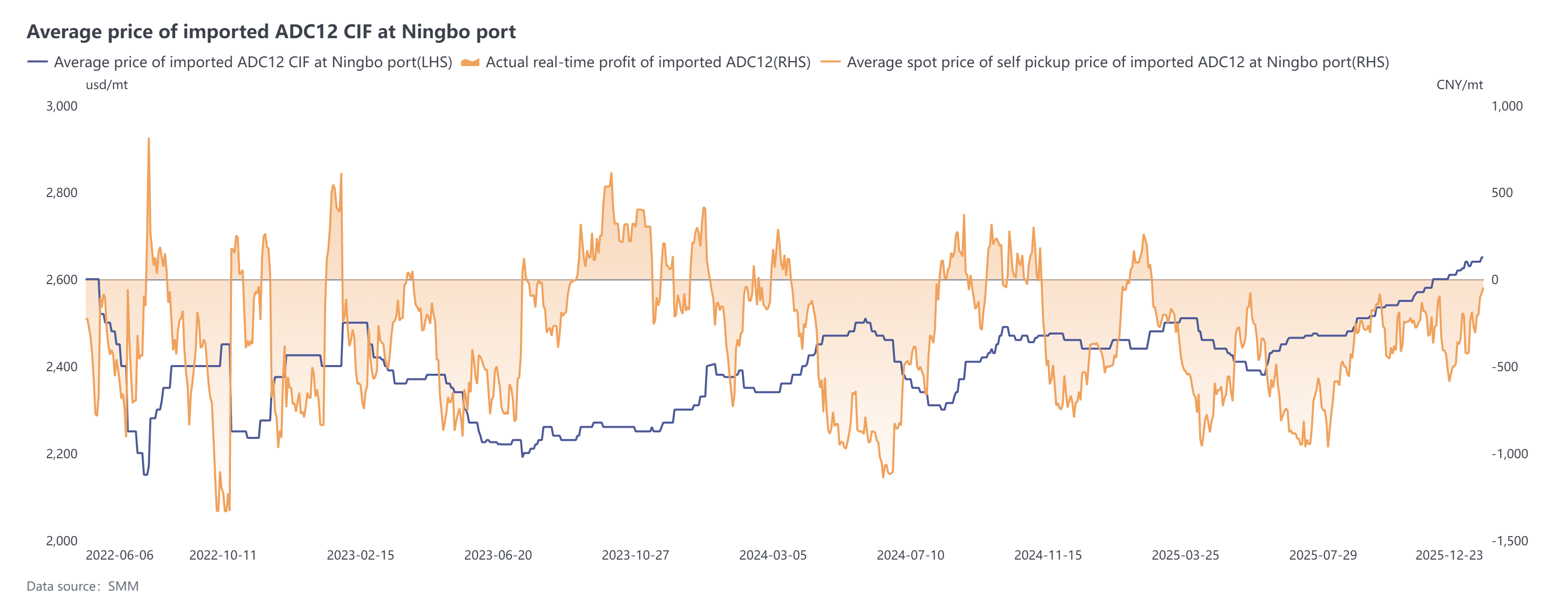

Overall, China's imports of unwrought aluminum alloy in November 2025 showed a declining trend both YoY and MoM. On the export side, although there was a slight MoM pullback, exports still maintained a strong YoY increase of over 50%. The weakness in imports was mainly due to the combined impact of two factors. First, the price spread between domestic and overseas aluminum alloy remained inverted throughout the year, closing the import arbitrage window and eliminating cost competitiveness. Second, tight aluminum scrap supply and rebounding demand in markets such as Japan, South Korea, and India pushed up regional alloy ingot prices, leading to a significant diversion of resources away from China.

Currently, overseas ADC12 offers have risen to $2,630–2,650/mt. Since December, driven by cost pressures and regional policy adjustments, domestic spot quotes have followed upward to 21,000–21,200 yuan/mt. Although a stronger yuan and rising domestic prices have narrowed the immediate import losses, the overall spread remains inverted. Imports in December are expected to stay in the range of 70,000–80,000 mt, while full-year 2025 imports are projected to fall below 1 million mt, with a YoY decline of approximately 18%.