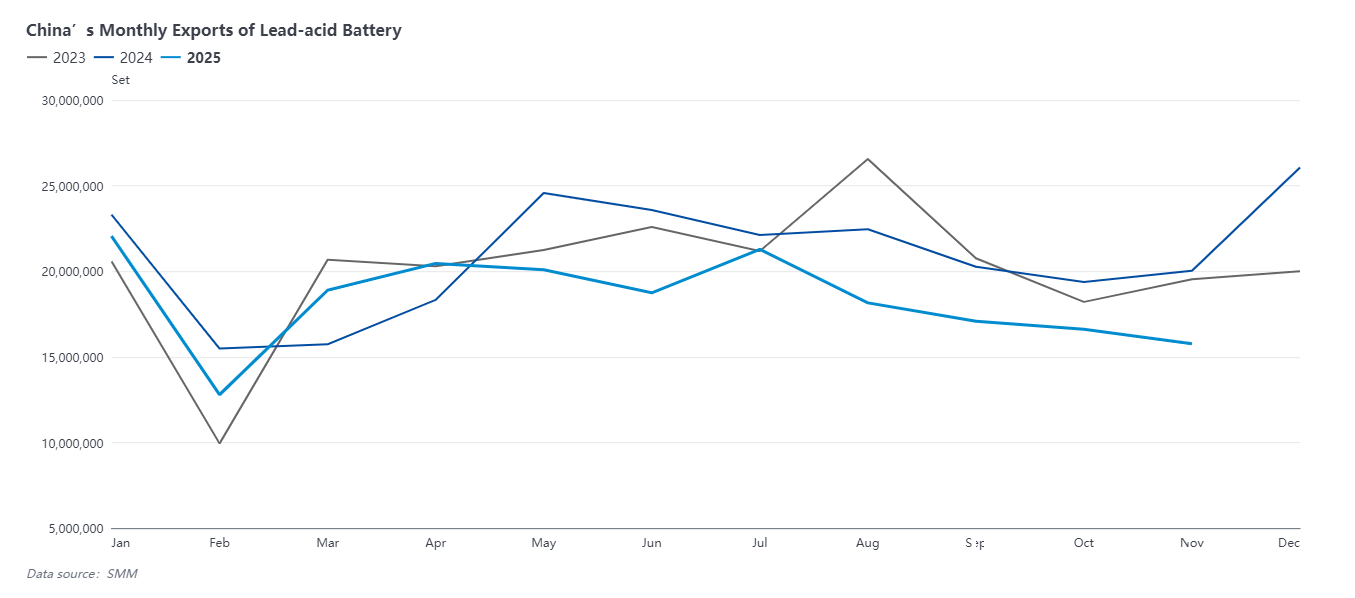

SMM, December 22: According to customs data, China's lead-acid battery exports totaled 15.776 million units in November 2025, down 5.05% MoM and down 21.25% YoY. Cumulative lead-acid battery exports from January to November 2025 reached 202 million units, down 10.36% YoY.

China's lead-acid battery imports stood at 475,700 units in November 2025, up 1.25% MoM and up 14.09% YoY. Cumulative lead-acid battery imports from January to November 2025 amounted to 4.9009 million units, down 6.49% YoY.

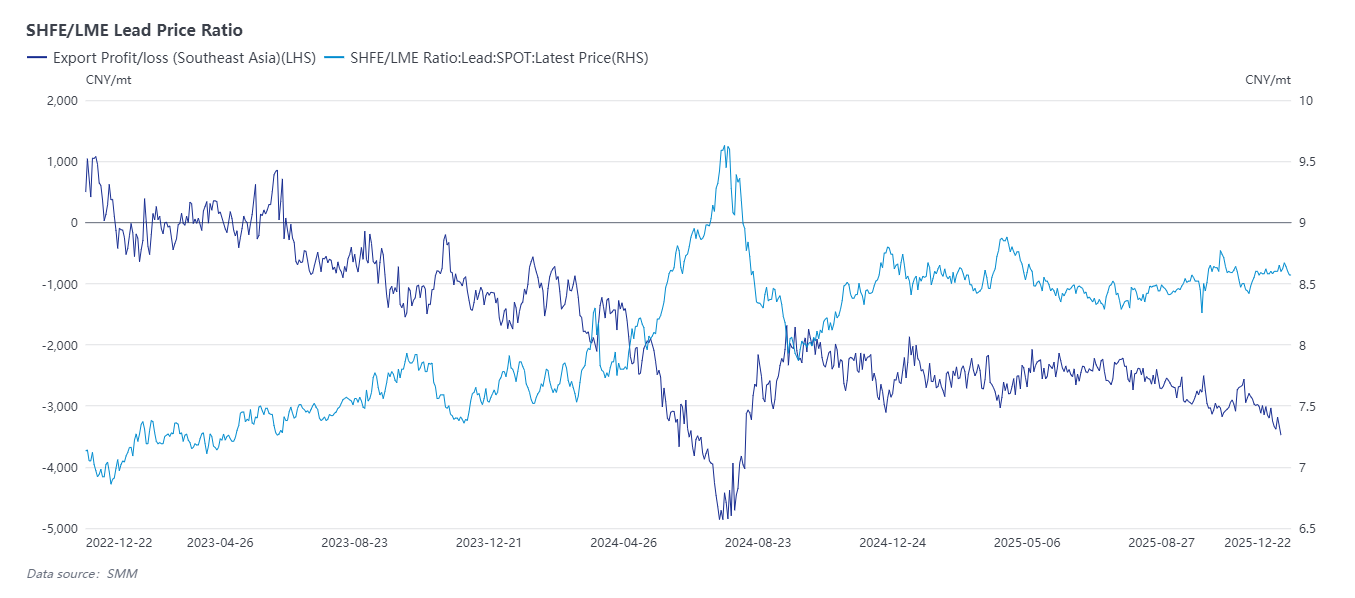

In November, lead prices in domestic and overseas markets showed an initial rise followed by a decline. During this period, LME lead once reached $2,097/mt, and the SHFE/LME lead price ratio narrowed, leading to a slight reduction in the loss on lead ingot exports. However, high prices somewhat dampened the purchasing enthusiasm of overseas enterprises. Even during the traditional stocking period, lead-acid battery exports continued to decline. The main reasons are: On one hand, domestic lead material prices were higher than overseas, putting lead-acid battery export costs at a disadvantage. The usual stocking demand of overseas enterprises before the Christmas holiday in December was not reflected in the Chinese market. On the other hand, there were some changes in the impact of tariff issues. The consensus reached in the November China-U.S. economic and trade consultations, where both sides ceased implementing some bilateral tariff hikes, led some lead-acid battery enterprises to report a slight recovery in export orders. However, the impact of the Middle East anti-dumping issue continued to intensify. According to the latest information, the punitive tariffs are expected to take effect from January 13, 2026, with rates ranging from 25.8% to 77%. Orders for related export enterprises weakened again, dragging down lead-acid battery exports for the month.

Entering December, lead prices gradually gave back all gains made since November. Overseas, in particular, due to high inventory factors, LME lead fell significantly more than domestic prices, and the loss on lead ingot exports expanded again, approaching -3,500 yuan/mt. Concurrently, export conditions for lead-acid batteries, for which lead ingot is the primary raw material, deteriorated again. Additionally, with the impending implementation of Middle East punitive tariffs, export-oriented enterprises in Zhejiang, Guangdong, and other regions reported persistently sluggish export orders and plan to take early holidays before New Year's Day. Lead-acid battery exports in December are expected to continue their downward trend.

![Tug-of-War Between Sellers and Buyers Continues, Short-Term Lead Price Fluctuation Trend Difficult to Break [Lead Futures Brief Review]](https://imgqn.smm.cn/usercenter/TmYox20251217171721.jpeg)