From January to October 2025, BYD's new energy vehicles (NEVs) continued to gain momentum in global markets, expanding their export footprint from Latin America and Europe to Southeast Asia, the Middle East, and other diverse regions. Brazil led all destinations with 99,322 units, consolidating its position as BYD's largest overseas market. Belgium and Mexico ranked second and third, supported by their strategic roles in Europe and North America. Meanwhile, emerging markets such as Indonesia, Turkey, the UAE, and the Philippines posted strong growth, helping BYD build a more balanced global expansion across both mature and rapidly developing markets.

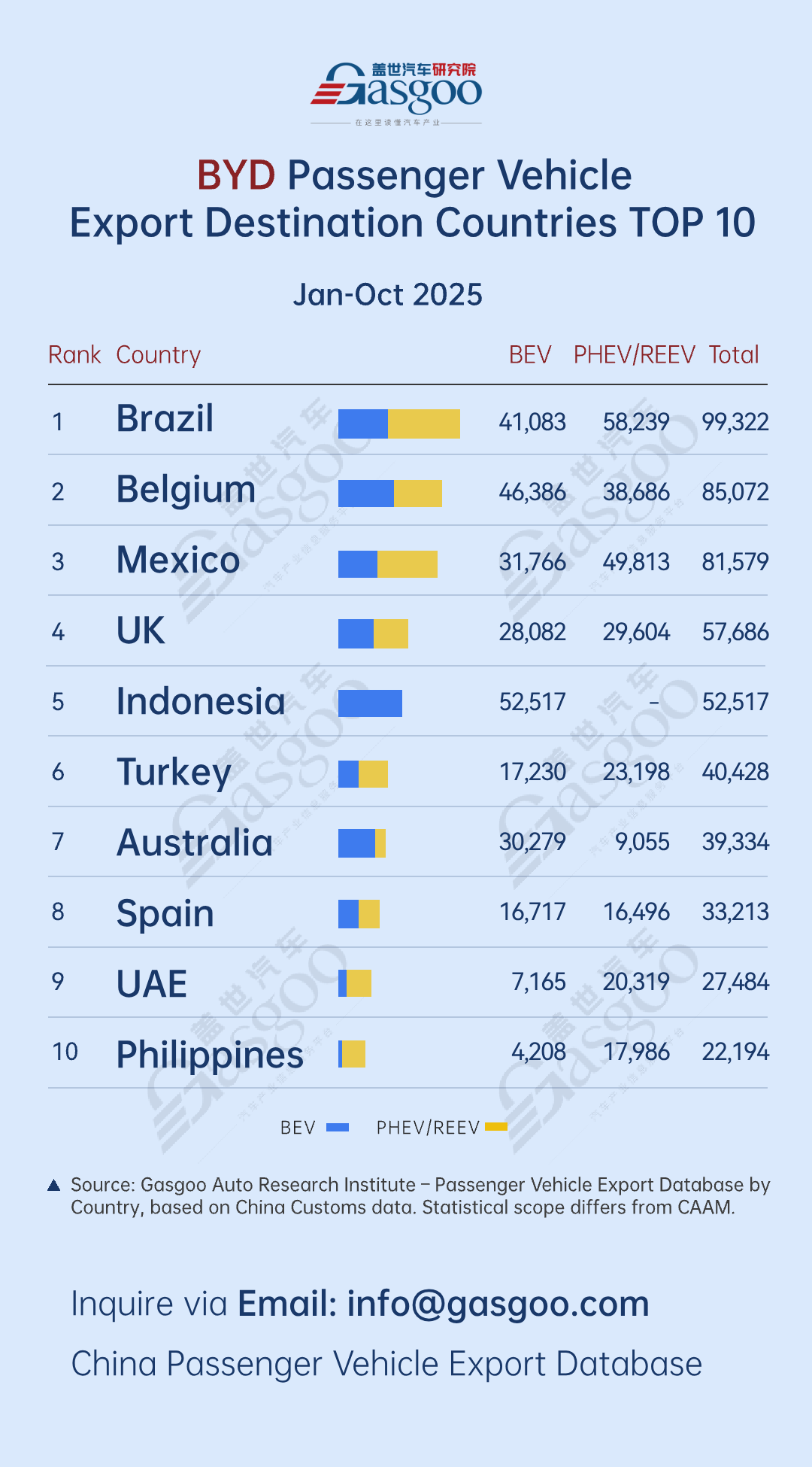

Here are the top 10 destination countries by BYD passenger vehicle exports from January to October, with detailed data:

NO.1 Brazil: 41,083 battery electric passenger vehicles and 58,239 plug-in hybrid electric passenger vehicles were exported from January to October 2025, totaling 99,322 units.

NO.2 Belgium: 46,386 battery electric passenger vehicles and 38,686 plug-in hybrid electric passenger vehicles, totaling 85,072 units.

NO.3 Mexico: 31,766 battery electric passenger vehicles and 49,813 plug-in hybrid electric passenger vehicles, totaling 81,579 units.

NO.4 UK: 28,082 battery electric passenger vehicles and 29,604 plug-in hybrid electric passenger vehicles, totaling 57,686 units.

NO.5 Indonesia: 52,517 battery electric passenger vehicles, totaling 52,517 units.

NO.6 Turkey: 17,230 battery electric passenger vehicles and 23,198 plug-in hybrid electric passenger vehicles, totaling 40,428 units.

NO.7 Australia: 30,279 battery electric passenger vehicles and 9,055 plug-in hybrid electric passenger vehicles, totaling 39,334 units.

NO.8 Spain: 16,717 battery electric passenger vehicles and 16,496 plug-in hybrid electric passenger vehicles, totaling 33,213 units.

NO.9 UAE: 7,165 battery electric passenger vehicles and 20,319 plug-in hybrid electric passenger vehicles, totaling 27,484 units.

NO.10 Philippines: 4,208 battery electric passenger vehicles and 17,986 plug-in hybrid electric passenger vehicles, totaling 22,194 units.

Brazil continued to be BYD's largest overseas market, with growth supported by both battery electric passenger vehicles (BEVs) and plug-in hybrid electric passenger vehicles (PHEVs). PHEVs (58,239 units) dominated due to local needs for long-distance travel and fuel–electric flexibility, while rising BEV demand was driven by the ride-hailing sector, government incentives, and network expansion. Mexico recorded 81,579 units, remaining a top-three destination. Strong PHEV uptake reflected user preferences for cost efficiency, stable range, and refueling convenience. Mexico's supply-chain access to the United States also gave BYD a strategic position for future North American development.

In Europe, Belgium's local market was relatively small, but its export volume (85,072 units) reflected its role as a key port and logistics hub, with many vehicles entering through Belgium before being distributed across the region. BYD's higher BEV share in Belgium also aligned with Europe's broader electrification trend. The United Kingdom (57,686 units) and Spain (33,213 units) delivered steady results with a balanced mix of BEVs and PHEVs. Compared with emerging markets, European consumers placed greater emphasis on brand strength, service networks, and charging infrastructure. As a result, growth depended more on deeper localization, competitive pricing, and continued brand development.

Indonesia became BYD's largest export destination in Southeast Asia after Thailand, with over 50,000 BEVs shipped. This underscores the region's rapidly rising acceptance of fully electric models, supported by government policies, ride-hailing demand, and taxi fleet renewal. The UAE and the Philippines show the opposite pattern, with PHEVs significantly outpacing BEVs—reflecting local road conditions, fuel-price structures, and user needs for multi-scenario flexibility. Overall, BYD's product portfolio has demonstrated strong cross-market adaptability, meeting diverse energy profiles and customer requirements across different countries.