[SMM Analysis] Ningbo HRC Inventory Fluctuates Rangebound, Trading Turns Mediocre

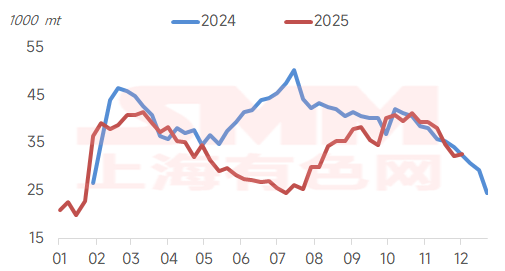

According to an SMM survey, SMM’s large-caliber HRC inventory in Ningbo stood at 327,900 mt as of 12.10, up 3,900 mt WoW.

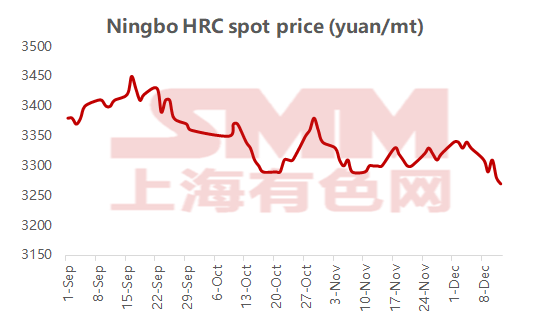

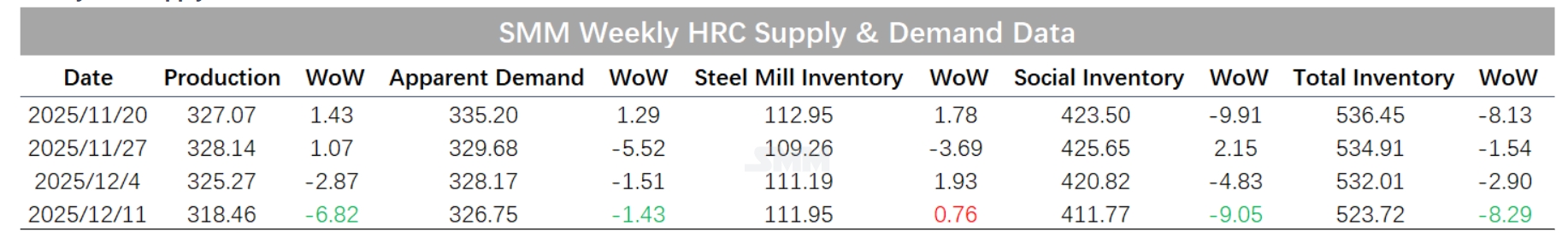

This week HRC prices fluctuated downward; spot prices fell 40-90 yuan/mt WoW, and overall market sentiment stayed weak. By the 12.12 afternoon close, the most-traded HRC 2605 contract settled at 3,232 yuan/mt.

SMM’s survey also shows that in Ningbo’s spot market this week, mainstream HRC transaction prices dropped sharply; by the 12.12 afternoon close, late-session offers were 3,270-3,280 yuan/mt, down 40-50 yuan/mt from last Friday. Futures remained in the doldrums, spot trading turned sluggish, some traders cut offers early to move cargo, and turnover was moderate. Arrivals of mainstream resources followed normal schedules, DDH deliveries were also steady, so near-term supply pressure is not pronounced. Inventory rose slightly this week, but a short-term decline is still expected; however, the trend lacks staying power, and a buildup is forecast within four to five weeks.

SMM released its weekly HRC balance sheet: scheduled maintenance at mills increases in December, so HRC production is expected to fall MoM. This week SMM tallied 4.1177 million mt of HRC social inventory at 86 warehouses nationwide (large sample), down 90,500 mt (-2.15%) WoW and up 37.59% YoY. National destocking continued; by region, the Northeast, East China and Central China markets posted larger declines.

Copyright and Intellectual Property Statement:

This report is independently created or compiled by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"), and SMM legally enjoys complete copyright and related intellectual property rights.

The copyright, trademark rights, domain name rights, commercial data information property rights, and other related intellectual property rights of all content contained in this report (including but not limited to information, articles, data, charts, pictures, audio, video, logos, advertisements, trademarks, trade names, domain names, layout designs, etc.) are owned or held by SMM or its related right holders.

The above rights are strictly protected by relevant laws and regulations of the People's Republic of China, such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, and the Anti-Unfair Competition Law of the People's Republic of China, as well as applicable international treaties.

Without prior written authorization from SMM, no institution or individual may:

1. Use all or part of this report in any form (including but not limited to reprinting, modifying, selling, transferring, displaying, translating, compiling, disseminating);

2. Disclose the content of this report to any third party;

3. License or authorize any third party to use the content of this report;

4. For any unauthorized use, SMM will legally pursue the legal responsibilities of the infringer, demanding that they bear legal responsibilities including but not limited to contractual breach liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

Data Source Statement:

(Except for publicly available information, other data in this report are derived from publicly available information (including but not limited to industry news, seminars, exhibitions, corporate financial reports, brokerage reports, data from the National Bureau of Statistics, customs import and export data, various data published by major associations and institutions, etc.), market exchanges, and comprehensive analysis and reasonable inferences made by the research team based on SMM's internal database models. This information is for reference only and does not constitute decision-making advice.

SMM reserves the final interpretation right of the terms in this statement and the right to adjust and modify the content of the statement according to actual circumstances.

![[SMM Steel] Jindal Steel wins a new iron ore mine in Odisha with ~38 mt reserves](https://imgqn.smm.cn/usercenter/jUyJR20251217171716.jpg)

![Silicon Metal Prices Tested Higher as Market Transactions Remained in Stalemate, While Polysilicon Prices Trended Downward [SMM Silicon Industry Weekly Review]](https://imgqn.smm.cn/usercenter/zLhJl20251217171720.jpg)

![[SMM Daily HRC Trading Volume] Futures Continued to Rise, Spot Trading Continued to Recover](https://imgqn.smm.cn/usercenter/UrrTG20251217171717.jpg)