Q1 2026 Japan MJP (main ports) aluminum ingot premium is expected to rebound from the low of $86/mt in Q4 2025, with the center rising. The core logic stems from tightening supply in Asia triggered by the restructuring of global aluminum trade flows, coupled with catalysts from European carbon policies and structural demand support. The latest offers from leading smelters have already indicated an upward trend, but restocking constraints due to the end of Japan's fiscal year may limit the extent of the rebound. Detailed analysis is as follows:

Core Driver: Restructuring of Global Supply Chains, Widening Supply Gap in Asia

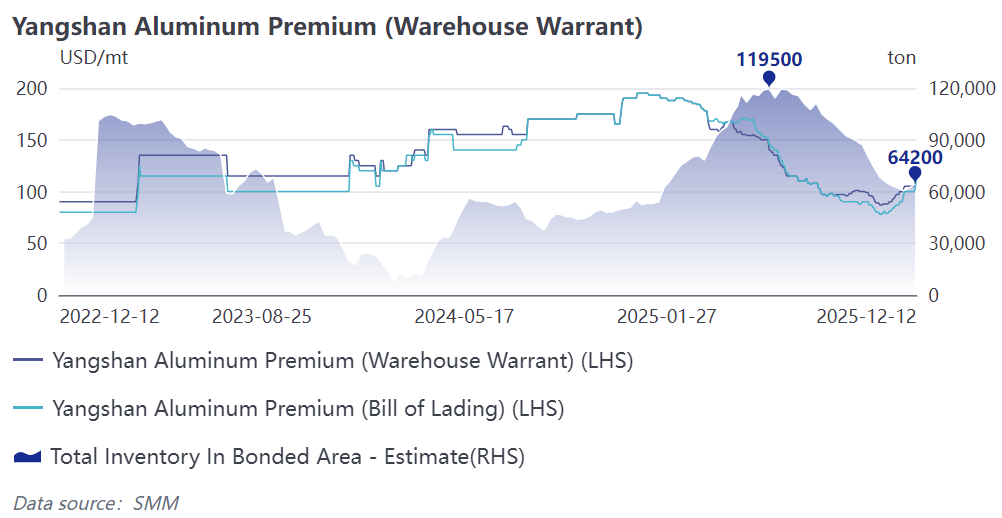

Arbitrage windows between regions have opened, accelerating the flow of aluminum ingots to European and US markets. Since Q4 2025, global aluminum premiums have shown an extreme divergence pattern of "strong Europe/US, weak Asia": the US Midwest premium after tax exceeded $1,940/mt, the premium for P1020A aluminum ingots in Rotterdam, Europe, rose to $260/mt (up 62.5% from early September), while the Japan MJP premium in Q4 was only $86/mt, and spot premiums in China fell sharply due to the closure of processing trade windows. Price spreads have driven cross-regional arbitrage, causing Asian aluminum ingot resources to continuously flow to Europe and the US, directly leading to a contraction in import supply in Asia. By December 2025, aluminum inventory in China's bonded zones had decreased by 50% from the year's high, and LME inventories in Asia were also at low levels, laying the foundation for a rebound in MJP premiums.

2. Disruptions in Overseas Smelting Capacity Intensify Expectations of Tight Supply

Supply-side disruptions have further amplified the global gap: an unexpected shutdown and production cut at a smelter in Iceland, and the risk of closure at an aluminum smelter under South32, both directly affecting effective aluminum ingot capacity in Europe and globally. For the Japanese market, which relies heavily on imports (import dependency over 90%), global capacity contraction and shifts in trade flows have created a combined effect, continuously heating up expectations of tight domestic supply, which forms the core logic supporting the rise in premiums.

3. European Carbon Policy Catalyzes Early Stockpiling, Indirectly Boosting Asian Premiums

With the imminent implementation of the EU Carbon Border Adjustment Mechanism (CBAM), downstream enterprises have started early stockpiling cycles to avoid future carbon tax costs, directly pushing up aluminum premiums in Europe. This trend not only locks in part of the global aluminum ingot resources but also triggers restocking anxiety among Asian importers, creating a spillover effect that drives up global premiums. Demand Support: Structural Rigid Demand Underpins the Market, Spot Market Has Already Started to Recover

1. Marginal Improvement in Traditional Industry Demand, Seasonal Factors Aid Recovery

Demand from the construction and automotive sectors, which weighed on premiums in Q4 2025, is expected to see marginal recovery. In the construction sector, Q1 is the traditional period for new project initiations in Japan's construction industry, leading to a seasonal rebound in rigid demand for aluminum products (such as doors, windows, and curtain walls). Although the overall recovery pace of Japan's automotive industry remains gradual, the rigid demand for aluminum consumption persists due to the lightweight trend in NEVs, together providing a floor for demand.

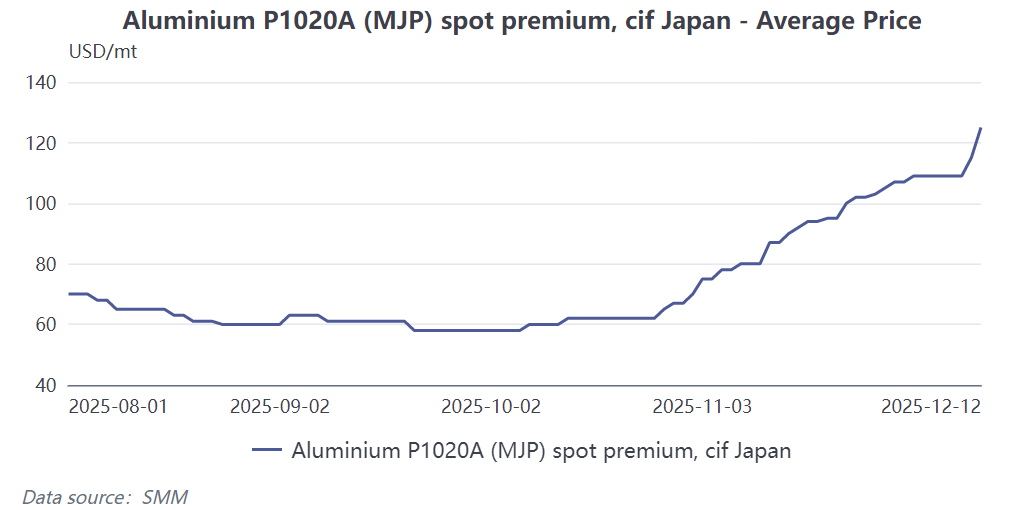

2. Spot Market Reacts First, Clear Signals of Price Increase

The spot market has already anticipated the upward trend in advance: the SMM Japan MJP spot premium has risen to $130/mt, up 85% from the low at the end of October. At Port Klang, Malaysia, a key transshipment hub for aluminum ingots in Asia, the FCA transaction price range reached $130-135/mt. From a trade logic perspective, the $130/mt FCA price at Port Klang, plus $20/mt FOB charges and $12/mt shipping costs, corresponds to approximately $162/mt in major Asian regions, significantly higher than the Q4 2025 settlement price, providing a direct reference for the rebound in Q1 2026 premiums. (However, in practice, due to different final cargo flows, the FCA transaction premium in Malaysia serves only as a directional guide under profit orientation.)

Market Signal: Smelters' Offers Raised Significantly, Negotiation Dynamics Shift to Sellers

In December 2025, two major aluminum smelters had already submitted offers of $190/mt and $203/mt for aluminum ingots to be shipped to Japan in Q1 2026, up 48%-49% QoQ from the Q4 2025 offer range of $98-103/mt. The significant increase in offers reflects both cost and tight supply expectations on the supply side, and indicates that the market negotiation dynamics have shifted from buyer-dominated in Q4 2025 to seller-dominated in Q1 2026, further confirming the certainty of the premium increase.

Risk Warning: Fiscal Year-End Constraints on Stockpiling May Limit Rebound Magnitude

It is important to note that the end of March 2026 marks the fiscal year-end for Japanese enterprises. Affected by annual budget controls, the stockpiling scale of some Japanese enterprises may be suppressed, constraining the magnitude of the premium increase in the short term. Currently, the LME near-month contract structure is at C$26.68/mt. With low holding pressure and market expectations for a MJP rebound, most suppliers are holding back cargoes, awaiting the finalization of Q1 premiums next year. Focus on the restocking intensity after Japan's fiscal year-end, changes in global smelting capacity, and the implementation pace of Europe's carbon policies, as these factors will determine the specific magnitude and sustainability of the rebound.